- The new device is designed to reduce the risk of injuries when medicines being delivered into a vein enter the surrounding tissues

- It detects this problem at the earliest stages, before it is visible to the human eye

- The project is being supported by SPARK The Midlands at Aston University, a network to support technology development for unmet clinical needs.

Clinicians at Birmingham Women’s and Children's NHS Foundation Trust (BWC) have joined with academics at Aston University to create an innovative sensor to reduce the risk of injuries caused when drugs being delivered into a vein enter the surrounding tissue.

This complication, called extravasation, can cause harm and, in the most severe cases, life-changing injuries and permanent scarring. It happens most often when infusing medicines into peripheral intravenous (IV) devices, such as a cannula, but can also occur when infusing into a central venous access device. By joining together, BWC and Aston University are combining clinical, academic and engineering expertise to create a sensor that can detect extravasation at its earliest stages.

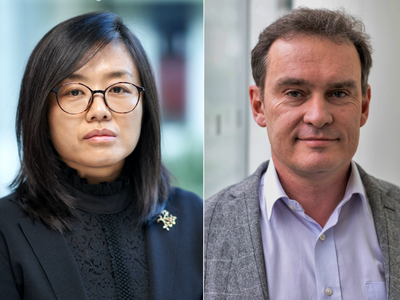

Karl Emms, lead nurse for patient safety at BWC, said:

“We've done lots of work across our Trust that has successfully reduced incidents. While we've made fantastic progress, there is only so much we can do as early signs of extravasation can be difficult to detect with the human eye.

“The next step is to develop a technology that can do what people can't - detection as it happens. This will make a huge impact on outcomes as the faster we can detect extravasation, the less likely it is that it will cause serious harm.”

The focused work to date addressing the issue has recently been recognised by the Nursing Times Awards 2024, winning the Patient Safety Improvement title for this year.

This new project is supported by SPARK The Midlands, a network at Aston University dedicated to providing academic support to advance healthcare research discoveries in the region. SPARK The Midlands is the first UK branch of Stanford University's prestigious global SPARK programme. It comes as a result of Aston University’s active involvement in the delivery of the West Midlands Health Tech Innovation Accelerator (WMHTIA) – a government-funded project aimed at helping companies drive their innovations towards market success.

The SPARK scheme helps to provide mentorship and forge networks between researchers, those with technical and specialist knowledge and potential sources of funding. SPARK members have access to workshops led by industry experts, covering topics such as medical device regulations, establishing good clinical trials, and creating an enticing target product profile to engage future funders.

Luke Southan, head of research commercialisation at Aston University and SPARK UK director, said:

“I was blown away when Karl first brought this idea to me. I knew we had to do everything we could to make this a reality. This project has the potential to transform the standard of care for a genuine clinical need, which is what SPARK is all about.”

Work on another potentially transformative project has also begun as the team are working to develop a medical device that detects the position of a nasogastric feeding tube.

There is a risk of serious harm and danger to life if nasogastric tubes move into the lungs, rather than the stomach, and feed is passed through them.

Emms explained:

“pH test strips can usually detect nasogastric tube misplacement, but some children undergoing treatment can have altered pH levels in the stomach. This means this test sometimes does not work.

“A medical device that can detect misplacement can potentially stop harm and fatalities caused by these incidents.”

SPARK will bring together engineers, academics and clinicians for both projects to develop the devices for clinical trial, with a goal of the technologies being ready for clinical use in three to five years.

Southan said:

“BWC is one of our first partners at SPARK and we're really excited to work with them to make a vital impact on paediatric healthcare in the Midlands and beyond."

Notes to editors

About Aston University

For over a century, Aston University’s enduring purpose has been to make our world a better place through education, research and innovation, by enabling our students to succeed in work and life, and by supporting our communities to thrive economically, socially and culturally.

Aston University’s history has been intertwined with the history of Birmingham, a remarkable city that once was the heartland of the Industrial Revolution and the manufacturing powerhouse of the world.

Born out of the First Industrial Revolution, Aston University has a proud and distinct heritage dating back to our formation as the School of Metallurgy in 1875, the first UK College of Technology in 1951, gaining university status by Royal Charter in 1966, and becoming the Guardian University of the Year in 2020.

Building on our outstanding past, we are now defining our place and role in the Fourth Industrial Revolution (and beyond) within a rapidly changing world.

For media inquiries in relation to this release, contact Helen Tunnicliffe, Press and Communications Manager, on (+44) 7827 090240 or email: h.tunnicliffe@aston.ac.uk

About Birmingham Women’s and Children’s NHS Foundation Trust

Birmingham Women’s and Children’s NHS Foundation Trust (BWC) brings together the very best in paediatric and women’s care in the region and is proud to have many UK and world-leading surgeons, doctors, nurses, midwives and other allied healthcare professionals on its team.

Birmingham Children’s Hospital is the UK’s leading specialist paediatric centre, caring for sick children and young people between 0 and 16 years of age. Based in the heart of Birmingham city centre, the hospital is a world leader in some of the most advanced treatments, complex surgical procedures and cutting-edge research and development. It is a nationally designated specialist centre for epilepsy surgery and also boasts a paediatric major trauma centre for the West Midlands, a national liver and small bowel transplant centre and a centre of excellence for complex heart conditions, the treatment of burns, cancer and liver and kidney disease.

The hospital is also home to one of the largest Child and Adolescent Mental Health Services in the country, comprising of a dedicated inpatient Eating Disorder Unit and Acute Assessment Unit for regional referrals of children and young people with the most serious of problems (Tier 4) and Forward Thinking Birmingham community mental health service for 0- to 25-year-olds.

Birmingham Women’s Hospital is a centre of excellence, providing a range of specialist health care services to over 50,000 women and their families every year from Birmingham, the West Midlands and beyond. As well as delivering more than 8,200 babies a year, it offers a full range of gynaecological, maternity and neonatal care, as well as a comprehensive genetics service, which serves men and women. Its Fertility Centre is one of the best in the country, while the fetal medicine centre receives regional and national referrals. The hospital is also an international centre for education, research and development with a research budget of over £3 million per year. It also hosts the national miscarriage research centre – the first of its kind in the UK - in partnership with Tommy’s baby charity.

For interview requests please email the Communications Team on bwc.communications@nhs.net