You might also like...

Check out some other posts from J.S. Held LLC

Environmental risks are becoming a central concern for organizations as regulations tighten, public expectations rise, and litigation related to environmental claims grows more common. Companies today must navigate a complex landscape where regulators, investors, and advocacy groups are paying closer attention to how environmental impacts are managed and reported.

Recently, J.S. Held published the article, Environmental Claims and Disputes: Navigating Regulatory Change and Litigation Pressure, led by environmental risk and compliance expert Kimberly Logue Ortega. In this article, experts from J.S. Held share practical insights for insurance professionals and legal advisors on identifying environmental risks across industries and preparing for environmental disputes before they escalate. It examines how this increased scrutiny is creating new legal and financial pressures, particularly when organizations fail to comply with evolving regulations or when environmental claims made in public disclosures are challenged.

A key issue is the growing focus on corporate environmental statements and sustainability reporting. Businesses face potential consequences whether they overstate environmental achievements, commonly referred to as “greenwashing" or avoid discussing them altogether.

Without strong governance systems, clear internal oversight, and transparent reporting processes, organizations may expose themselves to regulatory penalties, legal disputes, and reputational damage. The article emphasizes that effective environmental governance is no longer simply a compliance exercise but an essential part of responsible corporate management.

Kimberly Logue Ortega specializes in environmental risk and compliance. With over fifteen years of experience in the areas of environmental and natural resources law, Ms. Logue provides consulting and expert services for industrial facilities and law firms throughout the country. She has extensive experience with assessing and managing potential and ongoing compliance obligations. She routinely supports clients and media on rulemaking and legislative efforts focused on environmental and natural resources issues.

View her profile As environmental regulations and stakeholder expectations continue to evolve, organizations that proactively strengthen their compliance frameworks and reporting practices will be better positioned to manage risk and build trust. The full report offers deeper insights into how companies can navigate regulatory change, reduce exposure to environmental claims, and develop stronger governance strategies in an increasingly complex landscape.

To explore the topic further, simply connect with Kimberly through her icon below.

Global consulting firm J.S. Held announces the release of the Ocean Tomo Intangible Asset Market Value (IAMV) study. With this release, the study now reflects a panel of 50 years of data in the US market and 20 years of data in foreign markets.

The study examines the components of market value, specifically the role of intangible assets, across a range of global indexes. IAMV is shown as of calendar year end by subtracting net tangible asset value from market capitalization.

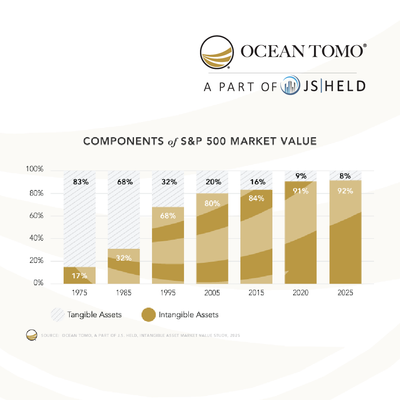

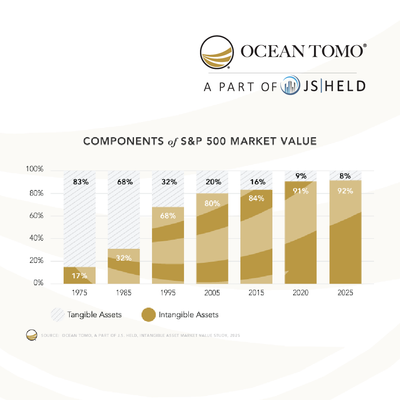

Commenting on the Components of S&P 500® Market Value, economic expert and study author Matthew Johnson observes, “the composition of corporate value has undergone a fundamental transformation over the past five decades.” In 1975, tangible assets—property, plant, equipment, inventory, and other physical capital—represented 83% of the market value of companies comprising the S&P 500 index, with intangible assets accounting for only 17%. By the end of 2025, this relationship had completely inverted: intangible assets now constitute approximately 92% of S&P 500 market capitalization, while tangible assets have been reduced to a mere 8%. Johnson adds, “This 75 percentage point shift represents what Ocean Tomo has defined as ‘economic inversion’— a wholesale transformation in the nature of value creation whereby economic worth has migrated from what can be ‘touched’ to what can be ‘thought’."

The magnitude and implications of this transformation are comparable to the Industrial Revolution of the 18th and 19th centuries. Just as the Industrial Revolution fundamentally restructured economic activity from agrarian and craft-based production to mechanized manufacturing, the intangible revolution has redefined the sources and measurement of corporate value in the 21st century. Ocean Tomo Co-founder and J.S. Held Chief Intellectual Property Officer, James E. Malackowski observes, “While the Industrial Revolution required a century to unfold fully, the intangible revolution has occurred within a single human lifespan, with particularly rapid acceleration occurring in the 1985-2005 period when intangible asset market value increased from 32% to 79%—a remarkable 47 percentage point surge in just two decades.”

The 2020-2025 period deserves special attention: S&P 500 IAMV remained stable at approximately 90% despite the Federal Reserve implementing the most aggressive monetary tightening cycle in four decades. Dr. Nikki Tavasoli, PhD, shares, “Traditional financial theory predicts that intangible-intensive firms should be highly sensitive to interest rate changes due to their long-duration cash flows and limited collateral value.” She adds, “The observed stability challenges this prediction and requires explanation, which we address in a forthcoming paper.”

In 2005, the IAMV study was expanded beyond the S&P 500 to explore the components of value in several key international markets. Stock market indexes from Europe, China, Japan, and South Korea were selected and analyzed to determine the comparable role of intangible assets.

To learn more about the 2025 Intangible Asset Market Value Study, please visit:

Media Contact Kristi L. Stathis, J.S. Held

1 786 833 4864

Kristi.Stathis@JSHeld.com JSHeld.com

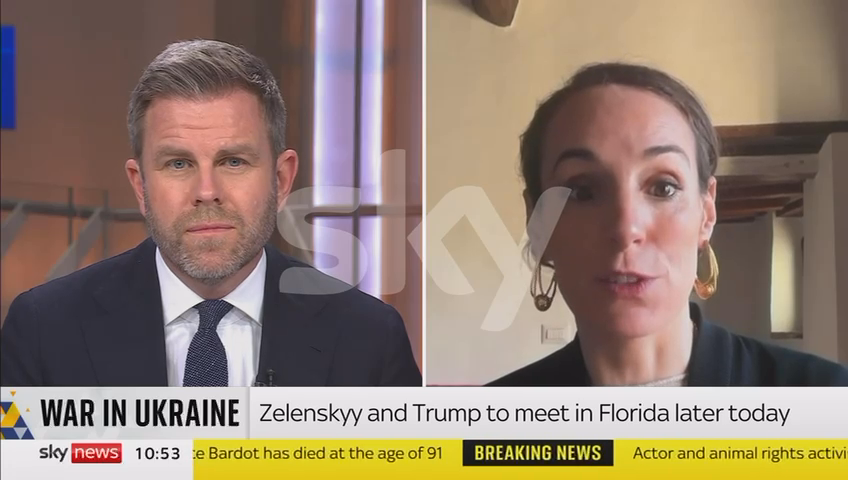

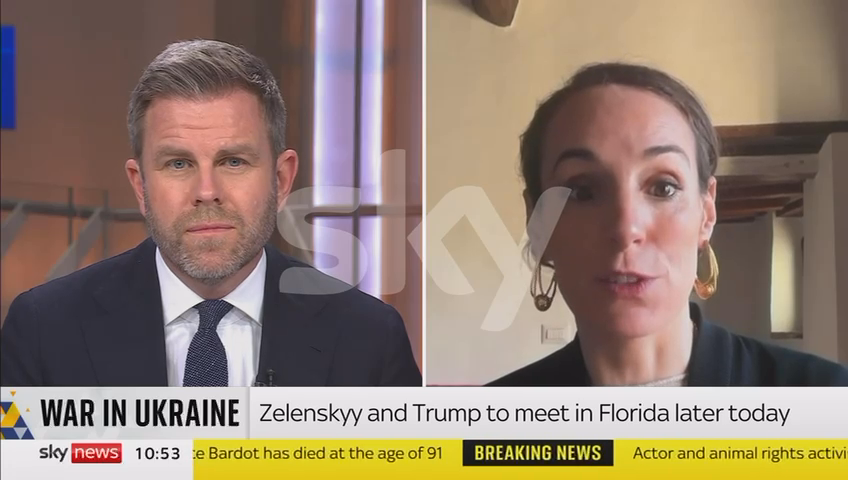

In a recent interview, Livia Paggi of J.S. Held discussed the implications of reported discussions between President Donald Trump and President Volodymyr Zelensky about a potential peace plan aimed at ending the war in Ukraine. The conversation focused on what these talks signal politically, what pressure points may be shaping each leader’s approach, and why the timing and framing of any “peace plan” matters as much as the details themselves.

Paggi emphasized that peace-plan conversations at this level often have multiple audiences at once: domestic political constituencies, international allies, and adversaries assessing resolve and leverage. She explored how diplomatic positioning can influence the credibility of negotiations and how public messaging, even before formal agreements exist, can shift perceptions on the battlefield, at the negotiating table, and across NATO-aligned capitals.

The interview also examined the risks embedded in any peace-plan narrative. Paggi highlighted that negotiation efforts can introduce uncertainty for markets, governments, and populations when expectations outpace realities. She discussed how the mechanics of ending a war extend beyond a headline announcement, including enforcement, guarantees, verification, and the long-term stability of whatever framework is proposed.

When we look at what Trump is likely to do, he's going to try to go back and forth, favor different political actors and see what he can do to unlock the situation. A copy of the full interview is below:

For journalists following the Ukraine war, shifting diplomatic strategies, or the real-world consequences of peace negotiations, Livia Paggi offers a clear, practical lens on what these discussions could mean next. Her perspective helps reporters move beyond political theatre and toward the key questions: what’s being signaled, who gains leverage, what conditions would make an agreement durable, and what risks emerge if the process breaks down.

Looking to connect with Livia Paggi? Livia is a sought-after speaker and regularly provides commentary on global political trends for the media, including for the BBC, Bloomberg TV, CNN, and the Financial Times. Livia is the recipient of numerous awards for her work. Most recently, she was named by Management Today as one of Britain’s top women in business under 35 and Bloomberg TV named her as one of the top female foreign policy commentators.

Click on her profile icon to arrange an interview or get deeper insights into geopolitical risk, government relations, and business impacts.