Experts Matter. Find Yours.

Connect for media, speaking, professional opportunities & more.

The School of Science at Rensselaer Polytechnic Institute (RPI) has launched a new minor in quantum computing, positioning students at the forefront of one of the most rapidly developing fields in technology. The minor leverages RPI's unique status as the first university in the world to house an IBM Quantum System One on campus, providing students with unprecedented access to utility-scale quantum computing technology. The minor, which is now available to all currently enrolled students, requires four courses drawn from physics, computer science, mathematics, and engineering. The curriculum provides both theoretical foundations and practical exposure to quantum hardware and software, and gives students a leg up in a field rapidly approaching quantum advantage — the point at which quantum systems outperform classical computing approaches on meaningful tasks. "The quantum computing minor will augment the training of RPI students with insight into an emerging technology that will reshape industries from pharmaceuticals to artificial intelligence," said Steven Tait, Ph.D., Dean of the School of Science. "With direct access to the IBM Quantum System One, our students will gain hands-on experience with cutting-edge tools that are not yet widely available. This minor equips them with the interdisciplinary foundation needed to understand and contribute to quantum-enabled innovation." The minor arrives at a pivotal moment in quantum computing's evolution. IBM's demonstration of quantum utility in 2023 marked the beginning of an era in which quantum systems serve as scientific tools to explore complex problems in chemistry, physics, and materials science — areas where quantum advantage offers transformative potential. Hannah Xiuying Fried, graduating this December, is one of the first students to declare the minor. “I'm not a physics or computer science major, so it allows me an accredited way to prove a relevant background to future employers,” she said. “It prepares me for graduate school where I plan to continue pursuing quantum hardware research.” Currently enrolled students may declare the minor now and pursue it alongside their established degree programs. Interested students should contact Chad Christensen at sciencehub@rpi.edu.

Trim the Clutter, Keep the Cheer

The holiday season brings warmth, joy and a touch of magic into our homes, but it also can bring excess clutter, waste and energy consumption, making it hard to feel festive. However, there are simple and creative ways to decorate sustainably without sacrificing the festive spirit. Baylor University human sciences and design professor Elise King, M.I.D., M.A., an expert in interior design and built environments, says embracing sustainable decorations, changing to energy-efficient lights, eliminating clutter and reducing waste can help maintain a tidy, eco-friendly home – and create a holiday atmosphere that resonates with joy and meaning. “The holidays can often feel busy and stressful, so it’s helpful to focus on traditions and decorations that bring joy and add meaning to the season,” King said. By taking simple steps to reuse materials, reduce energy consumption and focus on what matters most, families can celebrate the season with both heart and mindfulness, King said. Decorating sustainably One of the easiest ways to approach sustainable decorating is by reusing or repurposing materials you already have or finding decorations at resale shops. "Upcycling items from thrift stores or turning last year’s Christmas cards into garlands are simple and creative ideas," King said. “Beyond thriftiness, these practices add a personal and nostalgic touch to decorations.” King also said that it is important to consider the lifecycle of a product, beyond just being recyclable. "Also consider elements such as durability/longevity, manufacturing processes, transportation, energy consumption and disposal,” she said. “I recommend people make the best-informed decisions they can, while also remembering not to let it become overwhelming. Switch to LED Christmas lights Changing from incandescent to LED Christmas lights is good for both style and sustainability. LED lights reduce energy usage, are more durable and typically last longer than incandescent. Plus, they have come a long way over the past few years. “The criticism used to be that LEDs had a blue hue and were ‘cold’ compared to incandescent,” King said. “That isn’t really the case anymore. You have to be particular about what you purchase, but several companies offer lights that are virtually indistinguishable from vintage lights.” A clutter-free peaceful mindset While holiday decorations create a festive touch around the house, they can add to the clutter and busyness, which ultimately takes away the joy, King said. Decluttering and organization can help create a peaceful environment. “Most people enjoy Christmas decorations, but over the years we tend to accumulate a lot of them,” King said. “Sadly, for many, the thought of decorating for Christmas no longer brings feelings of excitement and joy. Instead, we dread going into the attic, dragging out the tree and boxes of ornaments, checking strands of lights, fixing broken bulbs, etc., only to know that we’ll have to put it all back in about a month. "Keep decorations that bring joy and let go of what no longer feels fulfilling can make a big difference in decreasing the excess while emphasizing what is important to you and your family," she said. By clearing both physical and mental space, families can better prioritize the activities and moments that truly matter. Reducing paper use It can be difficult to go fully paperless because of gift wrapping, but there are ways to reduce paper in the holidays from reusing materials or gifting experiences. “You can reuse paper shopping bags or even cut up the bags or other paper you have around the house and wrap gifts,” King said. Gifting experiences rather than physical items is another growing trend. “I find that many people are interested in receiving or gifting experiences, which can also reduce wrapping needs,” King said. “Not only does this minimize waste, but it also emphasizes shared moments over material possessions.” King noted that since COVID, there has been a trend to go paperless and people tend to be more comfortable with virtual communication and remote collaboration in general, which can also eliminate the need for Christmas cards and other paper products.

One AI-based advancement at a time, UF leaders are transforming the sports industry

As emerging technologies like AI reshape sport industries and professional demands evolve, it is essential for students to graduate with the expertise to thrive in their future careers. To ensure that these students are set up for success, the UF College of Health & Human Performance has launched a new sports analytics program. Led by Scott Nestler, Ph.D., CAP, PStat, a professor of practice in the Department of Sport Management and a national analytics and data science expert, the program ties back to the UF & Sport Collaborative – a five-part project intended to elevate UF’s presence on the global stage in sports performance, healthcare and communication. “Tools and insights that previously were only available to professional sports teams are now coming to the college level, and it makes sense for universities to begin using these data, technologies and new analytic methods,” Nestler said. The sports analytics program fosters collaboration between academic units, such as the Warrington College of Business and the University Athletic Association, helping bridge the gap between sport research and innovation and empowering students to address real-world challenges through data and AI. For example, the program offers opportunities to leverage technology and analytics for strategic decision making in player acquisition, team formation and in-game decisions. Beyond performance metrics, the program also explores marketing strategies and revenue analytics, providing a well-rounded understanding of the field. “When you have enough data and a large enough sample of individuals, AI can help make predictions that otherwise would take prohibitively longer for a human to accomplish with traditional methods,” said Garrett Beatty, Ph.D., the assistant dean for innovation and entrepreneurship and an instructional associate professor in the College of Health & Human Performance’s Department of Applied Physiology and Kinesiology. “Because those data volumes are getting so large, AI models, machine learning, deep learning and other strategies can be leveraged to make sense and glean insights from sport and human performance data in ways that have never been done before.” The program seeks to offer several educational opportunities, such as individual courses, certificate programs and potentially a full degree program. In the long term, Nestler envisions the program evolving into a center or institute, beginning with establishing a research lab in the spring. Additionally, the program will leverage the university’s supercomputer, HiPerGator, to analyze larger data sets and use newer predictive modeling machine learning algorithms. “As faculty and staff move from working with box score and play-by-play data to using tracking data, which contains coordinates of all players and the ball on the field or court tens of times per second, the size of data files in sports analytics has grown tremendously,” Nestler said. “HiPerGator, with its large storage capacity and multiple central processing units/graphic processing units, is ideal for using in sports analytics work in 2025.” Nestler also aims to increase student involvement by enhancing UF’s Sport Analytics Club and hiring research assistants to work on projects for the University Athletic Association. “We need to take a broader view of what AI is and realize that it incorporates a lot of what we’ve been calling data science and analytics in the form of machine learning models, which came more out of statistics and computer science. Those are types of AI and those that I think will largely continue to be used in the coming years within the sports space,” Nestler said. “Also, we’re continuing to see growth in the number of people interested in working in this space, and I don’t foresee that changing. Fortunately, we are also seeing the number of opportunities available to those with the appropriate skills increase as well.”

Budget 25 – initial reactions related to personal financial wellbeing

As the director of the Aston Centre for Personal Financial Wellbeing, and a professor of taxation, I obviously take particular interest in the annual budget day as it sets a tone for much of the personal finance changes that are likely to occur in the near future. The lead up to this year’s budget had unprecedented levels of speculation with much of the press and commentators trying to get attention with ever more it seemed wilder guessing of what the chancellor might do – largely unhelpfully and worrying people and the markets unnecessarily. Almost all of this proved wide of the mark as the budget didn’t increase any of the main taxes at all, and where it might nudge National Insurance contributions (NICs) up for some, this won’t be for a few years and only in a small area (pension payments for employees) that won’t actually affect most people. Small and cautious steps to reform The reason for all this speculation of key changes needed was that everyone suspected there was a big hole in the national finances. This was shown not to be the case. In fact, predictions provided in the budget documents are we’d in fact be in budget surplus by the end of this parliament period even before the changes announced take effect. This was a surprise to many and meant the chancellor could actually focus on at least some small and cautious steps towards reforming how our tax, benefit and government spending systems work. What she proposed therefore is currently predicted will raise circa £26bn and give the government ‘head-room’ to cope with economic changes later rather than needed to fill a feared financial black hole now – good news all round! This meant what we actually got was lots of smaller changes with fewer ‘rabbit out of a hat’ big tax surprises than we have had in recent years – a welcome steadying trend I hope will continue. She also promised some short-term spending that can be paid for with a combination of extra borrowing now and with increased taxes later – again a trend of recent budgets. If these tax changes actually happen in the end, then it will be down to what happens between now and when these were proposed to commence – by no means a guarantee these will ever happen. Later budgets, or other rule changes in the future, could easily retract or counter them (all chancellors like to announce planned tax changes aren’t going to happen for obvious political gain reasons!). Income tax changes The largest share of the extra £26bn raised will come from extending the income tax thresholds for a further period – now to 2031. These have been fixed (at £12,570 for example for the point at which income tax starts to need to be paid on personal incomes) since at least 2023, some well before this. This matters, as, when wages rise due to inflation, people are not better off in reality (you get more income but things cost more), but may end up paying more tax than before as the thresholds haven’t increased with inflation to the same degree (what we call ‘fiscal drag’). As such, holding these thresholds fixed for longer will raise extra money for the government (predicted to be over £12bn a year in 2030-31 for example) – largely unnoticed as to many it doesn’t feel like the tax rise it clearly is. The threshold fixing extension announced today will mean that as many as 700,000 more people will start to pay some income tax when they wouldn’t currently, and up to 1 million more people will start to pay higher rates of tax than currently – all without being actually better off in real terms. Some call this stealth tax, but it feels very real when it starts to affect you if your total taxable incomes fall near these threshold levels. There were in total more than 70 other tax measure changes in this budget – a huge number and lots to get your head around. However, most of these will not affect most people and are relatively small in nature – targeted at making the tax system a little fairer (i.e. those on higher incomes, with more savings, dividends, receiving additional income from property they own etc – paying more taxes as a proportion of the total amount raised in tax from all sources). This is clearly welcome news (at least for those not being asked to pay this extra) in the current climate. The biggest changes for financial wellbeing As a research centre focusing on individual and family financial wellbeing, what do we think are the specifics announcements made that are most likely to affect people – several headline announcements are worth highlighting: - 1. The removal of the two-child limit on benefit eligibility is obviously a key headline – long touted as a key reason larger families are much more likely to be in poverty than smaller families. This is a key change that many Labour MPs wanted to see happen and the chancellor has delivered on it. This is very welcome news – although it won’t start to affect these families until after April 2026 to give time to bring these measures into place – but then predicted to lift 450,000 children out of poverty. 2. As part of making the tax system more progressive, a brand-new tax was announced on very expensive houses in England – to be snappily called the High Value Council Tax Surcharge (or HVCTS) – although expect it to be called the ‘mansion tax’ by everyone! The UK’s main local tax (council tax) isn’t going to be reformed as such in this change – despite being the target of much speculation that it is just too regressive to leave unreformed any longer after we haven’t revalued houses in most of the UK since 1991. This will instead be an additional tax, commencing in April 28, on those whose properties are valued (now) at £2m or more – with higher rates rising to those with properties over £5m. Clearly this will affect relatively few in most of the UK (only expected to affect 1% of properties nationally), but will affect some and will raise extra revenues (expected to raise circa £400m+ a year) to directly support provision of local services – much needed in many parts of the UK. 3. New taxes on electric cars – given fuel duty is not paid by those who drive electric cars (as they don’t buy petrol or diesel) there have been calls for new taxes to be charged to electric car drivers. While these cars may be better for the environment when driven, they continue to wear roads and contribute to congestion. The government is proposing a per mile charge from April 28 (to be called the Electric Vehicle Excise Duty or eVHD) for these vehicles which will be painful for electric car divers – not least as this cost as not known when purchase decisions were made. No-one likes a tax charged on something you have already made the decision to buy so expect this to be unpopular. It is proposed currently to cost EV drivers around £20/month – about half the rate of fuel duty on average – and expected to raise circa £2bn a year by 2030-31. I expect this tax will become more nuanced in future perhaps as technology enables perhaps different charges to be applied to use of congested city roads compared to open rural driving perhaps - we will see. 4. National Insurance deductibility for pension contributions via salary sacrifice schemes operated by many employers for their employees is to be capped at £2,000 (although only from April 29 – so no immediate effect). This now very widely used approach to making pension contributions if you are an employee that in effect avoids you having to pay NIC on this income going into your pension. For those with larger pension contributions the bit that can be made before NIC is due on the extra this will be capped in the future to £2,000 per year – again affecting those who receive higher pension contributions most and affecting those at the bottom of the income spectrum, little if at all (74% of employees are predicted not to be affected). Is this a breach of the Labour manifesto promises not to increase the main taxes? For some it certainly seems that way. What didn’t happen? There are many smaller measures to explore, or ones that are not coming into effect for the next year or more that might have been missed from the news headlines but that will almost certainly affect lots of people. To name just a few (including highlighting several things NOT going to happen – which will obvious not save people money per se, but help by not costing them more): - above inflation increases to national minimum (‘living’) wage for all age groups from April 2026 (+4.1% for those over 21)– although still not raising this to ‘real living wage’ levels. further extension of holding off on the 5p/litre fuel duty rise not increasing prescription charges (staying at £9.90 for the next year) confirming state pension rises by 4.8% from next April (worth £575/year) confirming £150 winter fuel payments again this winter to over 6 million homes freezing regulated rail fares – preventing the usual annual increases from January (the first time this has happened in 30 years) extending the government’s Help to Save scheme to more benefit recipients than previously No immediate impact for most Overall, this is therefore probably a welcome budget for many, those on lower incomes will likely get the most from these measures, if all are applied as proposed, but most won’t see much of an immediate impact immediately – and with the largest benefit likely to all on larger families in receipt of benefits from next April.

Why Are Canadian Banks Not Protecting Seniors? The $40 Billion Dollar Question

After an 89-year-old Victoria man lost $1.7 million to phone scammers despite bank red flags, retirement expert and authour, Susan Pimento, exposes a critical protection gap: while U.S. banks like Bank of America offer "Trusted Contacts" (designated people banks call to verify suspicious transactions) for all accounts, Canadian banks restrict this safeguard to investment accounts only—leaving everyday banking vulnerable where most fraud occurs. In Canada, senior fraud is vastly underreported (RCMP estimates only 5-10% surface), and banks are treating this as a cost issue rather than a moral crisis. Susan Pimento is available for interviews to discuss practical solutions, industry insights from her decades of work within financial institutions, and why Canadian banks are failing to implement a simple fix that could save seniors' life savings. Connect with her directly through ExpertFile to schedule TV, radio, podcast, or print interviews. As I was polishing this post for Canadian Financial Literacy Month, another senior fraud story flashed across my screen. This one stopped me cold. According to this CBC story, an 89-year-old man in Victoria, B.C., was tricked into handing over nearly $1.7 million of his life savings in a months-long phone scam. The caller claimed to be from the fraud department at CIBC and said he was helping with a national money-laundering case. (Spoiler: he wasn't.) Despite red flags and staff awareness, the bank still allowed large in-person withdrawals. He was told to buy gold bars — yes, actual gold bars — with drafts of up to $395,000, which couriers then collected like some twisted Uber Eats retirement fraud. Every week in Canada, we see another heartbreaking headline: a senior sends thousands, sometimes millions, to a scammer pretending to be their grandchild, the CRA, or — the ultimate irony — their bank. These scams targeting seniors don't require fancy hacking. They rely on fear, isolation, and misplaced trust. Once the money's gone, it's gone—no refund policy. And here's the kicker: what we're reading about is just the tip of the iceberg. For seniors, fraud now ranks as the top crime, and most fraud goes unreported—especially in this demographic. In a previous post, I showed how the data suggests the real figures could be 10 to 20 times higher than what's officially reported. The RCMP estimates that only 5-10% of fraud victims come forward. Many victims never speak out due to embarrassment, fear, or confusion. Translation? For every story that makes the news, countless others suffer in silence. How The Banking Industry Can Actually Fight Fraud I've worked within financial institutions for decades. Let's just say I understand how the process works. Banks have billion-dollar tech stacks, layers of compliance, and advanced fraud detection systems that can flag a suspicious $47 transaction in milliseconds. But the solution for this type of fraud isn't a multimillion-dollar algorithm or a new "AI-powered fraud prevention dashboard." Instead, it's a human-based approach called a Trusted Contact. What's a "Trusted Contact," Anyway? It's not an app, a chatbot, or some new gadget that requires a firmware update every Thursday. It's a person. Someone you trust — a family member, attorney, accountant, or another third-party who you believe would respect your privacy and know how to handle the responsibility of communicating with your bank in your best interests if something suspicious occurs. They don't access your money or view your accounts. They can't see that you spent $47 at the LCBO last Tuesday (Your secret is safe). They're simply your human safety net — a fraud wing person, if you will. The Origins of the Trusted Contact The concept began in the U.S. in 2018, when FINRA mandated investment firms to request a Trusted Contact Person. Canada followed in 2022, when the Canadian Securities Administrators introduced similar guidance for investment accounts. What things can be discussed with a trusted contact? As its name implies, a Trusted Contact is a designated person who is inherently trusted by the individual (and has no authority to transact business on a client’s account), so there is little to no danger that any reasonable disclosure would violate a client’s trust or give rise to any material issue.” What Canadian Banks Are Doing...And Not Doing Here's the good news. If you invest through Wealthsimple, RBC Direct Investing, TD Direct, or BMO InvestorLine, you can already designate a Trusted Contact. But here's where it gets ridiculous: RBC Direct might have that security feature — but your regular RBC chequing account? Not so much. That protection vanishes the moment Mom or Dad logs into their everyday banking. And that's where most fraud actually occurs. It's like installing a state-of-the-art security system on your front door but leaving the back door wide open with a welcome mat that says "Scammers Enter Here!" Fraud in Canada for Banks is Still a Budget Item: Not a Moral Crisis Here's the uncomfortable truth: For banks, fraud is considered a "cost of doing business." And since most of those losses are borne by customers, not the bank, there isn't much urgency to innovate. The Big Five earned over $40 billion in total last year. They have the means to care. They're not particularly motivated to actually do so. The Big Opportunity for Banks: Add a Little Humanity to the System Banks like to boast about their AI, blockchain, and next-gen fraud analytics. But most scams don't occur because of breached firewalls — they happen because of breached hearts. A Trusted Contact provides an additional simple, low-tech layer: human verification. Picture this: The bank spots an unusual transaction — a large new payee, an international wire transfer, or a sudden gold-bar purchase (it happens). Instead of sending another automated text alert, the system could ask: "This looks unusual. Would you like us to confirm with your Trusted Contact before proceeding?" or “Just a heads-up: scammers often use urgent or unusual requests. Prefer we run this by your Trusted Contact before we proceed?” That's it. One additional step. One extra set of eyes. One brief conversation could save someone's life savings. This isn't about limiting independence — it's about safeguarding autonomy. Ensuring your decisions are genuinely yours, not the scammer's. Banks could even call it "Senior Protection Mode." I'd sign up tomorrow. Heck, I'd pay extra for it. (Shhh, don't tell them that.) Here's the Proof Trusted Contacts Work: Bank of America Did It In 2022, Bank of America became the first major bank to extend Trusted Contacts beyond investment accounts to everyday banking clients. Customers can now add a trusted person the bank can call if something seems wrong, if they can't reach you, or if staff suspect undue influence. That person can't access your money — they're just the human speed bump before disaster: one simple form, one phone number, and much heartbreak avoided. If Bank of America can do it, why can't ours? Canadian banks already have the tech — and indeed the profits — to make it happen. What's Holding Canada's Banks Back? Cue the usual excuses: "Our legacy systems can't handle that." Sure — some of your code still thinks "Y2K" is an active threat. But if you can build an app that tracks my latte points and sends me notifications about my "spending insights," you can add one field for a Trusted Contact. "Privacy laws make it risky." Nope. FINRA and the CSA already provide safe-harbour protections. With consent, banks can legally contact a Trusted Person. Just add a checkbox. You love checkboxes. You make us check dozens of them every time we update our password. "Customers haven't asked for it." They're asking now. Loudly. With megaphones. And pointing at stories like the Victoria gentleman who lost $1.7 million in gold bars. The business case has historically been weak because most fraud losses affect customers, not the bank's balance sheet. But here's the catch: every fraud story damages trust. And in banking, trust is supposed to be the core of the business. For Canadian Banks There's a Competitive Advantage in Caring Rolling out a Trusted Contact feature isn't just good ethics; it's good business. Imagine the marketing campaign: "We don't just protect your password — we protect your peace of mind." Seniors would love this. So would their kids. That's multi-generational loyalty money can't buy. If EQ Bank or any challenger brand wanted a PR home run, this would be it. It's Time to Take Action on Fraud To the Banks: Stop waiting for regulators to force your hand. Lead. Be the first to offer Trusted Contacts for all customers — not just investors. You have the framework, the talent, and the budget. You absolutely do not need another consultant to tell you this is the right thing to do. To Policymakers: The Financial Consumer Agency of Canada should update its Code of Conduct to include a mandatory Trusted Contact option for all customers, safe-harbour rules allowing banks to pause suspicious transactions, and annual public reporting on outcomes. Because sunshine is the best disinfectant, even in banking. To Consumers: Don't wait for policy — be the policy. Ask your bank today if you can add a Trusted Contact. If they say no, ask why not — and post it. Loudly. Talk to your family. Choose your Trusted Person now. Write your MP or MPP and ask why U.S. banks protect seniors better than ours. Remember the $3 ATM Fee Rebellion? Canadians once revolted over paying $3 to access their own money at ATM's. We later got no-fee accounts, digital challengers, and a whole new generation of more innovative banking. If we can rally over an ATM fee, surely we can rally to protect our parents and grandparents from losing their life savings. Fraud isn't an inevitable part of aging — it's a solvable problem. And Trusted Contacts are one of the simplest, most human solutions we have. Don't Forget Two-Factor Authentication for the Soul Adding a Trusted Contact won't stop all fraud — let's be clear about that. But it will go a long way toward slowing it down, adding a common-sense pause, and potentially saving even one senior from losing any part of their hard-earned money. It's unfortunately too late for that gentleman and his family in BC, but it's not too late for countless others. This won't crash legacy systems or drain bank profits. It just adds a little humanity back into banking — right where it belongs. Because the best kind of security isn't just two-factor authentication. It's two people who care. And if we don't care about protecting our elders, who exactly do we care about? Sue Don’t Retire…Re-Wire! Want to become an expert on serving the senior demographic? Just message me to be notified about the next opportunity to become a "Certified Equity Advocate" — mastering solution-based advising that transforms how you work with Canada's fastest-growing client segment.

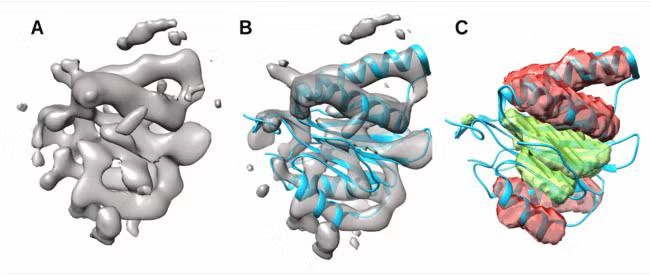

Proteins, often called the building blocks of life, play a central role in drug development. When scientists develop new treatments, they must understand how drugs interact with proteins involved in disease mechanisms and with proteins in the human body that influence drug response. Scientists commonly use cryo-electron microscopy (cryo-EM) 3D imaging data to study proteins. While recent advances have enabled higher-resolution images that are easier to analyze, medium-resolution images—which are more difficult to interpret—are still the most common for larger protein complexes. Salim Sazzed, Ph.D., an assistant professor in the computer science department of Georgia Southern University’s Allen E. Paulson College of Engineering and Computing, has been awarded a two-year National Science Foundation grant of about $175,000 to lead a groundbreaking project to develop novel Artificial Intelligence (AI) techniques for determining protein secondary structures from medium-resolution cryo-electron microscopy (cryo-EM) images. Improved modeling from medium-resolution images will help researchers study more proteins efficiently, giving new insights into diseases and potentially guiding the development of new treatments and future drugs. At its core, this research will combine biology and machine learning to study protein structures. The multidisciplinary approach and potential impacts on public health are what most excite Sazzed. “The impetus behind this research is the positive impact on public health and possibly contributing to the biomedical workforce,” he said. “Seeing biology and computer science combine for that kind of impact is incredibly moving.” As the Principal Investigator (PI) for the project, Sazzed will use his expertise in deep learning computer models to focus on a major challenge in structural biology: identifying the two main secondary structures of proteins—the alpha helix and the beta sheet. These structures are critical for a protein’s overall shape and function, but in medium-resolution cryo-EM images they often appear indistinct or lack clear detail, making them particularly difficult to analyze. Sazzed’s research will focus on two main goals. First, he will quantify the variability of alpha helices and beta sheets in medium-resolution images, comparing them to idealized structures. Second, by integrating this structural variability with the image data in a deep learning model, he will aim to generate more precise and accurate representations of protein secondary structures. “When we feed this information into a deep learning model along with the image data, the model should be able to determine protein secondary structures more precisely,” Sazzed elaborated. Sazzed believes students will greatly benefit from this multi-disciplinary approach. In addition to a Ph.D. student, several undergraduate students will be directly engaged in the research. A full-day workshop will also be organized, allowing Georgia Southern students from diverse disciplines to participate. This initiative will build on Georgia Southern’s strong tradition of involving undergraduates in research and will support the University’s recent focus on biomedical and health sciences. “There are many different knowledge areas coming together in this work,” Sazzed said. “It involves computer science, biology, chemistry, and even public health. I look forward to students following the research and exploring these different fields themselves.” Allen E. Paulson College of Engineering & Computing Interim Associate Dean of Research, Masoud Davari, Ph.D., echoes this sentiment and emphasizes its importance to the University’s research profile. “Sazzed’s interdisciplinary research, which bridges the gap between biology and computer science, will foster multidisciplinary research in our college—as it is cutting-edge and potentially groundbreaking in drug development to impact people’s lives nationally and globally,” Davari said. “It’s also well aligned with the college’s strategic research plan—as we make the move to R1 status to be aligned with ‘Soaring to R1,’ which is among the transformational initiatives for the University.” Looking to know more about Georgia Southern University or connect with Salim Sazzed — simply contact Georgia Southern's Director of Communications Jennifer Wise at jwise@georgiasouthern.edu to arrange an interview today.

The University of Florida’s ‘AI Queen’ is using AI technology to help prevent dementia

To help the 50 million people globally who live with dementia, the National Institute on Aging is finding researchers to develop tech-based breakthroughs that target the disease — researchers like the University of Florida’s “AI Queen.” It’s a fitting nickname for Aprinda Indahlastari Queen, Ph.D., who is applying artificial intelligence technology to study transcranial direct current stimulation, or tDCS — a technique that involves placing electrodes on the scalp to deliver a weak electrical current to the brain — as a possible way to prevent dementia. The assistant professor in the UF College of Public Health and Health Professions’ Department of Clinical and Health Psychology is using UF’s supercomputer, HiPerGator, to perform neuroimaging and machine learning analyses to study how anatomical differences may affect tDCS outcomes. “Investigating working memory in patients with mild cognitive impairment offers an opportunity to understand how cognitive processes are disrupted in the early stages of Alzheimer’s disease,” said Queen, whose study — funded by a National Institute on Aging research career development grant — integrates neuroimaging with information on brain structure that is unique to older adults and those with mild cognitive impairment. Refining the treatment with AI Using neuroimaging, Queen captures real-time changes during tDCS to the parts of the brain associated with working memory, which is the type of memory that allows humans to temporarily keep track of small amounts of information. Think of this as a mental “scratchpad.” Her study includes older adults with mild cognitive impairment as well as individuals who are cognitively healthy. In tDCS, a safe, weak electrical current passes through electrodes placed on a person’s head. The stimulation is being used in research and clinical settings for a variety of conditions and has shown partial success as a nonpharmaceutical intervention that can improve cognitive and mental health in older adults. But tDCS results can vary across individuals, and the suspected cause is both simple and complex: Everyone’s head is different. “One potential reason tDCS may not work for some individuals is the variation in head tissue anatomy, including differences in brain structure,” Queen said. “Since electrical stimulation must travel through multiple layers of tissue to reach the brain, and every individual’s anatomy is unique, these differences likely affect outcomes.” To address this further, Queen is using AI. “Artificial intelligence will play a major role in the modeling pipeline, including constructing individualized head models, conducting predictive analyses to identify which participants will respond to the stimulation, and disentangling multiple individual factors that may contribute to these outcomes,” Queen said. An estimated 10 to 20% of adults over age 65 have memory or thinking problems characterized as mild cognitive impairment. Their symptoms are not as severe as Alzheimer’s disease and other dementias, but they may be at increased risk for developing dementia. “The fact that not all individuals with mild cognitive impairment progress to Alzheimer’s disease emphasizes the need to identify effective interventions that can slow the progression to dementia,” Queen said. “This project presents an opportunity to differentiate between multiple types of mild cognitive impairment and investigate how tDCS affects the brain across these subtypes.” An AI visionary Queen, who joined the UF faculty under the university’s AI hiring initiative, is an instructor in the College of Public Health and Health Professions’ undergraduate certificate program in AI and public health and health care, and the co-chair of the college’s AI Workgroup. She is also the assistant director for computing and informatics at the UF Center for Cognitive Aging and Memory Clinical Translational Research and a member of UF’s McKnight Brain Institute. Queen received her Ph.D. training in engineering with a focus on building and running computational models to investigate medical devices. She experienced a career “a-ha” moment as a postdoc, when she was a co-investigator on a large clinical trial that paired brain stimulation with cognitive training to enhance cognition in older adults. “This experience was transformative for me. I had the chance to interact directly with participants, which was both fulfilling and eye-opening. These interactions allowed me to see the immediate, real-world implications of my work and sparked a passion for pursuing aging research,” Queen said. “I realized that, through this type of research, I could have a more direct impact on addressing age-related challenges, which prompted a shift in my career plans.” The new grant will help Queen further improve her understanding of the neurobiology and progression of Alzheimer’s disease and other dementias. “These experiences will ultimately prepare me to become a well-rounded aging investigator, capable of making meaningful contributions to the field of aging research,” Queen said. She also credits her mentors and collaborators — Ronald Cohen, Ph.D.; Adam Woods, Ph.D.; Steven DeKosky, M.D.; Ruogu Fang, Ph.D.; Joseph Gullett, Ph.D.; and Glenn Smith, Ph.D. — with supporting her as an early career scientist. “It really takes a village to get here!” Queen said.

How UF researchers are helping Floridians to build resilience

When Hurricane Idalia hit the Big Bend region of Florida in 2023, Jeff Carney and his team were watching. A coalition of architects, planners, and landscape architects led by Carney worked closely with the tiny Gulf island of Cedar Key, which is particularly vulnerable to hurricanes, to prepare for this moment. The researchers had modeled for city officials how a major storm would flood the city’s core services. “Idalia caused flooding exactly where the maps said it would, including city hall, the historic downtown, older homes, and many streets,” Carney said. After the storm, Cedar Key moved city hall to higher ground, as outlined in the plan. And just in time. Barely a year later, Cedar Key was hit even harder by Hurricane Helene. Between the storms, Carney’s group had worked with the city to refine their storm preparation. The new plan focused more on resilience-boosting projects, like improving drainage around the city. Cedar Key finalized their plans just weeks before Helene. “A lot of the projects we put forward in this plan are in the process of seeking additional funding after Helene,” Carney said. A professor of architecture at the University of Florida, Carney directs the Florida Institute for Built Environment Resilience, or FIBER. A research institute in UF’s College of Design, Construction and Planning, FIBER engages with communities to understand how the designs of buildings and cities expose Floridians to risks — not just storms, but also excessive heat, poor air quality, even a lack of health care. FIBER faculty then work with cities to mitigate these hazards. By preparing for emergencies, upgrading buildings, and providing targeted services, communities across Florida are bolstering the resilience of their residents, all with expert help from UF researchers. Preparing to weather big storms That kind of resilience is especially important for some of Florida’s most vulnerable residents. Older and poorer Floridians face higher-than-average risks from natural disasters and other environmental hazards. That vulnerability was apparent in Cedar Key as it weathered the last two hurricane seasons. Centered around aquaculture and tourism, Cedar Key seems in many ways to be thriving. Yet, with the feel of a small fishing village, roughly 13% of its nearly 1,000 full-time residents are considered to be financially disadvantaged, according to U.S. Census data. Poorer residents may also have a harder time walking away from coastal communities devastated by storms. With savings invested into damaged homes and jobs tied to the local area, less-wealthy residents often have no choice but to stay and rebuild. Carney’s team helps people see the opportunities for rebuilding with a clearer vision of a future where rising sea levels are a reality. “You capture people’s attention and excitement when you can offer them options that are not doomsday,” said Carney, who has been working in Pine Island and Matlacha in Southwest Florida’s Lee County to help residents affected by recent storms prepare for the future. “There’s a lot of opportunity for rebuilding as long as you don’t try to have it be business as usual. We help people see how redevelopment can provide a community asset for the future,” he added. “We try to paint the picture of all the possible scenarios so people can find their own comfort level. It puts them in the driver’s seat.” Aging with fewer choices While that kind of agency is empowering, it can be harder to come by as people retire and find themselves facing tough decisions on fixed incomes. That’s a common experience in Florida, which has a larger proportion of seniors than any other state, due in part to its popularity as a retirement destination. More than 10% of Americans over the age of 65 live below the federal poverty line. This population often finds themselves moving to less safe places as they age. “Older people with more social vulnerability — such as low income or poor health — have a tendency to move to worse places,” said Yan Wang, Ph.D., a professor of urban and regional planning in the UF College of Design, Construction and Planning. “They are more likely to move to places with less economic stability, with less access to health care, and with more exposure to extreme weather.” Wang and postdoctoral researcher Shangde Gao, Ph.D., recently published a study that uncovered the risks low-income seniors face when moving. Compared to their peers with higher incomes, poorer seniors were more likely to end up in neighborhoods lacking access to health care facilities. To address these kinds of disparities, UF Health has launched mobile health units that can reach people who have trouble traveling to health centers, including low-income seniors. The Mobile Outreach Clinic provides primary care and referrals for specialists. And the newly launched cancer screening vehicle, which serves all of North Central Florida, can help catch the disease in the early stages when it is easiest to treat. It’s not just finding health care that’s a struggle. Older adults from minority racial groups were also more likely to increase their exposure to poor air quality and to natural disasters like flooding and hurricanes when they moved, Wang and Gao discovered. “If we understand the trend and causes of these income disparities better, we could better prepare some places with more health care resources or better hurricane preparation for these older populations,” Wang said. Building safer, healthier homes That preparation is happening right now in Jacksonville, not just for big storms but for the everyday nuisances and hazards — even the ones people are exposed to in their own homes — that threaten people’s lives and health. The Jacksonville Restore and Repair for Resiliency research initiative was founded to address these kinds of risks while improving energy efficiency. The R3 initiative, as it’s known, is a home remodeling program organized by a slew of community partners and supported by FIBER research on the impact of housing quality on health. The project aims to keep longtime residents of the Historic Eastside in their homes while addressing the home hazards that put people at risk for medical complications like asthma attacks and emergency room visits. “The designs of buildings impact human health and well-being,” said Lisa Platt, Ph.D., the lead researcher with the Jacksonville program and an assistant professor of interior design with FIBER. “Our research is helping the team prioritize the home improvements that will benefit residents’ health the most.” Jacksonville’s Eastside faces a lot of challenges. The population is older than the city as a whole. Roughly three-quarters of residents are over the age of 60, and the poverty rate is over 40%. Yet more than a third of residents own their own homes. Often passed down from previous generations, some of the houses are now over a century old and struggle to keep the intense Florida heat and humidity out. Platt’s research has modeled how things like high heat days — only growing more common in a warming world —are associated with increased emergency room use and poor perceived physical and mental health. That science helps guide the community partners to prioritize providing air conditioning and better insulation to protect Historic Eastside residents. To date, the Jacksonville program is targeting up to 70 homes for renovation. Builders have fixed holes in roofs, replaced drafty windows, and hooked up air conditioning for the first time, keeping the heat and humidity at bay and protecting residents’ health. Now the R3 initiative is applying for federal grants to expand the program. “I think the best way to approach this kind of community action research is with humility and outreach. Community members have amazing expertise. I always say, ‘I can build models to analyze the problem, but you are the ones that are the experts,’” Platt said. “That’s where UF can be most useful, is coming in from a perspective of service.”

Your First Scroll of the Day Is Wrecking Your Sleep and Focus, Says ADHD Therapist

For many people, the day doesn’t start with getting out of bed - it starts with reaching for the phone. Psychotherapist Harshi Sritharan, who specializes in ADHD and anxiety, says that tiny habit is doing more damage than most of us realize. “When you check your phone before you’ve even sat up, you’re flooding your brain with microbursts of dopamine,” she explains. “Dopamine is a key part of our motivation and reward system. Those quick hits of novelty - notifications, texts, news, social feeds - tell the brain, ‘This is where the good stuff is.’” The problem? That early surge doesn’t just switch on your day. It primes your nervous system to stay on high alert. “You’ve now trained your brain to expect that level of stimulation,” Sritharan says. “For many people with ADHD, nothing else in their day compares - school, work, chores all feel flat by comparison. That’s where that constant ‘I’m bored’ feeling can come from.” That ongoing “high alert” isn’t just about boredom, though. It’s also a sign of a dysregulated nervous system: your brain scanning for the next hit of information, your body sitting in low-level fight-or-flight. Over time, that uncertainty - What’s waiting for me in my inbox? Did I miss something? - can exacerbate anxiety and executive dysfunction. Nighttime habits make things worse. Those late-night emotional spikes from doom-scrolling, stressful emails, or intense content don’t just keep your mind busy. They can trigger the sympathetic nervous system - the body’s fight, flight, or freeze response - and potentially release stress hormones like cortisol and adrenaline. “That combination,” Sritharan notes, “blocks melatonin, dysregulates the nervous system, and sends your body the opposite message of what it needs before sleep. You’re basically telling your brain, ‘We’re in danger,’ and then expecting it to rest.” Instead of shaming people for these habits, Sritharan takes a “knowledge equals power” approach. “I don’t tell clients, ‘Just stop doing that,’” she says. “I teach them what’s happening in their brain and nervous system so they can understand why it feels so hard to put the phone down. Once people see the pattern, they feel less broken - and more motivated to experiment.” “Most people don’t need a total digital detox,” Sritharan says. “They need skills, not shame. When they understand how their brain is wired - especially with ADHD - they can design habits that work with their nervous system instead of against it.” Her message to anyone who feels stuck in the cycle: don’t blame your willpower. “This is your biology, not a personal failure,” she says. “When you understand what your brain is doing, you can finally start changing the script.” ⸻ About the Expert Harshi Sritharan is a psychotherapist who focuses on ADHD, anxiety, and intentional tech use. She helps clients understand dopamine cycles, rebuild healthy routines around sleep and screens, and create realistic boundaries that work in real life - not just on paper. Harshi is part of the Offline.now ADHD Expert Community.

When Markets Wobble (Part 2): How Canadians Can Use Home Equity as Their Ultimate Cash Wedge:

In an earlier post I laid out one of the foundational blocks of your retirement defense system: the "Cash Wedge" - that boring-but-brilliant cushion of cash, GICs, and T-Bills that protects you from selling investments when markets wobble. The Cash Wedge is the mild-mannered superhero of your retirement plan. It buys you time, flexibility, and peace of mind, as it gives you permission to wait for markets to recover— Now if you missed Part 1, go back and give it a quick read here. For Canadian homeowners — especially those whose wealth is mostly in their property — there are additional options that allow you to use your equity as a second buffer, dramatically strengthening your financial resilience. How Home Equity Strategies Can Help You Create a Backup Wedge for Retirement Here's the risk that catches thousands off guard: sequence-of-returns risk combined with home equity concentration. Translation: While you own your home, you encounter problematic market conditions early in retirement while withdrawing, and your options narrow quickly. Author Wade Pfau's research demonstrates that home equity can serve as a "buffer asset," shielding investments during economic downturns. Instead of selling investments when markets are down, it might be smarter to temporarily access a pre-arranged HELOC or reverse mortgage. Once markets recover, you can repay the credit line. This isn't debt panic — it's strategic damage control. Warren Buffett's Wisdom Applied to Canadian Retirement As an investor, Warren Buffett is the epitome of control and discipline. His now famous quote rings true in these times. “The stock market is a device for transferring money from the impatient to the patient.” Translation for retirees: Keep dry powder. Own quality investments. Don't chase fads. And stop looking for the bottom — nobody knows where it is until it's in the rear-view mirror. The Canadian "Brick-and-Mortar" Retirement Strategy Listen up, homeowners. Canadians whose retirement plan is pretty much: buy a home, pay it off, and repeat; "we're mortgage-free" with pride. This strategy is very common and effective. But let's be honest: if your home is part of your retirement plan, economic changes matter even more. If you’re in this camp, you need to accept the facts and plan how you'll use your equity to secure your retirement. It’s better to have a ready, aim, fire approach than the more typical fire, ready, aim! When markets decline, central banks often cut rates. Lower rates can support real estate — but they don't guarantee rising prices. Meanwhile, inflation drives up costs, buyers' budgets fluctuate, property values can soften, and retirees feel the impact most quickly. Even a modest dip in home values creates real erosion in net worth when your home carries the bulk of your financial future. The Case for Securing Home Equity Access Now It's much easier to qualify for credit when home values are higher, finances are stable, and you're not already in a pinch. Your options: Home Equity Line of Credit (HELOC) This includes products like Manulife One: Competitive rates and flexible options — but retirees often face income qualification barriers. Reverse Mortgage: No income needed, no payments required. Plus, the No Negative Equity Guarantee — you can never owe more than your home is worth — but retirees dislike debt! HESA (Home Equity Sharing Agreement): You get cash now in exchange for sharing a percentage of your home's future appreciation. No monthly payments, not technically debt, but you give up a share of future gains. This isn't about needing money today. It's about safeguarding your future from having to sell, downsize, or rely on credit card debt because the economy experienced a mood swing. It's insurance — with a door handle. Building Your Cash Wedge: Step-by-Step Calculate 12–24 months of living expenses. Select where to store each layer (high-interest Savings Account, cashable GICs, T-Bills). Refill the wedge with income from dividends, distributions, or planned draws Monitor your situation closely. If your income is tight: consider arranging a home-equity line or reverse mortgage as a backup wedge - not an emergency scramble. Review annually — cost of living changes, inflation changes, and so should your wedge. The Bottom Line for Canadian Retirees The real question isn't "Do I need a Cash Wedge?" It's "Can I afford NOT to have one?" Retirees have limited capacity to earn income to cover shortfalls. Budgets can tighten unexpectedly. Inflation doesn't seek permission. And sometimes the thing we think we'll never need becomes the lifeline that secures our retirement. Your retirement security comes from: Owning quality investment Building reliable dividend income Preparing smart home-equity backstops Keeping emotions out of financial decisions Avoiding saving too much while living too little The Cash Wedge is the most boring tool in your retirement plan — and the most powerful. Yet most financial plans ignore it. Don't. Sue Don’t Retire… ReWire!!! Want to become an expert on serving the senior demographic? Just message me to be notified about the next opportunity to become a "Certified Equity Advocate" — mastering solution-based advising that transforms how you work with Canada's fastest-growing client segment.