2 min

Ocean Tomo Releases 2025 Intangible Asset Market Value Study Results

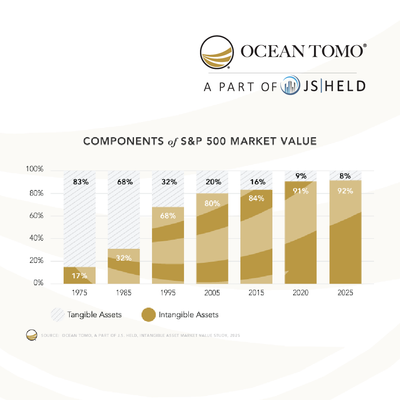

Global consulting firm J.S. Held announces the release of the Ocean Tomo Intangible Asset Market Value (IAMV) study. With this release, the study now reflects a panel of 50 years of data in the US market and 20 years of data in foreign markets. The study examines the components of market value, specifically the role of intangible assets, across a range of global indexes. IAMV is shown as of calendar year end by subtracting net tangible asset value from market capitalization. Commenting on the Components of S&P 500® Market Value, economic expert and study author Matthew Johnson observes, “the composition of corporate value has undergone a fundamental transformation over the past five decades.” In 1975, tangible assets—property, plant, equipment, inventory, and other physical capital—represented 83% of the market value of companies comprising the S&P 500 index, with intangible assets accounting for only 17%. By the end of 2025, this relationship had completely inverted: intangible assets now constitute approximately 92% of S&P 500 market capitalization, while tangible assets have been reduced to a mere 8%. Johnson adds, “This 75 percentage point shift represents what Ocean Tomo has defined as ‘economic inversion’— a wholesale transformation in the nature of value creation whereby economic worth has migrated from what can be ‘touched’ to what can be ‘thought’." The magnitude and implications of this transformation are comparable to the Industrial Revolution of the 18th and 19th centuries. Just as the Industrial Revolution fundamentally restructured economic activity from agrarian and craft-based production to mechanized manufacturing, the intangible revolution has redefined the sources and measurement of corporate value in the 21st century. Ocean Tomo Co-founder and J.S. Held Chief Intellectual Property Officer, James E. Malackowski observes, “While the Industrial Revolution required a century to unfold fully, the intangible revolution has occurred within a single human lifespan, with particularly rapid acceleration occurring in the 1985-2005 period when intangible asset market value increased from 32% to 79%—a remarkable 47 percentage point surge in just two decades.” The 2020-2025 period deserves special attention: S&P 500 IAMV remained stable at approximately 90% despite the Federal Reserve implementing the most aggressive monetary tightening cycle in four decades. Dr. Nikki Tavasoli, PhD, shares, “Traditional financial theory predicts that intangible-intensive firms should be highly sensitive to interest rate changes due to their long-duration cash flows and limited collateral value.” She adds, “The observed stability challenges this prediction and requires explanation, which we address in a forthcoming paper.” In 2005, the IAMV study was expanded beyond the S&P 500 to explore the components of value in several key international markets. Stock market indexes from Europe, China, Japan, and South Korea were selected and analyzed to determine the comparable role of intangible assets. To learn more about the 2025 Intangible Asset Market Value Study, please visit: Media Contact Kristi L. Stathis, J.S. Held 1 786 833 4864 Kristi.Stathis@JSHeld.com JSHeld.com