2 min

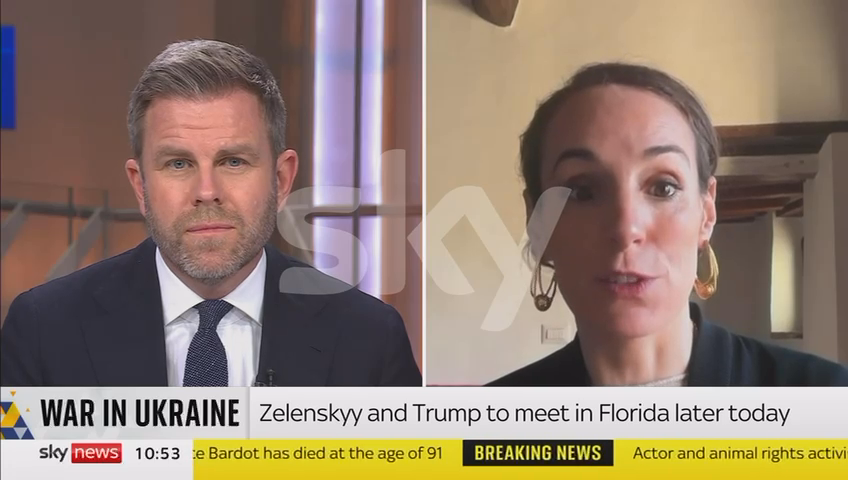

What Comes Next In Ukraine? Livia Paggi Breaks Down Trump–Zelensky Peace Plan Talks And The Stakes Ahead

In a recent interview, Livia Paggi of J.S. Held discussed the implications of reported discussions between President Donald Trump and President Volodymyr Zelensky about a potential peace plan aimed at ending the war in Ukraine. The conversation focused on what these talks signal politically, what pressure points may be shaping each leader’s approach, and why the timing and framing of any “peace plan” matters as much as the details themselves. Paggi emphasized that peace-plan conversations at this level often have multiple audiences at once: domestic political constituencies, international allies, and adversaries assessing resolve and leverage. She explored how diplomatic positioning can influence the credibility of negotiations and how public messaging, even before formal agreements exist, can shift perceptions on the battlefield, at the negotiating table, and across NATO-aligned capitals. The interview also examined the risks embedded in any peace-plan narrative. Paggi highlighted that negotiation efforts can introduce uncertainty for markets, governments, and populations when expectations outpace realities. She discussed how the mechanics of ending a war extend beyond a headline announcement, including enforcement, guarantees, verification, and the long-term stability of whatever framework is proposed. When we look at what Trump is likely to do, he's going to try to go back and forth, favor different political actors and see what he can do to unlock the situation. A copy of the full interview is below: For journalists following the Ukraine war, shifting diplomatic strategies, or the real-world consequences of peace negotiations, Livia Paggi offers a clear, practical lens on what these discussions could mean next. Her perspective helps reporters move beyond political theatre and toward the key questions: what’s being signaled, who gains leverage, what conditions would make an agreement durable, and what risks emerge if the process breaks down. Looking to connect with Livia Paggi? Livia is a sought-after speaker and regularly provides commentary on global political trends for the media, including for the BBC, Bloomberg TV, CNN, and the Financial Times. Livia is the recipient of numerous awards for her work. Most recently, she was named by Management Today as one of Britain’s top women in business under 35 and Bloomberg TV named her as one of the top female foreign policy commentators. Click on her profile icon to arrange an interview or get deeper insights into geopolitical risk, government relations, and business impacts.