Experts Matter. Find Yours.

Connect for media, speaking, professional opportunities & more.

Are alternative investments right for the average person?

Given the risk, alternative investments were once considered only appropriate for the affluent and institutional investors. However, investment firms increasingly are offering alternative investment products, including mutual funds, ETFs, and private equity funds with strategies similar to hedge funds, to less affluent people. While average investors are responding eagerly to the move and forking over billions for alternative offerings, there are critics who argue that nontraditional assets are simply too risky for them. In a news article, Klaas Baks, associate professor in the practice of finance and executive director of the Center for Alternative Investment at Goizueta, offered his support of the investment strategy, while George Papadopoulos, a fee-only wealth manager, cautioned against it. Baks noted that alternative vehicles allow less affluent individuals to diversify their portfolios. Alternative investments also require minimal initial investment. Papadopoulos wrote that the risk and fees, as well as a lack of transparency and liquidity, were reasons to avoid nontraditional assets. In the article, Baks contended that all investments offer some risk but that alternative investments, when used correctly, also provide critical access to leverage. Source:

The return on international investment products

Individual investors have access to an ever-increasing number of US-registered equity funds that invest in international assets, as well as institutional investment products focused on global assets. Despite the growing importance of global equity markets for US investors, there is little academic research devoted to their study. Jeffrey Busse, associate professor of finance, Amit Goyal (University of Lausanne), and Sunil Wahal (Arizona State U) advanced the research, tackling the common theory that less developed markets are less efficient and, consequently, “exploitable by active fund managers.” The trio analyzed a large sampling of active retail mutual funds and institutional products investing in global equity markets, concentrating their research on a sample period from 1991 to 2009. The authors used quarterly returns net of trading costs and gross of fees. They also collected information on annual fee schedules, portfolio turnover, and assets under management. On average and in the aggregate, the data showed a lack of “superior performance” for the sampling. The research paper won the Spangler IQAM Best Paper in Investments Prize at the 2014 European Finance Association Annual Meeting in Lugano, Switzerland. Source:

Consumer word-of-mouth and social media

Certainly, marketers are well aware of the value of the consumers’ word-of-mouth (WOM) endorsements of a product or service. But the ubiquitous nature of social media demands that advertisers find new ways to tap into how consumers interact and communicate to leverage the power of WOM online. Panagiotis Adamopoulos, assistant professor of information systems & operations management; Vilma Todri, assistant professor of information systems & operations management; and Anindya Ghose (NYU-Stern) take a close look at the role of hidden personality traits of online users and how they play into the effectiveness of product WOM on Twitter. The trio used big data, machine learning methods, and causal inference econometric techniques to study consumer purchases made through Twitter accounts. The research showed an increase in the likelihood of a purchase by 47.58% when there was exposure to WOM tweets from a sender who had similar personality traits to the recipient of the information. The trio found that introvert users were much more accepting of WOM versus extrovert users. They also noted agreeable, conscientious, and open social media users are more effective influencers. The combinations of personality traits of disseminators and recipients of WOM impacted the decision to buy a product, with the researchers noting that a “WOM message from an extrovert user to an introvert peer increases the likelihood of a subsequent purchase by 71.28%.” Source:

The rise of ETFs and market impact

As the popularity of exchange-traded funds (ETFs) continues to grow at a rapid pace, the role that these basket or index-linked products play in the market is an ever-growing concern. For instance, ETFs now constitute more than 30% of the daily value traded in US exchanges. Suhas A. Sridharan, assistant professor of accounting, and coauthors Doron Israeli (Interdisciplinary Center Herzliya) and Charles M. C. Lee (Stanford U) dive into the issue by examining the impact of ETF ownership on the availability of information on individual securities and the market for those same securities. The trio analyzes a sample of 443 unique ETFs for the firm-year between 2000 and 2014. They note that ETFs are a particularly attractive investment vehicle for less informed traders. With trading costs for individual securities rising as a result of the flow to ETFs, more informed traders have less of an incentive “to expend resources to obtain firm-specific information.” As the depth and size of the ETF market grows, individual stock prices become less informative. Source:

Securitized loan modification and loan performance

After the collapse of the housing market, the wave of foreclosures in the US changed the economic landscape of many neighborhoods across the country. Some academics and policymakers have argued that the renegotiation of those loans was a much better alternative than foreclosure and that incentives should have been offered to financial institutions to encourage it. However, little research exists to understand the performance of loans that were modified. Gonzalo Maturana, assistant professor of finance, takes a close look at loan modifications made early in the recent housing crisis to better understand the value of offering incentives to modify securitized non-agency loans. According to Maturana, researchers contend that the small number of loan modifications added to the number of foreclosures during the subprime crisis. His analysis consisted of slightly more than 835,000 non-agency securitized loans that became delinquent between August 2007 and February 2009. Maturana found that loan “modification reduces loan losses by 35.8% relative to the average loss, which suggests that the marginal benefit of modification likely exceeded the marginal cost.” Additionally, modifications resulted in fewer liquidations. He also found that modifications were particularly useful “in preventing future loan losses in times of large increases in delinquencies when servicers are more likely to be working at full capacity.” Source:

Today, US President Donald Trump and Russian President Vladimir Putin met at the presidential palace in Helsinki to discuss the relationship between their respective countries. Prior to the meeting, Trump cited national security concerns and trade as agenda items. Since the start of the meeting, the two presidents have also discussed the tension between the two countries and accused election meddling. At Augusta University, our experts have been following the historic meeting, and made the following observations: • Trump is correct in asserting the importance of having Russia as an ally. • The US is currently facing Russian cyberaggression, so how Trump addresses this issue has immediate concerns. • US posture in Syria is at stake. • It is important to keep this meeting in the context of “America First.” Trump will push messages at the summit that fall in line with his national security interests. What are the implications of this summit for every-day Americans? Will this meeting improve the relationship between the United States and Russia? How will this meeting effect the United States’ relationship with other European allies? There are a lot of questions to answer – and that’s where our experts can help. Dr. Craig Albert is an expert on American politics and political philosophy. He was recently appointed director of Augusta University’s new Masters of Arts in Intelligence and Security Studies. Dr. Albert has experience with all forms of national and local news organizations and is available to speak to media regarding the Helsinki Summit. Simply click on his icon to arrange an interview. Source:

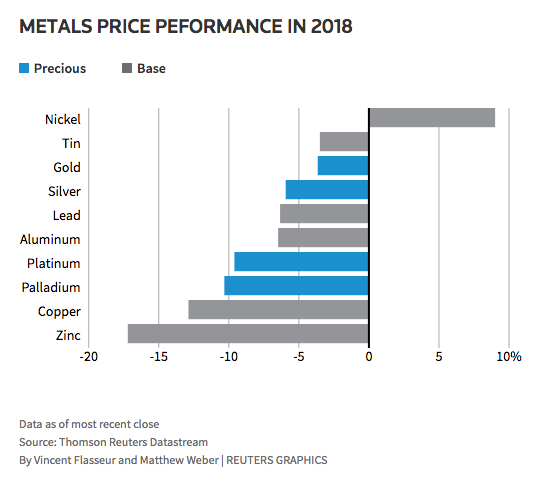

With the shine coming back on nickel – what will it mean for Ontario’s local and wider economies.

It’s boom or bust in the nickel business. From cycles, to slumps to super-cycles and even the most recent decade-long crash, it appears the time for nickel to rebound is near. The last big boom at the turn of the 21st Century saw nickel soar above 20 dollars per pound. It led to multi-billion dollar takeovers of smaller mining companies by industry giants and saw local economies flourish as bonuses skyrocketed, overtime was uncapped and investments in service, supply, innovation and industry support were elevated almost exponentially. Today, with analysts projecting the price of nickel to at least double over the next four years, what can local and provincial economies expect? After a 10-year slump can we expect the same rush to invest and spend? Will companies be more cautious and what will it mean for investors, the markets and businesses. There are a lot of questions and speculation out there about just how big of a splash there will be if nickel finally makes its comeback. And that’s where the experts from Freelandt Caldwell Reilly LLP can help. Ian Fitzpatrick is a Chartered Professional Accountant and a Chartered Business Valuator. He is an expert in advising business owners and entrepreneurs on all aspects of corporate sales, mergers, acquisitions, litigation, succession and ownership issues. To contact Ian directly, simply click on his icon to arrange an appointment regarding this topic. Source:

Disaster Psychologist Available to Discuss Thai Boys' Recovery from Trauma

The world watched with relief as 12 soccer players and their coach were rescued from a flooded cave in northern Thailand after an 18-day ordeal. Amid the relief at the players' safe rescue, Dr. Jamie Aten, a Wheaton College psychologist, says it’s important that they receive care for mental health needs in addition to the physical care they are receiving. Aten, the founder and Executive Director of the Humanitarian Disaster Institute at Wheaton College, is an internationally known expert who helps others navigate mass, humanitarian, and personal disasters with scientific and spiritual insights. Aten recommends the boys’ mental health be monitored closely following their rescue. “They may show extremes in behaviors ... they [may] sleep too much, or have difficulty sleeping,” he says. “They may develop triggers that weren’t there previously.” “Some may withdraw, while others need more attention. Over time these symptoms may lessen, but for some it could be a lifelong struggle.” To request an interview with Dr. Aten, contact Wheaton College Director of Media Relations LaTonya Taylor, latonya.taylor@wheaton.edu. Source:

6 Facts We Learned Working with Migrants and Refugees Around the World Working with migrants and refugees is our business at Catholic Relief Services. CRS was founded in 1943 to assist refugees during World War II. Seventy-five years later, we are still coming to the aid of people escaping conflict, violence and natural disasters. While CRS doesn’t resettle refugees in the United States (these programs are run by the Catholic Church’s Migration and Refugee Service and Catholic Charities), our rich history has taught us valuable lessons on how to best help families fleeing crisis. 5. Adults Need Work and Income. We know from experience that people find pride and purpose in helping earn an income for their families, no matter how small. Refugees and migrants are looking for a hand-up, not a handout and being integrated with their host communities benefits everyone. Caroline Brennan is the Emergency Communications Director for Catholic Relief Services. In her role, she travels to and/or works in areas facing natural or man-made emergencies. See her contact information at the bottom. 6. The Poorest Countries House the Most Refugees and Migrants. Although media stories can give the impression that the U.S. is swamped with migrants, the reality is that 85% of the world’s refugees are in the developing world. The country with the largest refugee population is Turkey, with almost 3 million. One in 3 people in Lebanon is a refugee. The Bidi Bidi Refugee Camp in Uganda alone is home to 229,000 South Sudanese who have fled civil unrest. Richer nations like the U.S. should look at the lessons of how these countries with far fewer resources welcome and host refugees. Caroline Brennan is the Emergency Communications Director for Catholic Relief Services. In her role, she travels to and/or works in areas facing natural or man-made emergencies. See her contact information at the bottom. The experts at Catholic Relief Services are available to help with any media coverage or insight that is required regarding this ongoing news story and issue that is continuing in America. Simply click on any of their icons to arrange a time for an interview. Source:

6 Facts We Learned Working with Migrants and Refugees Around the World - Facts 3 and 4 Working with migrants and refugees is our business at Catholic Relief Services. CRS was founded in 1943 to assist refugees during World War II. Seventy-five years later, we are still coming to the aid of people escaping conflict, violence and natural disasters. While CRS doesn’t resettle refugees in the United States (these programs are run by the Catholic Church’s Migration and Refugee Service and Catholic Charities), our rich history has taught us valuable lessons on how to best help families fleeing crisis. 3. Support the Family. The family unit provides the primary support for children during the traumatic refugee experience -- whether it is witnessing violence or crossing a desert on foot. CRS focuses on keeping families together. This means housing a family together and using any services provided – from trauma counseling to income generation – to boost family cohesion. Shannon Senefeld is a global development expert at CRS. She has published and presented extensively on international children’s issues and the importance of strengthened family care for children’s development. See her contact information at the bottom. 4. Kids Need School and Play. CRS is dedicated to keeping up children’s education, to provide stability and normality and give them hope for the future so they can be productive citizens wherever they end up. Kids need to be kids, too. Whether they are in a camp or any sort of migrant or refugee holding center they need a space to play. Caroline Brennan is the Emergency Communications Director for Catholic Relief Services. In her role, she travels to and/or works in areas facing natural or man-made emergencies. See her contact information at the bottom. The experts at Catholic Relief Services are available to help with any media coverage or insight that is required regarding this ongoing news story and issue that is continuing in America. Simply click on any of their icons to arrange a time for an interview. Source: