The global AI landscape has become a melting pot for innovation, with diverse thinking pushing the boundaries of what is possible. Its application extends beyond just technology, reshaping traditional business models and redefining how enterprises, governments, and societies operate.

Advancements in model architectures, training techniques and the proliferation of open-source tools are lowering barriers to entry, enabling organisations of all sizes to develop competitive AI solutions with significantly fewer resources. As a result, the long-standing notion that AI leadership is reserved for entities with vast computational and financial resources is being challenged.

This shift is also redrawing the global AI power balance, with a decentralised approach to AI where competition and collaboration coexist across different regions. As AI development becomes more distributed, investment strategies, enterprise innovation and global technological leadership are being reshaped. However, established AI powerhouses still wield significant leverage, driving an intense competitive cycle of rapid innovation.

Amid this acceleration, it is critical to distinguish true technological breakthroughs from over-hyped narratives, adopting a measured, data-driven approach that balances innovation with demonstrable business value and robust ethical AI guardrails.

Implications of the Evolving AI Landscape

The democratisation of AI advancements, intensifying competitive pressures, the critical need for efficiency and sustainability, evolving geopolitical dynamics and the global race for skilled talent are all fuelling the development of AI worldwide.

These dynamics are paving the way for a global balance of technological leadership.

Democratisation of AI Potential

The ability to develop competitive AI models at lower costs is not only broadening participation but also reshaping how AI is created, deployed and controlled.

Open-source AI fosters innovation by enabling startups, researchers, and enterprises to collaborate and iterate rapidly, leading to diverse applications across industries. For example, xAI has made a significant move in the tech world by open sourcing its Grok AI chatbot model, potentially accelerating the democratisation of AI and fostering innovation.

However, greater accessibility can also introduce challenges, including risks of misuse, uneven governance, and concerns over intellectual property. Additionally, as companies strategically leverage open-source AI to influence market dynamics, questions arise about the evolving balance between open innovation and proprietary control.

Increased Competitive Pressure

The AI industry is fuelled by a relentless drive to stay ahead of the competition, a pressure felt equally by Big Tech and startups. This is accelerating the release of new AI services, as companies strive to meet growing consumer demand for intelligent solutions. The risk of market disruption is significant; those who lag, face being eclipsed by more agile players.

To survive and thrive, differentiation is paramount. Companies are laser-focused on developing unique AI capabilities and applications, creating a marketplace where constant adaptation and strategic innovation are crucial for success.

Resource Optimisation and Sustainability

The trend toward accessible AI necessitates resource optimisation, which means developing models with significantly less computational power, energy consumption and training data. This is not just about cost; it is crucial for sustainability.

Training large AI models is energy-intensive; for example, training GPT-3, a 175-billion-parameter model, is believed to have consumed 1,287 MWh of electricity, equivalent to an average American household’s use over 120 years1. This drives innovation in model compression, transfer learning, and specialised hardware, like NVIDIA’s TensorRT.

Small language models (SLMs) are a key development, offering comparable performance to larger models with drastically reduced resource needs. This makes them ideal for edge devices and resource-constrained environments, furthering both accessibility and sustainability across the AI lifecycle.

Multifaceted Global AI Landscape

The global AI landscape is increasingly defined by regional strengths and priorities. The US, with its strength in cloud infrastructure and software ecosystem, leads in “short-chain innovation”, rapidly translating AI research into commercial products. Meanwhile, China excels in “long-chain innovation”, deeply integrating AI into its extended manufacturing and industrial processes. Europe prioritises ethical, open and collaborative AI, while the APAC counterparts showcase a diversity of approaches.

Underlying these regional variations is a shared trajectory for the evolution of AI, increasingly guided by principles of responsible AI: encompassing ethics, sustainability and open innovation, although the specific implementations and stages of advancement differ across regions.

The Critical Talent Factor

The evolving AI landscape necessitates a skilled workforce. Demand for professionals with expertise in AI and machine learning, data analysis, and related fields is rapidly increasing. This creates a talent gap that businesses must address through upskilling and reskilling initiatives. For example, Microsoft has launched an AI Skills Initiative, including free coursework and a grant program, to help individuals and organisations globally develop generative AI skills.

What does this mean for today’s enterprise?

New Business Horizons

AI is no longer just an efficiency tool; it is a catalyst for entirely new business models. Enterprises that rethink their value propositions through AI-driven specialisation will unlock niche opportunities and reshape industries. In financial services, for example, AI is fundamentally transforming operations, risk management, customer interactions, and product development, leading to new levels of efficiency, personalisation and innovation.

Navigating AI Integration and Adoption

Integrating AI is not just about deployment; it is about ensuring enterprises are structurally prepared. Legacy IT architectures, fragmented data ecosystems and rigid workflows can hinder the full potential of AI. Organisations must invest in cloud scalability, intelligent automation and agile operating models to make AI a seamless extension of their business. Equally critical is ensuring workforce readiness, which involves strategically embedding AI literacy across all organisational functions and proactively reskilling talent to collaborate effectively with intelligent systems.

Embracing Responsible AI

Ethical considerations, data security and privacy are no longer afterthoughts but are becoming key differentiators. Organisations that embed responsible AI principles at the core of their strategy, rather than treating them as compliance check boxes, will build stronger customer trust and long-term resilience. This requires proactive bias mitigation, explainable AI frameworks, robust data governance and continuous monitoring for potential risks.

Call to Action: Embracing a Balanced Approach

The AI revolution is underway. It demands a balanced and proactive response. Enterprises must invest in their talent and reskilling initiatives to bridge the AI skills gap, modernise their infrastructure to support AI integration and scalability and embed responsible AI principles at the core of their strategy, ensuring fairness, transparency and accountability.

Simultaneously, researchers must continue to push the boundaries of AI’s potential while prioritising energy efficiency and minimising environmental impact; policymakers must create frameworks that foster responsible innovation and sustainable growth. This necessitates combining innovative research with practical enterprise applications and a steadfast commitment to ethical and sustainable AI principles.

The rapid evolution of AI presents both an imperative and an opportunity. The next chapter of AI will be defined by those who harness its potential responsibly while balancing technological progress with real-world impact.

Resources

Sudhir Pai: Executive Vice President and Chief Technology & Innovation Officer, Global Financial Services, Capgemini

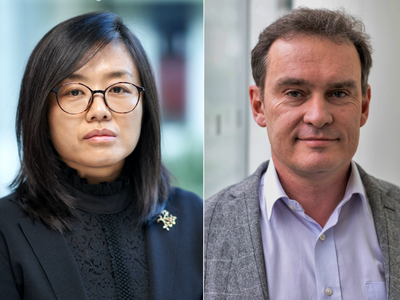

Professor Aleks Subic: Vice-Chancellor and Chief Executive, Aston University, Birmingham, UK

Alexeis Garcia Perez: Professor of Digital Business & Society, Aston University, Birmingham, UK

Gareth Wilson: Executive Vice President | Global Banking Industry Lead, Capgemini

1 https://www.datacenterdynamics.com/en/news/researchers-claim-they-can-cut-ai-training-energy-demands-by-75/?itm_source=Bibblio&itm_campaign=Bibblio-related&itm_medium=Bibblio-article-related