2 min

Aston University economists say Prime Minister can reduce UK trade vulnerability with China visit

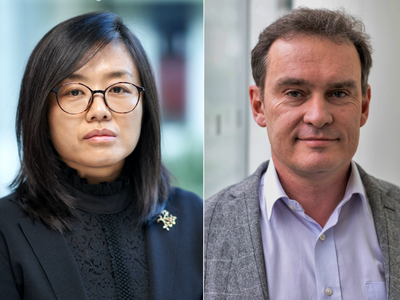

Greenland episode exposed UK’s lack of effective response to economic coercion from allies Research shows tariff retaliation would have cost the average UK household up to £324 per year Economists say China visit is “portfolio risk management” – diversification reduces vulnerability. The Prime Minister’s visit to China – the first by a British PM since 2018 – is an opportunity to reduce the UK’s vulnerability to economic coercion, according to new research from Aston University. A policy paper from Aston Business School’s Centre for Business Prosperity analyses the January 2026 Greenland tariff episode, when President Trump threatened and then withdrew tariffs on eight European countries. The researchers found that the UK had no good options: retaliation would have made Britain worse off, while absorbing the tariffs left Europe without credible deterrence. Director of the centre for business prosperity, Professor Jun Du, said: “The Greenland episode was a wake-up call. When your principal security ally threatens economic coercion, the old assumptions about who is safe and who is dangerous no longer hold. “The PM’s China visit should be framed as portfolio risk management – building diversified trading relationships that reduce the UK’s exposure to any single partner. Just as investors don’t put all their money in one stock, countries shouldn’t put all their trade into one basket. A UK with multiple strong partnerships is harder to pressure, whether the pressure comes from Washington or Beijing.” The research found that coordinated UK–EU tariff retaliation would have cost British households up to £324 per year – the worst outcome modelled. But the authors argue that Europe has untapped leverage elsewhere: the US runs a €148 billion annual services surplus with the EU, and mutual investment exceeds €5.3 trillion. Associate professor of economics and co-author, Dr Oleksandr Shepotylo, said: “Tariff retaliation fails because it hurts consumers and distorts the economy – the retaliator suffers similarly to the target. But Europe has cards it isn’t playing. Services, investment screening, and regulatory access are pressure points where Europe can respond effectively.” UK exports to China fell by 10.4% in the year to Q2 2025, with goods exports down 23.1% – the sharpest decline among major trading partners. The researchers argue that this closes off the UK’s largest alternative market at precisely the moment US reliability is in question. The paper identifies three priorities for UK policy: Recognise the permanent incentives behind US tariffs. US tariff revenue hit $264 billion in 2025. Trade negotiations alone cannot resolve revenue-driven policy. Build UK–EU coordination on non-tariff instruments. Services, investment, procurement, and regulation offer leverage that tariffs do not. Treat China engagement as portfolio risk management. Concentration in any single market creates vulnerability. Diversification is not about picking sides – it’s about resilience. Professor Du added: “The question for the Prime Minister is whether to use this breathing space to build resilience – or wait for the next Greenland.” To read the policy paper in full, click on this link: