Biography

Dr. David Christensen is a professor of accounting at Southern Utah University. He has published over 70 refereed journal articles and made numerous presentations at academic and professional conferences.

Dr. Christensen served as a cost analyst for the United States Air Force at the Air Force Institute of Technology in Ohio. After retiring as a major, he began his second career at SUU as a professor of accounting in 1998.

Dr. Christensen earned a bachelor of science in biology from the University of Utah, a master of accounting from Utah State University, and a Ph.D. in business administration from the University of Nebraska.

Media

Publications:

Documents:

Audio/Podcasts:

Industry Expertise (4)

Accounting

Education/Learning

Writing and Editing

Management Consulting

Areas of Expertise (13)

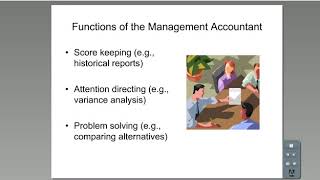

Cost & Management Accounting

Accounting

Accounting Ethics

Accounting; Ethics Scandals and Moral Exemplars

Accounting; Profitabilty Analysis

Accounting; Theory of Constraints

Cost Accounting

Cost Analysis

Earned Value Project Management

History of Accounting Principles

Managerial Accounting

Theories and Methods of Accounting

Cost Estimation

Education (3)

University of Nebraska: Ph.D., Business Administration (Accounting)

Utah State University: M.A., Accounting

University of Utah: B.S., Biology

Accomplishments (6)

Best Session Paper (professional)

International Business and Economics Research Conference, 2009

Certificate of Merit (professional)

Institute of Management Accounting, 2009

Exemplary Use of Technology Faculty Award (professional)

Utah System of Higher Education, 2007

Driessnach Award for Distinguished Service (professional)

Project Management Institute, 2004

Outstanding Scholar (professional)

Southern Utah University, 2003

Certified Management Accountant

CMA, current

Affiliations (2)

- Institute of Management Accounting

- Certified Management Accountant

Links (2)

Languages (1)

- Thai

Media Appearances (1)

Accounting Program Receives National Rank with U.S. News

SUU News online

2015-02-11

Taking online classes can be taxing, but for Southern Utah University students graduating with their master’s of accountancy (MAcc) they know getting their degree online is adding up with the program's recent recognition from U.S. News as a Best Online Graduate Business Degree. Currently celebrating its 10th birthday, the graduate accounting program is adding up numbers that can’t be seen at any other online graduate program in the state, according to David Christensen, accounting department chair.

Articles (15)

Is the CPI-Based EAC a Lower Bound to the Final cost of a Post Contracts A-12

Journal of Cost Analysis and ManagmentDavid S. Christensen

Christensen (1994b, 1999) describes several methods to evaluate the predicted final cost of a defense acquisition contract, termed the “Estimate at Completion” (EAC). One of the methods uses the EAC derived from the cumulative Cost Performance Index (CPI) as a lower bound to the final cost of a defense contract. The method was derived from Department of Defense (DOD) experience on hundreds of defense programs completed in the 1970s and 1980s. This study tests the validity of the rule on contracts completed after 1991. Based on an analysis of 52 defense acquisition contracts completed after 1991, the rule is still valid for CPI-based EACs computed in the early and middle stages of a contract, but not valid in the late stage.

Allocating Service Department Costs with Excel

Strategic FinanceDavid Christensen & Paul Schneider

2017-05-01

A note on using Microsoft Excel's iterative calculation option in the reciprocal method of service department cost allocation by breaking down the three methods for allocating service department costs: direct, sequential, and reciprocal.

Web of Deception

IMA Educational Case JournalDavid Christensen

2014-05-01

Escalating commitment to a failing project, the case of the A12 Stealth Bomber

Haliburton Whistleblower Tony Menendez: An Accountant with Moral Courage

Mountain Plains Journal of Business and EconomicsChristensen, D. and G. Calvasina

This case describes the experience of accounting whistleblower Tony Menendez.

Flight or Fight – A Case Study on Resolving Ethical Issues.

The Case JournalChristensen, D., P. Schneider, and J. Orton

Theoretical basis Students apply the new Institute of Management Accounting (IMA) ethics standard to “contribute to a positive ethical culture” and advice to “actively seek to resolve an ethical issue.”

A Note on Using Microsoft Excel’s Iterative Calculation Option in the Reciprocal Method of Service Department Cost Allocation

Strategic FinanceChristensen, D. and P. Schneider

While service departments generally aren’t involved in the direct production of goods or services, they play an integral role in enabling an organization’s operations. Yet often the prospect of allocating service department costs can lead to feelings of frustration or dread in accounting practitioners and students.

How Should I Advise My Client?

Journal of the International Academy for Case StudiesBoneck, R. and D. Christensen

The primary subject matter of this case concerns professional standards of tax advice.

James F. Alderson: White-hat Accountant with Moral Courage

Mountain Plains Journal of Business and EconomicsChristensen, D. and R. Boneck

The objective of this case study is to increase resolve to have moral courage by studying the whistleblowing experience of James Alderson.

For the Accounting Profession, Leadership Matters Regarding Ethical Climate Perceptions

Journal of Accounting, Ethics, and Public PolicyBarnes, J., D. Christensen, and T. Stillman

We tested the hypothesis advanced by Mannarelli (2006) and Early and Davenport (2010) that professional accounting organizations would benefit from a transformational leadership style.

Organizational Leadership And Subordinate Effect In The Certified Public Accounting Profession

Journal of Applied Business ResearchBarnes, J., D. Christensen, and T. Stillman

Using the Multifactor Leadership Questionnaire (Bass and Avolio 2004), we test the correlation of transformational, transactional, and passive-avoidant leadership styles to subordinate perceptions of workplace efficiency, effectiveness, and satisfaction.

Escalating Commitment to a Failing Project: The Case of the A-12 Stealth Bomber

IMA Educational Case JournalChristensen, D., and R. Boneck

The A-12 was the Navy’s top aviation priority. The carrier-based stealth bomber was designed to replace the aging and crippled A-6 Intruder.

Small Things First Things – A Pedagogical Tool for Accounting Students

Mountain Plains Journal of Business and EconomicsChristensen, D., G. Powell, and D. Rees

Experiences early in life or career can shape character and set patterns of behavior.

Videos to Promote Ethical Decision Making: A Pedagogical Tool

Mountain Plains Journal of Business and EconomicsChristensen, D.

This paper provides a tool for developing the ethical decision-making skills of business students.

Four Questions for Analyzing the Right-Versus-Right Dilemmas of Managers

Journal of Business Case StudiesChristensen, D., and R. Boneck

Ethics dilemmas are different than moral temptations. The former involve right-versus-right problems. The latter are right-versus-wrong problems.

Spreadsheet Design: An Optimal Checklist for Accountants

American Journal of Business EducationBarnes, J., D.Tufte, and D. Christensen

Just as good grammar, punctuation, style, and content organization are important to well-written documents, basic fundamentals of spreadsheet design are essential to clear communication.

Courses (11)

ACCT 2010 Financial Accounting Principles

This course provides a thorough study of basic accounting principles. The accounting cycle is introduced using an appropriate mix of conceptual and procedural problems. A real-world problem using computer applications is also covered. This is a basic course, which aids in building a foundation for financial analysis and decision-making.

ACCT 2020 Managerial Accounting

A study of the accumulation and flow of managerial accounting information and its impact on decisions within a business entity. Emphasizes cost behavior, cost-volume profit analysis, and management’s use of quantitative tools for planning and control.

ACCT 3300 Cost Accounting

Analysis of costs in a business organization. Includes cost development in both service and manufacturing situations. Areas discussed include: job order costing, process costing, standard costing and variance analysis.

ACCT 4890 Internship

Internship

ACCT 6000 Foundations of Accounting

This course provides an accelerated overview of both the theories and methods of accounting in support of the common body of knowledge core required for all MBA students not having previous business coursework.

ACCT 6100 Advanced Management Accounting

This course reviews the development and use of management accounting information systems in planning and control activities. Using case studies of actual companies, its focus is on new management accounting practices adopted by the innovative companies around the world.

ACCT 6320 Advanced Cost Accounting

Topics include balanced scorecard, cost allocation, profitability analysis, process costing, quality, theory of constraints, capital budgeting, transfer pricing, and performance measurement.

ACCT 6600 Practice and Theory Seminar

Special accounting problems related to accounting practice and theory, with emphasis on conceptual analysis and historical development of generally accepted accounting principles. Readings cover current theory as well as current accounting issues. Problems requiring in-depth research into pronouncements issued by FASB and predecessor standing-setting bodies are used.

ACCT 6650 Accounting Ethics Seminar

This seminar is designed to help students develop the strength of their own characters by receiving ethics education in moral sensitivity, judgment, and motivation. Ethics philosophies, professional codes of conduct, and strategies for ensuring ethical behavior in the workplace are discussed using case studies of ethics scandals and moral exemplars.

ACCT 6700 Graduate Readings

Graduate readings

ACCT 6890 Accounting Internship

Internship

Social