You might also like...

Check out some other posts from Cedarville University

From medication safety to seasonal illness prevention, pharmacists are often the most accessible, and overlooked, healthcare professionals in our communities.

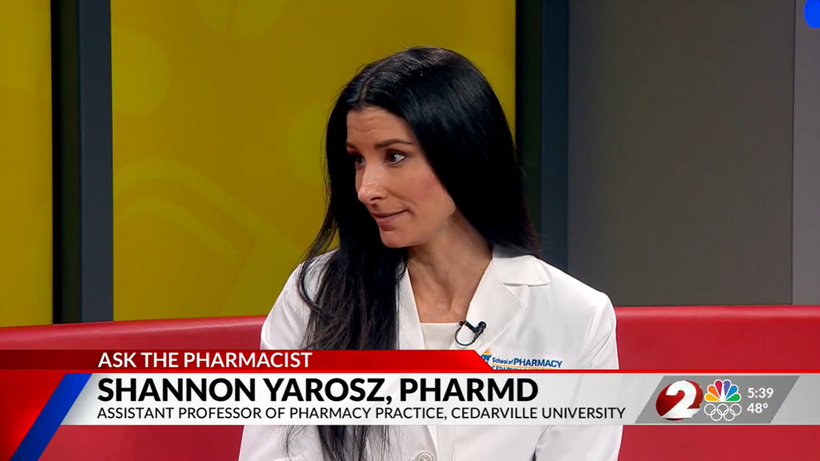

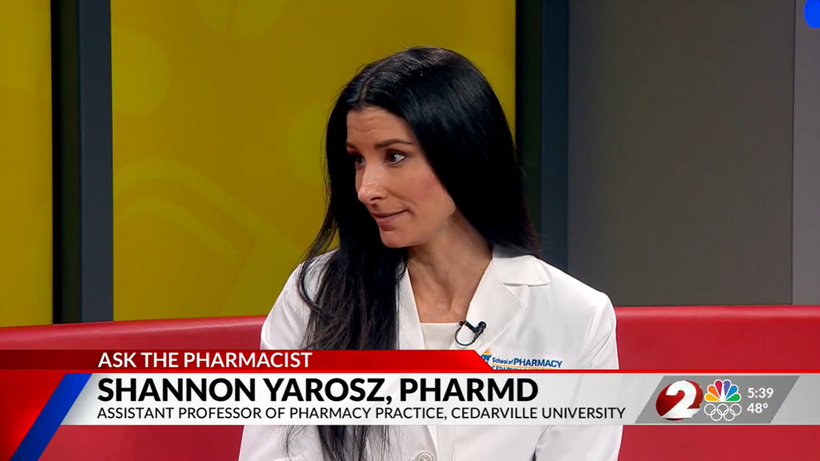

In a recent segment on NBC, Dr. Shannon Yarosz breaks down common misconceptions about prescriptions, explains how drug interactions really work, and shares practical advice patients can use immediately to better manage their health.

Dr. Shannon Yarosz is an Assistant Professor of Pharmacy Practice. Prior to joining the faculty at Cedarville University, served in multiple pharmacy roles. Her career reflects a deep commitment to patient care with experience in pediatrics, community pharmacy practice, and clinical healthcare services. As healthcare systems face growing pressure and patients navigate increasingly complex medication regimens, pharmacists are playing a larger role than ever before. This discussion highlights why their expertise matters, from helping patients avoid costly mistakes to providing front-line guidance on everyday health concerns.

When should I stop taking antibiotics? Is it ok to stop when I begin feeling better? This question and several others were addressed in this week's Ask the Pharmacist segment on WDTN TV in Dayton, Ohio. Looking to know more or connect with Dr. Shannon Yarosz?

Simply contact: Mark D. Weinstein

Executive Director of Public Relations

Cedarville University

mweinstein@cedarville.edu

As online gambling and sports betting surge across the United States, concerns are mounting about the financial and social consequences—particularly for young people. Dr. Jared Pincin, Associate Professor of Economics at Cedarville University, offers journalists a data-driven economic lens on how the rapid expansion of digital gambling is reshaping personal finances and increasing financial risk among younger Americans.

What's Happening Mobile betting apps have transformed gambling into an always-available activity, accessible anywhere and at any time. With aggressive marketing tied to professional and collegiate sports, online gambling has become normalized—especially among young adults. As participation rises, so do reports of debt, financial instability, and problem gambling, raising questions about consumer protection, regulation, and long-term economic impact.

Dr. Jared Pincin primary research interests explore the intersection of public choice economics with foreign aid as well as issues in sports economics. Pincin has published in popular publications such as The Hill, Real Clear Markets, Foxnews.com, and USA Today and scholarly journals such as Oxford Development Studies, Applied Economic Letters, and the Journal of Sport and Social Issues.

View his profile here Key Insights Online Gambling Is Built for Continuous Spending Modern gambling platforms are designed to encourage repeated engagement. Gamified interfaces, instant wagers, and constant prompts make it easy for users to lose track of spending, increasing the likelihood of financial loss over time.

Young Adults Face Elevated Risk Young people, particularly college-age students and adults in their twenties, are among the fastest-growing users of online betting platforms. Limited financial experience, combined with easy credit access and social pressure, makes this group especially vulnerable to poor financial outcomes.

Personal Finances Are Directly Impacted Gambling losses often come at the expense of savings, rent, tuition, and long-term financial planning. Dr. Pincin emphasizes that gambling platforms generate profit only when users lose, making sustained participation a negative-sum financial activity for individuals.

Economic Incentives Drive Expansion From an economic standpoint, gambling growth is fueled by state revenue incentives and private profit motives. Dr. Pincin helps explain how these incentives can conflict with consumer well-being, particularly when regulatory safeguards lag behind technological innovation.

About Jared Pincin Dr. Jared Pincin is an Associate Professor of Economics at Cedarville University. He holds a Ph.D. in economics and specializes in public choice, behavioral economics, and sports economics. His work examines how incentives shape individual decision-making and how policy choices affect financial outcomes at both the personal and societal levels.

Let Us Help with Your Coverage Jared Pincin can assist reporters by:

Explaining why online gambling participation has risen so quickly among young people Breaking down the economic mechanics of betting platforms and personal financial risk Providing context on the long-term financial consequences of habitual gambling Contributing expert insight to stories on regulation, advertising, and consumer protection Why This Matters As gambling becomes increasingly embedded in American culture, its financial consequences are no longer limited to isolated cases. Understanding how online gambling affects young people’s financial stability is essential for informed public reporting. Dr. Pincin offers clear, accessible analysis that helps audiences understand the economic realities behind the headlines.

As tensions escalate over the possibility of the United States seeking control of Greenland — including threats of annexation that have drawn international backlash — seasoned international relations expert Glen Duerr, Ph.D. offers critical context for journalists reporting on the diplomatic, legal, and geopolitical dimensions of this unfolding crisis.

What's Happening In early 2026, high-level rhetoric from U.S. political figures has revived debates about Greenland’s status as a strategic territory. What began as discussions of acquisition has evolved into broad international concern over sovereignty, alliance cohesion, and Arctic security. Denmark and Greenland have reaffirmed their commitment to autonomy, while NATO allies and the European Union warn that any forceful move by the U.S. could undermine alliance unity and violate international norms — raising profound questions about territorial integrity, international law, and the politics of national interest.

Dr. Glen Deurr's teaching and research interests include nationalism and secession, comparative politics, international relations theory, sports and politics, and Christianity and politics.

View his profile here How Dr. Glen Duerr Can Help Journalists Cover This Story 1. Understanding Strategic National Interests Dr. Duerr’s expertise in international relations provides journalists with a framework to explain why Greenland has become such a focal point for U.S., European, and Arctic security policy — from its strategic location to its role in broader defense calculations.

2. Explaining Nationalism, Sovereignty & Self-Determination His research on nationalism and secession is especially relevant as Greenlanders and Danish authorities assert self-determination and reject external control, a central narrative in the current debate.

3. Contextualizing International Norms & Legal Constraints As commentators and policymakers discuss potential annexation, treaty obligations, and alliance commitments, Dr. Duerr can unpack how international law, treaties (such as NATO agreements), and norms against territorial conquest shape policy choices and diplomatic responses.

4. Making Sense of Geopolitical Fallout With European leaders labeling aggressive claims as a form of “new colonialism” and threatening economic countermeasures, Dr. Duerr can help journalists interpret how Greenland could become a flashpoint affecting transatlantic relations, alliance politics, and global perceptions of U.S. foreign policy.

About Glen Duerr, Ph.D. Dr. Glen Duerr is a Professor of International Studies at Cedarville University with deep expertise in international relations theory, nationalism, secession, and comparative politics. He holds a Ph.D. in Political Science and Government and is widely available to speak with media on geopolitics, sovereignty disputes, and the intersection of national interest and international order.

Why This Matters The evolving crisis over Greenland is not merely a diplomatic dispute — it touches on fundamental questions of sovereignty, global strategic balance, alliance credibility, and international legal norms. Dr. Duerr is positioned to help journalists go beyond headlines, offering analysis that clarifies motivations, stakes, and implications for audiences tracking one of the most talked-about international issues of 2026.