1 min

Experts in the Media: What You Need to Know About Medication Safety and Everyday Health

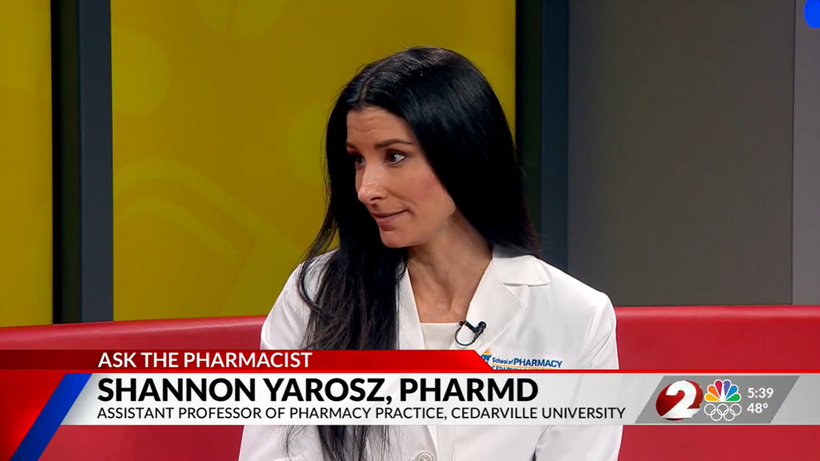

From medication safety to seasonal illness prevention, pharmacists are often the most accessible, and overlooked, healthcare professionals in our communities. In a recent segment on NBC, Dr. Shannon Yarosz breaks down common misconceptions about prescriptions, explains how drug interactions really work, and shares practical advice patients can use immediately to better manage their health. Dr. Shannon Yarosz is an Assistant Professor of Pharmacy Practice. Prior to joining the faculty at Cedarville University, served in multiple pharmacy roles. Her career reflects a deep commitment to patient care with experience in pediatrics, community pharmacy practice, and clinical healthcare services. As healthcare systems face growing pressure and patients navigate increasingly complex medication regimens, pharmacists are playing a larger role than ever before. This discussion highlights why their expertise matters, from helping patients avoid costly mistakes to providing front-line guidance on everyday health concerns. When should I stop taking antibiotics? Is it ok to stop when I begin feeling better? This question and several others were addressed in this week's Ask the Pharmacist segment on WDTN TV in Dayton, Ohio. Looking to know more or connect with Dr. Shannon Yarosz? Simply contact: Mark D. Weinstein Executive Director of Public Relations Cedarville University mweinstein@cedarville.edu