Experts Matter. Find Yours.

Connect for media, speaking, professional opportunities & more.

The economy may be slowing - but remains strong according to Georgia Southern expert

Georgia Southern’s Economic Monitor Q1 reports regional economy slows, retains strength Georgia Southern University’s latest Economic Monitor, which reflects Q1 2022, reports that growth in the Savannah metro economy moderated during the opening quarter of the year. “The broadest indicators of economic activity — overall regional employment and electricity sales to residential, industrial and commercial users — continue to signal strength,” stated Michael Toma, Ph.D., Georgia Southern’s Fuller E. Callaway Professor of Economics. “After good performance in the fourth quarter, there was a mild pull-back during the first quarter in tourism and port activity. In general, the regional economy maintained its forward momentum, but slowed its rate of acceleration. Toma also noted that the Savannah metro economy will grow approximately 2% through the remainder of 2022, noticeably slower as compared to the rebound year of 2021. The economic future is somewhat murkier now as inflation surges, the Federal Reserve tightens, and global energy and commodities markets remain rocked by Russia’s invasion of Ukraine, he said. Overall Strength, but Some Sectoral Weakness The business index for the Savannah metro economy increased 1.3% in the opening quarter of 2022, roughly half the pace of the previous quarter. The index of current economic activity increased to 207.3 from 204.7. The index was buoyed by solid employment growth of 1.6% during the quarter and electricity sales growth of 2.1%. Indicators of port activity, tourism and retail sales slowed during the quarter. Metro Savannah employers added 3,100 jobs pushing total regional employment to 197,500 — more than 5,000 jobs and 3% higher than the pre-pandemic peak of 192,100 in the fourth quarter of 2019. The Georgia Department of Labor recently completed its annual benchmarking process for employment in which the monthly payroll survey data is benchmarked against headcount data. Total employment data did not change significantly but business and professional industry services were revised downward while the information sector, including the film and entertainment industry, was revised upward substantially. A full media release detailing key indicators such as Employment Trends, Housing Market, and that Slowing Regional Growth Expected is attached. About the Indicators The Economic Monitor provides a continuously updated quarterly snapshot of the Savannah Metropolitan Statistical Area economy, including Bryan, Chatham and Effingham counties in Georgia. The coincident index measures the current economic heartbeat of the region. The leading index is designed to provide a short-term forecast of the region’s economic activity in the upcoming six to nine months. Looking to know more - then let us help. The Economic Monitor is available by email and at the Center’s website. If you would like to receive the Monitor by email send a ‘subscribe’ message to CBAER@georgiasouthern.edu. For more information or to arrange an interview - simply reach out to Georgia Southern Director of Communications Jennifer Wise at jwise@georgiasouthern.edu to arrange an interview today.

MEDIA RELEASE: CAA survey says gas prices affecting summer travel plans

Rising fuel prices means those heading out on road trips this year are being forced to make adjustments. A recent survey conducted by CAA South Central Ontario has found that rising gas prices are having an impact on road trip plans now that gas is higher than $2 per litre. Seventy-six per cent of those surveyed say they have a road trip planned within the province this year, while 26 per cent are planning an out-of-province road trip, and 23 per cent are planning to drive to the US. Of those who are planning a road trip, 64 per cent of these respondents said gas prices are likely to impact their road trip plans. While some are limiting the number of trips they take overall or driving shorter distances, some travelers are planning around gas prices, and others are adjusting their budget to accommodate fuel prices during their trip. As we transition into summer, there are easy ways to save money on fuel. This includes controlling speed and limiting hard stopping, avoiding unnecessary idling, and being mindful of your vehicle’s temperature. Savings can also start at the pump, as CAA Members save 3 cents per litre when filling up at select Shell gas stations. More summer fuel saving tips: Don’t start your car until you need to – your vehicle will “loosen up” as you drive. Turn off your vehicle if you’re going to be waiting for longer than a stoplight. Avoid “jackrabbit” starts and hard braking. Fuel economy peaks between 80-90km/h. Use cruise control to maintain your speed to get more distance out of your fuel tank. Gradually cool down your vehicle by first rolling down your windows to air out the vehicle, then turn on your air conditioning gradually. Close your windows and sunroof when highway driving, and use a window shade when the car is parked to help keep the vehicle cooler Keep your tires at the manufacturer’s recommended pressure. Set a reminder on your phone to check it monthly. Plan your route to avoid backtracking and unnecessary mileage. Planning is essential to ensure road trip safety. “We recommend you plan routes ahead of time and share them with someone, bring a map as a backup to your GPS, and check the weather ahead of time,” says Kaitlynn Furse, Director of Corporate Communications, CAA South Central Ontario. “We recommend a daily driving maximum of 800km per day with 15-minute breaks every two hours to ensure you are well rested before you get behind the wheel.” Be sure to pack your CAA membership or download the CAA app for peace of mind on the road. As a part of planning a trip, it’s important to ensure your vehicle is safe and reliable. Here are some ways to get your car road trip ready: Check your tires. Ensure the tire pressure meets the manufacturer's recommendations to improve your vehicle's handling and extend the life cycle of your tires. Top up your fluids. Consider packing extra summer washer fluid and change your oil if you are close to your regularly scheduled appointment. Clean your windshield. Clean any debris inside and out and replace worn wiper blades. Check your lights. Make sure your headlights, brake lights and turn signals are working properly. If you have kids, teach them about road safety by involving them in the process. Test the battery. Intense heat can cause just as much havoc on your car battery as the frigid cold. If your battery is older than three years, have a professional test your car battery and replace it. CAA Battery Service will test, boost or replace your battery. Pack an emergency roadside kit. Whether you buy a pre-assembled kit or create your own, it should include a few essentials like a flashlight, jumper cables, working jack cellphone battery charger, water and non-perishable food. Double check your licence plates are renewed. Doing a quick spot-check online is easy and will help you avoid the risk of getting a ticket. Renewing your licence plate is free. For CAA Members, when you run out of gas, a limited supply of gasoline will be delivered to your disabled vehicle to enable you to reach the nearest open service station, or in accordance with towing service provisions, a tow will be provided to a facility where fuel is available. Specific brands or octane ratings cannot be promised. CAA surveyed 1,697 respondents via a CAA Member Matters Panel in South Central Ontario from May 27 to June 5, 2022.

Is the housing bubble about to burst? Ask our expert about the state and stability of the market

With interest rates on the rise, inflation increasing and home prices out of reach for many, Americans are worried about their financial future. Media now covering the U.S. housing market are seeing signs that the bubble might be ready to burst. With a potential recession looming, some people are looking back to the last housing collapse with trepidation. But economists note that the ingredients causing the 2008 global financial crisis aren't there this time. This is an important issue, and one that will impact millions of Americans. If you’re a reporter interested in covering this topic, let the experts at Florida Atlantic University help with your coverage and questions. Ken H. Johnson, Ph.D., an economist and associate dean in FAU’s College of Business, is available to speak to the media. Simply click on his icon to arrange an interview and time.

#Expert Insight: Practice sound business practices, especially amid high inflation

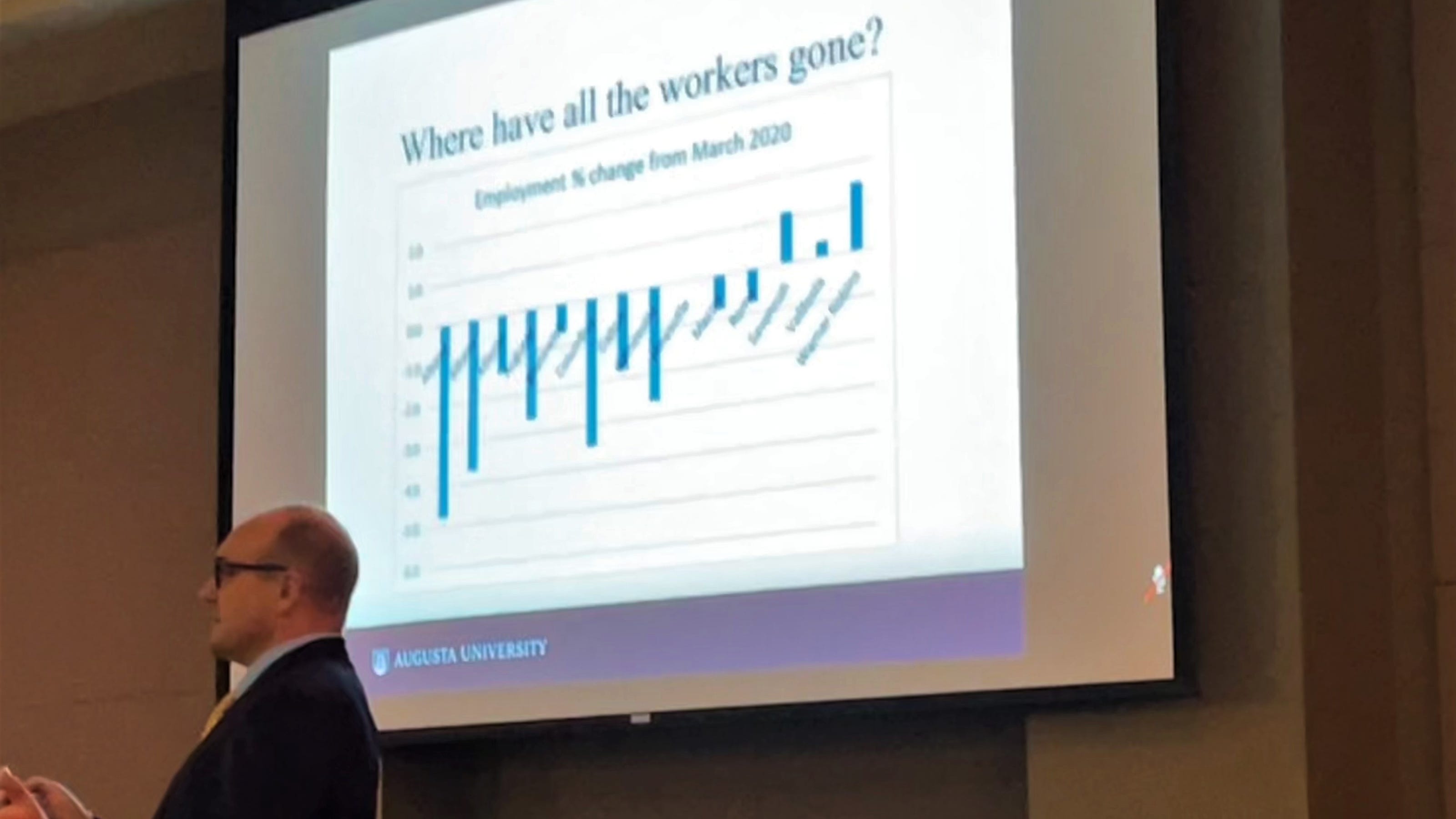

Understanding your market is of the utmost importance in a time with high inflation. Dr. Richard Franza, dean of the Hull College of Business at Augusta University, said business owners should always be examining processes to make sure they are as cost-effective as possible. But also, make sure to keep the customer in mind. “You have to understand where your price fits in with all the other components of your products,” said Franza. “You mustn’t spend money on elements that are not important to your customer. Cut your costs in a way that doesn’t affect the customer experience.” Being aware of everything when business is on an uptick is as important when times aren’t the best. “If you look at the processes when times are good, then you have a lot more flexibility with your margins. Understanding your market is important. Understand how you compete – is it through cost, quality, speed or customization? Understand where you’re better or worse than your competitors." When it comes to the service industry, businesses need to pay special attention to those dealing with the customers. “Understand that while you have to run your back room efficiently, you have to concentrate on your front room where you do interact with customers. Be focused on the experience of the customer. You may want to spend a little extra on the people you hire to interact with your customers; they’re your ‘face,’” added Franza. While inflation may be affecting everyone and every business, it’s important to remember one thing. “Be true to your brand. Your loyal customers are coming to you because of that.” If you're looking to know more about this important topic, then let us help. Franza is available to speak with media about trending issues like inflation, small business and the economy – simply click on his icon now to arrange an interview today.

Will tourism bounce back as the Sunshine State gets ready for a post-COVID return?

The COVID-19 pandemic wreaked havoc on the globe, leaving few industries untouched in its wake. Florida’s tourism industry was hit particularly hard, with resorts shuttered and millions of visitors to the Sunshine State canceling their vacation plans. In fact, it’s estimated Walt Disney World lost more than $7 billion in 2020, all because of COVID. But with Florida back open and visitors returning, what's next for hospitality and tourism? And how will organizations handle staffing, pricing, inflation and other issues? If you are a journalist looking to cover the tourism sector in Florida, let us help. Peter Ricci is a clinical associate professor and director of the Hospitality and Tourism Management program in FAU’s College of Business. He is a hospitality industry veteran with more than 20 years of managerial experience in segments including food service, lodging, incentive travel and destination marketing. Peter is available to speak with the media. Simply click on his icon to arrange an interview.

Market jitters making you anxious? Our expert might have the remedy to calm your nerves.

So far, 2022 has been, in a word, volatile. With the emergence of omicron, supply chain issues choking the economy, inflation the highest it has been in decades and now the war drums beating in Europe, investors are getting nervous and the markets are showing the strain. As political guru James Carville once said, "It's the economy, stupid!" Following that sage advice, Augusta University’s Wendy Habegger is here to offer expert perspective to journalists looking to figure out just what’s going on with the markets and what investors and the public can expect in the coming months. Q: What's the best advice to give people when the stock market is on such a roller coaster ride? “Frankly put, if one can't stomach when the roller coaster drops, don't get on the ride. If one does not have much tolerance for risk, they should not invest in the stock market. If one is already invested in the stock market and breaking into a cold sweat every time they look at their stocks, then they need to take a cash position, meaning cash out of the stock market. The market does not reward anyone based upon their level of anxiety. What good is making gains on stocks if one will turn around and spend those gains treating their ulcers? I liken it to pro sports athletes who don't retire when they are still healthy. What good is all the money they earned if they are only going to be spending it on medical treatments for the rest of their lives? What kind of quality of life is that?" Q: With the market trending down right now, if people can invest, is this the best time to do so? “Whenever the market trends down, it is always a great time to buy stable companies with solid cash flows and certain commodities. Look for those companies and commodities that always do well regardless of what is happening in the economy. But remember my response to the above question. One should do this if and only if they can tolerate risk.” Q: Should people look at safer places to put their money for the time being, and what would some of those places be? “Again, this depends upon their level of risk tolerance. If they are risk tolerant, they should shift into less risky investments. If they are not risk tolerant, cash out and put it in their savings accounts or CDs.” Q: Does the emergency fund rule of thumb still come in to play, maybe now more than ever? “Yes, but I don't go by the standard rule of thumb for emergency savings – having three to six months of expenses saved. I teach students their goal should be to have 12 months of expenses saved. The three to six months rule is obsolete. We saw this with the recession of 2007-09 and with the pandemic. People need to be able to live without employment longer because there is no definitive time frame for when one will find gainful employment and the government should not be relied upon to support the mass population in the meantime. Also, even when the government does provide assistance, not everyone receives it and some still never recover from the aftermath. “ The economy is front and center for just about every American business, investor and household – and if you’re a reporter looking to know more, then let us help. Wendy Habegger is a respected finance expert available to offer advice on making the right money moves during volatile times. If you’re looking to arrange an interview, simply click on her icon now to arrange an interview today.

UCI expert sources for the Russia/Ukraine Conflict

On Friday, Feb. 25, 2022, UCI’s School of Social Sciences hosted a webinar titled, “Understanding the Russia-Ukraine Crisis.” Several of the experts below offered perspective on key issues surrounding the escalating conflict between Russia and Ukraine. You can watch or listen to the webinar here: https://www.socsci.uci.edu/newsevents/news/2022/2022-02-25-understanding-the-russia-ukraine-crisis.php UCI faculty members available to comment, and their areas of expertise, are found below. Matthew Beckmann, Associate Professor, Political Science. Professor Beckman studies the organizational structures and operational strategies presidents can use to pick their team, invest their time, focus their attention, channel their effort, discipline their thinking, coordinate their subordinates, and, most importantly, make decisions. Contact: beckmann@uci.edu Jeffrey Kopstein, Professor, Political Science. In his research, Professor Kopstein focuses on interethnic violence, voting patterns of minority groups, and anti-liberal tendencies in civil society, paying special attention to cases within European and Russian Jewish history. As pertains to the Russia/Ukraine conflict, he can speak to politics in Russia and Ukraine, Authoritarianism, NATO and the transatlantic alliance, and European Union policy. Contact: kopstein@uci.edu Erin Lockwood, Assistant Professor, Political Science. Professor Lockwood’s research areas include international political economy and global financial politics. She can speak to questions related to economic sanctions, financial sanctions/financial infrastructure and payments systems more generally (for example, the prospect of cutting off Russian access to the SWIFT financial communications system.) Contact: eklockwo@uci.edu David Meyer, Professor, Sociology, Political Science and Planning, Policy & Design. Professor Meyer’s research examines the relationships between social movements and the political contexts in which they emerge. Topics surrounding the Russia/Ukraine conflict that align with his expertise include sanction strategy; the resistance strategy that might emerge in Ukraine in the face of occupation; the history of the Cold War and its influence today; and the possibility of a powerful peace/isolationist movement emerging in the U.S. Contact: dmeyer@uci.edu Gustavo Oliveira, Assistant Professor, Global & International Studies. Professor Oliveira is a specialist in global political economy and critical geopolitics, focusing on the BRICS countries (Brazil, Russia, India, China, and South Africa) and international commodity markets, especially agricultural trade and natural resource governance. He can speak to the basis of the Russia/Ukraine conflict on natural resources, and the repercussions of the conflict for international commodity markets, inflation, and disruptions to global food supply chains. He can also speak about the anti-war movements in Russia, Europe, the United States, and broader political repercussions of the conflict in Brazil, Latin America, and the U.S. Contact: gustavo.oliveira@uci.edu Stergios Skaperdas, Professor, Economics and Director of the Center for Global Peace and Conflict Studies. His general area of research is political economy, the interaction of economics and politics. Among other issues, he has studied conflict and wars, the role of the modern state in economic development, and the interaction of globalization and geopolitics. Contact: sskaperd@uci.edu Etel Solingen, Distinguished Professor, Political Science and Thomas T. and Elizabeth C. Tierney Chair in Peace and Conflict Studies. Solingen studies the reciprocal influence between international political economy and international security, globalization and its discontents. She can discuss the crisis in terms of historical precedents (of international crises), the utility of sanctions, bargaining in crisis, Russia’s economic decline and how it bears on the current crisis. Contact: etel.solingen@uci.edu Media Contacts: • Tom Vasich, Communications Officer, UCI | 949-285-6455 | tmvasich@uci.edu • Heather Ashbach, Executive Director of Marketing and Communications, School of Social Sciences | 719-651-3224 | hashbach@uci.edu

The Rise and Fall of Cryptocurrency—Again

2021 saw a meteoric rise in the value of Bitcoin and other cryptocurrencies. In addition, a reported 16% of Americans say they have invested in, traded or used cryptocurrency. But over the last two months, the value has dropped significantly. In September, El Salvador made Bitcoin a legal tender in the country and lost more than 20% of its investment in the four months since, resulting in the International Monetary Fund asking the country to stop its embrace of the currency. We have seen this song and dance before with cryptocurrency values dramatically rising and falling, but where do we go from here? According to Villanova University's John Sedunov, PhD, an associate professor of finance, people might have invested in crypto as a hedge against rising inflation in the last year because there weren't alternatives to the stock market, which itself has seen its fair share of volatility. If that trend continues and inflation concerns aren't erased, more Americans could invest in crypto. As crypto continues to work its way into the everyday vernacular, there could be an interesting player to help bring it more mainstream: traditional banks. Recently, JPMorgan announced a $12 billion investment into technology. JPMorgan, which has already launched one of its own digital coins, is ahead of the competition. "I think if anything is going to lead the way, as backwards as it is, it will be the traditional banks, specifically JPMorgan," Dr. Sedunov said. "Their reputation will bring competitors to market, allowing for the potential to become more mainstream." One of the key things, Dr. Sedunov notes, is that there needs to be wide knowledge and understanding about how cryptocurrency, and the blockchain where it's stored, actually works. "Until it's easier to understand and explain and becomes common knowledge, it's going to be a rough ride. It has to get to the point where the utility and ease of use is not trivial. It's very easy to buy it, but to spend or move it, it's a painful process to avoid fees. It has to be easier to access."

Inflation's on the rise - can it be reigned in for 2022?

It seems the cost of everything is going up. For most Americans, filling up your car and filling up your grocery cart are now noticeably more expensive. Costs of goods are going up and that's taking a toll on the cost of living for a lot of people across the country. But what's causing the prices of goods and services to creep upwards - and what will it take to tame the upward trend that has inflation at its highest rate in more than 30 years? Recently, Andrew Butters and Kyle J. Anderson from Indiana University’s Kelley School of Business sat down with Indiana NewsDesk to help explain what's going on. Inflation might be the one the leading news stories of 2022 - and if you are a reporter looking for answers - then let us help with your coverage. Andrew Butters is an Assistant Professor of Business Economics and Public Policy at Indiana University’s Kelley School of Business. He is also an expert in the areas of industrial organization, productivity, market integration, demand and business cycles. Kyle J. Anderson is a Clinical Assistant Professor of Business Economics. He is an is an economist researching business and pricing in online environments. Both Kyle and Andrew are available to speak with media regarding this important topic – simply click on either expert's icon now to arrange an interview today.

As the legendary political guru James Carville used to say, "It’s the economy, stupid." And these days with housing prices, inflation and the cost of living all pointing up in a very steep trajectory – the state of the economy is front and center for a lot of politicians, Americans and families as the year comes to a close. There’s a lot to be considered, and that’s where experts like Augusta’s Dr. Simon Medcalfe are being sought out to explain economic trends what is behind them. “U.S. retail sales are high,” explains Medcalfe “We had a lot of stimulus checks coming through the door and that’s really spurred extra spending and it’s across a whole range of retail sectors.” According to Medcalfe, household items are also seeing double-digit price increases. “What we’ve seen over the last 18 months during the pandemic, is a shift in our consumer preferences and consumer behavior.” • Furniture sales are up 29% • Used cars and cars in general are up 25-26% • Gardening and building supplies are up 14% • Electronics have seen an almost 30% increase • Clothing sales are up a whopping 50% But it’s not all good news - as the price of everything as we know is going up. “Inflation is running about 6.8% nationally,” Medcalfe explains. “It’s running about 7.2% in the south and it’s certainly a concern of policymakers and economists.” But theirs is sunshine behind those clouds as Medcalfe believes 2022 will see a return to normal. “I think next year inflation will come down. I know it won’t be at these high levels, but I still think it’ll be above the Feds target level of inflation, so look for those interest rate increases next year.” The economy and what to expect locally and nationally are hot topics – and if you are a reporter covering this topic – that’s where we can help. Dr. Simon Medcalfe is a highly regarded economics expert and the Cree Walker Chair in the Hull College of Business at Augusta University. Medcalfe is available to speak with media regarding the economy and its outlook – simply click on his icon now to arrange an interview today.