Experts Matter. Find Yours.

Connect for media, speaking, professional opportunities & more.

Expert Sources for Federal Reserve interest rate increase: UCI faculty members available to comment

On June 15, the Federal Reserve announced its largest interest rate hike in 28 years to try to regain control over elevated consumer prices. The Fed raised its benchmark interest rate by three-quarters of a percentage point – the biggest increase since 1994 – following a quarter-point jump in March and a half-point increase in May. “We’re strongly committed to bringing inflation back down and we’re moving expeditiously to do so,” said Federal Reserve Chairman Jerome Powell. Eric Swanson – professor of economics. Swanson’s research focuses on monetary policy, interest rates and the effects on economy, including output, unemployment and inflation. Swanson previously worked at the Federal Reserve Board and Federal Reserve Bank of San Francisco from 1998-2014 as an economist and research advisor. Email: eric.swanson@uci.edu Aaron James – professor of philosophy. James co-authored the book Money from Nothing: Or, Why We Should Stop Worrying About Debt and Learn to Love the Federal Reserve, which explains the nature of money and a number of alternatives the Federal Reserve can legally employ to curb inflation other than increasing interest rates. Email: aaron.james@uci.edu Jack Liebersohn – assistant professor of economics. Liebersohn’s research focuses on banking, banking risk taking, mortgages and the housing market and he can speak to how increasing the Federal Reserve interest rate affects any of those elements of the economy. Email: cjlieber@uci.edu Christopher Schwarz – associate professor of finance and faculty director of the Center for Investment and Wealth Management. Schwarz can discuss how far the Federal Reserve will have to go and its impact on the economy and financial markets moving forward. Email: cschwarz@uci.edu Media Contact: Cara Capuano, Communications Officer, UCI | 949-501-9192 | ccapuano@uci.edu

The economy may be slowing - but remains strong according to Georgia Southern expert

Georgia Southern’s Economic Monitor Q1 reports regional economy slows, retains strength Georgia Southern University’s latest Economic Monitor, which reflects Q1 2022, reports that growth in the Savannah metro economy moderated during the opening quarter of the year. “The broadest indicators of economic activity — overall regional employment and electricity sales to residential, industrial and commercial users — continue to signal strength,” stated Michael Toma, Ph.D., Georgia Southern’s Fuller E. Callaway Professor of Economics. “After good performance in the fourth quarter, there was a mild pull-back during the first quarter in tourism and port activity. In general, the regional economy maintained its forward momentum, but slowed its rate of acceleration. Toma also noted that the Savannah metro economy will grow approximately 2% through the remainder of 2022, noticeably slower as compared to the rebound year of 2021. The economic future is somewhat murkier now as inflation surges, the Federal Reserve tightens, and global energy and commodities markets remain rocked by Russia’s invasion of Ukraine, he said. Overall Strength, but Some Sectoral Weakness The business index for the Savannah metro economy increased 1.3% in the opening quarter of 2022, roughly half the pace of the previous quarter. The index of current economic activity increased to 207.3 from 204.7. The index was buoyed by solid employment growth of 1.6% during the quarter and electricity sales growth of 2.1%. Indicators of port activity, tourism and retail sales slowed during the quarter. Metro Savannah employers added 3,100 jobs pushing total regional employment to 197,500 — more than 5,000 jobs and 3% higher than the pre-pandemic peak of 192,100 in the fourth quarter of 2019. The Georgia Department of Labor recently completed its annual benchmarking process for employment in which the monthly payroll survey data is benchmarked against headcount data. Total employment data did not change significantly but business and professional industry services were revised downward while the information sector, including the film and entertainment industry, was revised upward substantially. A full media release detailing key indicators such as Employment Trends, Housing Market, and that Slowing Regional Growth Expected is attached. About the Indicators The Economic Monitor provides a continuously updated quarterly snapshot of the Savannah Metropolitan Statistical Area economy, including Bryan, Chatham and Effingham counties in Georgia. The coincident index measures the current economic heartbeat of the region. The leading index is designed to provide a short-term forecast of the region’s economic activity in the upcoming six to nine months. Looking to know more - then let us help. The Economic Monitor is available by email and at the Center’s website. If you would like to receive the Monitor by email send a ‘subscribe’ message to CBAER@georgiasouthern.edu. For more information or to arrange an interview - simply reach out to Georgia Southern Director of Communications Jennifer Wise at jwise@georgiasouthern.edu to arrange an interview today.

News in Atlanta is attracting from across the country. A Starbucks tucked away in the Ansley Mall in midtown Atlanta became the third of the popular chain's locations in the state to unionize. Georgia is not known a union strong state. But efforts are also on to see an Amazon warehouse in Gwinnett County organized as well. The union push in the Peach State is getting a lot of attention. In a state that has been historically non-union, the battle to organize in Georgia has often been uphill. And in a workforce of 5 million, most efforts may have a minimal impact. Yet in recent months, there have been public signs of union activism: among low-wage marginal workers, long-time unionists pushing for better contracts and — most visibly — upstart efforts in high-profile, non-factory settings like Starbucks and Apple. Maybe it's the tight labor market that gives workers more leverage. After all, the historically low unemployment rate during a time of economic growth has many employers desperate for workers, less able to dictate terms and pay, said Anthony Barilla, Ph.D, economist at Georgia Southern University, who has researched labor issues. "There is a shortage of workers willing to work at the minimum wage or at a wage that simply doesn't mesh with the area's standard of living," he said. "When labor deserves a higher wage, organizing is simply a tool to be used in accomplishing this." July 07 - Atlanta Journal Constitution/Miami Herald There's a lot of interest in the union push in Georgia and a lot of questions to ask: Are perceptions of organized labor changing in the south? What's motivating the union drives? Is it time larger corporations took notice? If you are a journalist looking to know more about this labor trend - then let us help. Anthony Barilla, Ph.D., is an associate professor of economics. He has published research in the fields of labor economics, sports economics and the aspects of economic education. He is available to speak with media about these recent developments - simply reach out to Georgia Southern Director of Communications Jennifer Wise at jwise@georgiasouthern.edu to arrange an interview today.

The EU-UK Trade and Cooperation Agreement is costly, what does the UK need to do? | Aston Angle

As far as trade is concerned, the EU exit has been rather costly to the UK. At the Centre for Business Prosperity, we have been tracking the performance of UK trade in recent years. The UK’s trade dropped sharply during COVID. Like other nations, this was due to the global recession and supply chain disruptions. However, the UK failed to recover and enjoy the boom, despite the tariff-free terms of trade in goods set out in the EU-UK Trade and Cooperation Agreement (TCA). The UK now trades less with the EU, its largest trading partner, than in 2019. During the same period, Germany and the Netherlands grew trade with the EU by nearly a quarter, and US trade with the EU has also grown considerably. Reports suggest, including those from the British Chambers of Commerce, that exporting to the EU has become much more costly and in some cases, unviable. It appears that the “certainty” provided by the TCA has not reversed the declining trend of the UK-EU trade so far. Our new paper for the Enterprise Research Centre (ERC) has found that UK exports experienced a large, negative, statistically significant decline in 2021 at the end of the transition after the EU-UK Trade and Cooperation Agreement (TCA) was put into force. We estimate that this amounts to a 22% reduction in exports to the EU and a 26% reduction in imports from the EU over the first half of 2021, relative to the counterfactual scenario of the UK remaining in the EU. How did this happen? After all, the TCA ensures that goods moving between the UK and the EU have no tariffs or quotas, so long as the rules of origin are complied with. Rules of origin help you work out where your goods originate from and which goods are covered in trade agreements. Our research found that non-tariff measures (NTMs) were responsible for the adverse TCA effect on UK trade with the EU and that the magnitude of loss was significant. It was equivalent to a reduction of £12.4 billion in UK exports over the first six months period of 2021. This equals 16% of UK total exports in the first half of 2019 and 70% of the documented total reduction in the EU exports in the same period. A number of factors can be attributed to the decline of UK exports to the EU. In particular, the increased trade frictions that occurred mainly due to sanitary and phytosanitary (SPS) and technical barriers to trade (TBT) as a result of entering the TCA. Sanitary and Phytosanitary (SPS) measures refer to the EU controls to protect animal, plant or public health. And technical barriers to trade (TBT) refers to mandatory technical regulations and voluntary standards that define specific characteristics that a product should have, such as its size, shape, design, labelling/marking/packaging, functionality or performance. On average, for the first six months of 2021, a 1% increase in SPS resulted in a 13–15% reduction in exports to the EU, most notably in the food and drink, wood and chemicals sectors. Furthermore, a 1% increase in TBT led to a 2–3% reduction in exports, especially in metals, equipment, machines and miscellaneous industrial products. What next? Since the post-Brexit dysfunctions are now diagnosed, in theory we could move on. The UK can directly tackle the trade challenges, so long as other things, such as politics, do not stand in the way. Fundamentally, what needs to happen is the removal or relief of the root causes coded by the TCA – the trade barriers newly erected. This is a key task; it is challenging but not impossible. Trade frictions due to the SPS measures are an acute problem of Brexit. Reducing some of the non-tariff measures between the EU-UK would help by exploring other mechanisms such as equivalent SPS measures or other ways to reduce businesses burden to a minimum. The technical barriers to trade are more complicated and challenging and they could potentially cause significant damage to the UK economy. Despite its limitation, maintaining and broadening the established arrangements of the current TCA provision, through some form of mutual recognition of specific practices or international regulations for selected sectors, should be the ambition of UK government to help ease the TBT trade barriers. Future EU-UK co-operation is critical and mutually beneficial but requires political will and strong leadership. In the short and medium term, supporting firms should be the priority, especially small- and medium-sized firms that are productive enough to have exported to the EU in the past, but now face hurdles to continue exporting. These firms tend to be limited on resource but have the infrastructure and ambition to internationalise. Targeted support for specific challenges could be also fruitful. The UK Department for International Trade Export Support Service, the British Chambers of Commerce and local growth hubs have the expertise and experience to help firms export. Therefore, resources should be made available to allow for customised and responsive support with exports, as well as taking advantage of technologies that can identify and reach businesses who require support. Provision should also be made to collect feedback on the quality of the support provided, to enable further improvement. Helping businesses continue to access EU markets, while enabling the economy to take advantage of welfare-enhancing benefits from trade, remains imperative. Given the economic benefits of the roll-out, the new free trade agreements are expected to be limited and effective only in the long term. UK domestic policies should be the focus to improve the competitiveness of exporters and their ecosystem. By Professor Jun Du Director of the Centre for Business Prosperity Professor of Economics, Finance and Entrepreneurship, Aston Business School Lecturer in Politics and International Relations School of Social Science and Humanities Dr Oleksandr Shepotylo Senior Lecturer, Economics, Finance and Entrepreneurship, Aston Business School

Professor Jun Du and Dr Oleksandr Shepotylo from Aston University analysed the effects of the end of the Brexit transition period on UK exports This equals to a nearly 16% of UK total exports in the first half of 2019 and 70% of the documented total reduction in the EU exports in the same period The research suggests non-tariff measures (NTMs) are responsible for the fall in trade between the UK and EU. New research by experts at Aston University for the Enterprise Research Centre (ERC) has found that UK exports experienced a large, negative, statistically significant decline in 2021 at the end of transition after the EU-UK Trade and Cooperation Agreement (TCA) was put in force. The TCA is a free trade agreement signed on 30 December 2020 between the European Union (EU), the European Atomic Energy Community (Euratom) and the United Kingdom (UK). Professor Jun Du and Dr Oleksandr Shepotylo used a Synthetic Difference in Differences (SDID) estimator to construct a counterfactual of the UK had it not exited the EU and entered the TCA, to compare its trading performance. This was done by comparing the actual performance of the UK with the modelled performance in 2021 with the same periods of 2018-2020. They also examined the extent to which the overall TCA effect has been due to the increased frictions due to non-tariff measures (NTMs). They estimate that this amounts to a 22 per cent reduction in exports to the EU and a 26 per cent reduction in imports from the EU over the first half of 2021, relative to the counterfactual scenario of the UK remaining in the EU. The research confirmed that NTMs are responsible for the adverse TCA effect on UK trade with the EU and that the magnitude of loss was significant. It was equivalent to a reduction of £12.4 billion in UK exports over the first six months period of 2021, notably in food and drink, wood and chemicals sectors. This equals to 15.6% of UK total exports in the first half of 2019, and 70% of the documented total reduction in the EU exports in the same period. Jun Du, professor of economics at Aston University, lead on internationalisation research at the ERC and director of the Centre for Business Prosperity (CBP), said: “These results underscore the heavy costs of erecting trade barriers on the UK’s side with its largest trade partner. “Trade frictions, due to sanitary and phytosanitary (SPS) measures (measures to protect humans, animals, and plants from diseases, pests, or contaminants), are acute problems due to the EU exit. “Reducing some of the NTMs between the EU-UK, by exploring mechanisms such as equivalence in SPS measures or other ways to reduce businesses’ burden to the minimum level possible. “More complicated and challenging are the technical barriers to trade, but they could potentially cause significant damage to the UK economy. Maintaining and broadening the established arrangements of the current TCA provision, despite being limited, through some form of mutual recognition of specific practices or international regulations for selected sectors, should be the ambition of UK government to ease the TBT (technical barriers to trade). “Future EU-UK co-operation is critical and mutually beneficial but requires political will and strong leadership.” Dr Oleksandr Shepotylo, a senior lecturer in Economics, Finance and Entrepreneurship Department at Aston Business School, co-wrote the working paper and said: “Continued alignment with the EU regulations was a demand from many businesses throughout the Brexit process, and it is expected to be still important post Brexit. This must be conveyed to policy makers. “In the short term, preparedness and adaptability have rewarded and will continue to reward businesses facing challenges and disruptions. The need for learning and training remains paramount. “In the medium and longer term, businesses will have to stay competitive to retain access to the global market, to perform better in it, and to gain more benefit from it. This is the case for all firms even if the ways to achieve it may differ. In addition, businesses need to consider adopting new business models through which they can balance the need for lean production with resilience, as well as weighing up economic, social, and environmental gains. Despite the many considerable challenges, there are boundless avenues where opportunities for breaking through are present.” You can read the full report on the ERC website here.

Last month, workers at an Amazon warehouse in Staten Island voted to unionize. In the decision's wake, employees across other firms—backed by national labor organizations—are following suit. Villanova University economics professor Cheryl Carleton, PhD, explains that the successful warehouse unionization in New York (a grassroots initiative) is changing the way we view labor unions. "It prevents employees from thinking about unions as just the large existing unions," notes Dr. Carleton. "Workers themselves can coalesce and maintain a unified front to negotiate for what they need from firms." And if unions succeed, firms without unions must compete to entice employees to their operations. As a counterweight to growing unionization efforts, companies have increasingly engaged in the use of intimidation tactics. We see this in the ways firms retaliate against union organizers. "Many large firms that have lots of money and have fostered strong relationships with political powers do not want to let workers have a stronger voice in negotiation of wages, benefits and work rules. They will try to have these unions nullified or intimidate workers not to join them," says Dr. Carleton. "There has been considerable consolidation in industries in the United States, which gives firms a lot more power." And according to economics professor Mary Kelly, PhD, "firms will argue that if they compensate existing [union-represented] workers with higher pay, better benefits and improved working conditions, those higher costs will limit the number of new workers hired, encourage the replacement of some labor with capital/technology if possible and/or 'force' prices higher to consumers." But even if unionization fails, there are still costs to the company. "We see this now with companies increasing the benefits they provide and spending more money to prevent more unionization efforts. The 'spillover' effects of the presence or threat of unions increases cost to firms," says Dr. Carleton. But we still don't know the final economic impact of unionization. "Companies, the stock market and shareholders always respond to change and uncertainty, so when a company unionizes it is a period of uncertainty," says Dr. Carleton. "If the company does unionize, does it create more stability and more profitability? Or does it end up being more costly for the firm? Time will tell!" Despite all the uncertainty, "the idea of unions and the need for unions is still present, and the current labor market situation has given workers the impetus they need," Dr. Carleton says. "Unions are necessary to stand up to industries. Each worker has little power, but combined workers have a stronger voice."

UCI expert sources for the Russia/Ukraine Conflict

On Friday, Feb. 25, 2022, UCI’s School of Social Sciences hosted a webinar titled, “Understanding the Russia-Ukraine Crisis.” Several of the experts below offered perspective on key issues surrounding the escalating conflict between Russia and Ukraine. You can watch or listen to the webinar here: https://www.socsci.uci.edu/newsevents/news/2022/2022-02-25-understanding-the-russia-ukraine-crisis.php UCI faculty members available to comment, and their areas of expertise, are found below. Matthew Beckmann, Associate Professor, Political Science. Professor Beckman studies the organizational structures and operational strategies presidents can use to pick their team, invest their time, focus their attention, channel their effort, discipline their thinking, coordinate their subordinates, and, most importantly, make decisions. Contact: beckmann@uci.edu Jeffrey Kopstein, Professor, Political Science. In his research, Professor Kopstein focuses on interethnic violence, voting patterns of minority groups, and anti-liberal tendencies in civil society, paying special attention to cases within European and Russian Jewish history. As pertains to the Russia/Ukraine conflict, he can speak to politics in Russia and Ukraine, Authoritarianism, NATO and the transatlantic alliance, and European Union policy. Contact: kopstein@uci.edu Erin Lockwood, Assistant Professor, Political Science. Professor Lockwood’s research areas include international political economy and global financial politics. She can speak to questions related to economic sanctions, financial sanctions/financial infrastructure and payments systems more generally (for example, the prospect of cutting off Russian access to the SWIFT financial communications system.) Contact: eklockwo@uci.edu David Meyer, Professor, Sociology, Political Science and Planning, Policy & Design. Professor Meyer’s research examines the relationships between social movements and the political contexts in which they emerge. Topics surrounding the Russia/Ukraine conflict that align with his expertise include sanction strategy; the resistance strategy that might emerge in Ukraine in the face of occupation; the history of the Cold War and its influence today; and the possibility of a powerful peace/isolationist movement emerging in the U.S. Contact: dmeyer@uci.edu Gustavo Oliveira, Assistant Professor, Global & International Studies. Professor Oliveira is a specialist in global political economy and critical geopolitics, focusing on the BRICS countries (Brazil, Russia, India, China, and South Africa) and international commodity markets, especially agricultural trade and natural resource governance. He can speak to the basis of the Russia/Ukraine conflict on natural resources, and the repercussions of the conflict for international commodity markets, inflation, and disruptions to global food supply chains. He can also speak about the anti-war movements in Russia, Europe, the United States, and broader political repercussions of the conflict in Brazil, Latin America, and the U.S. Contact: gustavo.oliveira@uci.edu Stergios Skaperdas, Professor, Economics and Director of the Center for Global Peace and Conflict Studies. His general area of research is political economy, the interaction of economics and politics. Among other issues, he has studied conflict and wars, the role of the modern state in economic development, and the interaction of globalization and geopolitics. Contact: sskaperd@uci.edu Etel Solingen, Distinguished Professor, Political Science and Thomas T. and Elizabeth C. Tierney Chair in Peace and Conflict Studies. Solingen studies the reciprocal influence between international political economy and international security, globalization and its discontents. She can discuss the crisis in terms of historical precedents (of international crises), the utility of sanctions, bargaining in crisis, Russia’s economic decline and how it bears on the current crisis. Contact: etel.solingen@uci.edu Media Contacts: • Tom Vasich, Communications Officer, UCI | 949-285-6455 | tmvasich@uci.edu • Heather Ashbach, Executive Director of Marketing and Communications, School of Social Sciences | 719-651-3224 | hashbach@uci.edu

Good COP or bad COP? | The Aston Angle

Four Aston University experts reflect on COP26 and what it means for transport, community and global action on decarbonisation, support for small businesses and China’s coal consumption. COP26 was the 26th United Nations Climate Change conference held in Glasgow from 31 October to 13 November 2021. The participating 197 countries agreed a new deal, known as the Glasgow Climate Pact, aimed at staving off dangerous climate change. But will it be enough? Dr Lucy Rackcliff explains why replacing petrol and diesel vehicles with electric ones alone is not radical enough. The overwhelming message coming from COP26 transport day seemed to be that moving to zero emission-vehicles would solve the well-documented issues created by petrol and diesel fuelled vehicles. As noted at the conference itself, transport is responsible for 10% of global emissions, and emissions from transport continue to increase. The WHO estimates that transport-related air pollution affects the health of tens of thousands of people every year in the WHO European Region alone. However, on-street pollution is not the only effect we should seek to address. Transport is responsible (directly or indirectly) for a wider range of environmental issues, and a wider range of health impacts. Moving to electric vehicles will not address impacts such as loss of land for other activities, use of finite resources in the manufacturing process, the need to dispose of obsolete materials such as used tyres, and the health effects of sedentary lifestyles, facilitated by car-use. In urban areas in particular, re-thinking policy to focus on walking, cycling and public transport-use could free up land for other activities. Car parks could become actual parks, in turn encouraging more active lifestyles, creating space for people and plants, and leading to a range of wider societal benefits. Assuming that replacing petrol and diesel vehicles with electric ones will solve all our problems is a strategy which lacks ambition, and thus denies us the benefits that more radical thinking could deliver. Dr Lucy Rackcliff, Senior Teaching Fellow, Engineering Systems & Supply Chain Management, Aston Logistics and Systems Institute, College of Engineering and Physical Sciences. "Assuming that replacing petrol and diesel vehicles with electric ones will solve all our problems is a strategy which lacks ambition." Professor Patricia Thornley reflects on the role that Aston University and EBRI can play in empowering community action and informing global action with research. COP26 energy day was a fabulous experience. I have never before seen so many people in one place with one ambition: to support and accelerate decarbonisation of the UK’s energy systems. We ran a “fishbowl”, which allows people with different perspectives on a topic (experts and non-experts) to participate in dialogue around a common interest. Our researchers, local government representatives, industrialists and students shared their thoughts on what our future energy mix should look like, how it should be delivered and who needs to act. Without doubt the consensus was that many different technologies have a role to play and there is an urgent need to accelerate implementation. There were reflections on the importance of governance at different levels and an interesting discussion around the relative merits of centralized solutions and devolved actions. The reality is that of course we need both and that made me think about what Aston University and EBRI can do. Of course we should implement centrally with initiatives like the impressively low carbon Students’ Union building, but we also need to raise awareness among our students. Our film showing with the Students’ Union a week later helped with that I hope, and many more of our courses are incorporating sustainability elements which is fantastic. But what we haven’t quite achieved yet is an empowered, proactive voice that would lead to wider community action. There are pockets of excellence but a lot still to be done. My second week at COP26 was very different with police presence outside a building where I had three meetings with industrialists on the controversial topics of forestry and land-use. It was sad to be working with key players to improve sustainability and increase carbon reductions through UK bioenergy while listening to drumbeats outside from objecting protestors. There is a real lack of understanding around forest management and global land use and we need to work harder to improve that. It is a huge challenge, but one that EBRI will work hard to address. Professor Patricia Thornley, Director of EBRI, Energy and Bioproducts Research Institute (EBRI), College of Engineering and Physical Sciences. "There is a real lack of understanding around forest management and global land use and we need to work harder to improve that." Professor Presanta Dey explores whether Government pledges on climate change will translate to practical support for small businesses Following the COP26 climate change summit, the UK Government led the way in making a series of pledges and policy commitments to combat climate change. The question is: how will this translate to practical support for SMEs? Large corporations often take centre stage at COP, which is welcomed, but if we are to see real change, everyone needs to be involved. COP26 provided a refreshing voice for UK small businesses which featured panel discussions on the ‘SME Climate Hub’, highlighting net zero opportunities and challenges for SMEs. The momentum of COP26 has already inspired over 2,000 UK small businesses to sign up to the UN's Race to Zero campaign, which is designed to accelerate the adoption of credible net-zero targets. A long journey ahead still awaits us, however campaigns like these will hopefully start a ripple effect inspiring the remaining six million UK SMEs to take climate action. Small businesses have been crying out for more assistance from the government in the form of ‘green’ grants and financial support to enable them to make the necessary long-term changes. The timely announcement of HSBC’s £500m Green SME Fund at COP26 marks a promising first step towards making it easier for SMEs to fund their green ambitions. In summary, COP26 provided some comfort to UK SMEs seeking a higher level of commitment from government, financial services and businesses. This moment must act as a catalyst for policy makers to continue removing the barriers that are holding small businesses back. Professor Presanta Dey, Professor of Operations & Information Management, College of Business and Social Sciences. Professor Jun Du explains what China’s deal means for the rest of the world following its own energy crisis earlier this year… Despite the many disappointments expressed around the COP26 outcomes, important progess has been made for the world economy moving towards carbon neutrality. Among the noticeable achievements China and the US, which together emit 43% of the total CO2 in the air, have agreed to boost climate co-operation despite many disagreements. This includes China’s pledge to more actively control and cut methane emissions during the next decade - even when the country did not sign up to the global methane pledge made in Glasgow. Reaching net zero will be an unprecedented challenge for all countries. China will need to do the heaviest lifting among all. The country’s energy crisis earlier this year has shown just how hard it will be to reach net zero. The exceptionally early and cold winter this year will demand even more coal, so China’s willingness and resolve for climate commitments are good news to all. While lots of attention was turned to the absence of China’s president, Xi Jinping, from the COP26 climate summit, what is less appreciated is the fact that China is serious about decarbonisation. Few countries invest as much as China in that area, nor grow as fast in finding alternative energy to coal and in green industries like electric cars. China has set specific plans in its 14th national five-year plan for economic and social development to reach peak carbon emissions by 2030 and carbon neutrality by 2060. COP26 could be an additional driver for “an era of accountability” for China. Professor Jun Du, Professor of Economics, Finance and Entrepreneurship, Centre Director, Centre for Business Prosperity, Aston Business School levy.

Inflation's on the rise - can it be reigned in for 2022?

It seems the cost of everything is going up. For most Americans, filling up your car and filling up your grocery cart are now noticeably more expensive. Costs of goods are going up and that's taking a toll on the cost of living for a lot of people across the country. But what's causing the prices of goods and services to creep upwards - and what will it take to tame the upward trend that has inflation at its highest rate in more than 30 years? Recently, Andrew Butters and Kyle J. Anderson from Indiana University’s Kelley School of Business sat down with Indiana NewsDesk to help explain what's going on. Inflation might be the one the leading news stories of 2022 - and if you are a reporter looking for answers - then let us help with your coverage. Andrew Butters is an Assistant Professor of Business Economics and Public Policy at Indiana University’s Kelley School of Business. He is also an expert in the areas of industrial organization, productivity, market integration, demand and business cycles. Kyle J. Anderson is a Clinical Assistant Professor of Business Economics. He is an is an economist researching business and pricing in online environments. Both Kyle and Andrew are available to speak with media regarding this important topic – simply click on either expert's icon now to arrange an interview today.

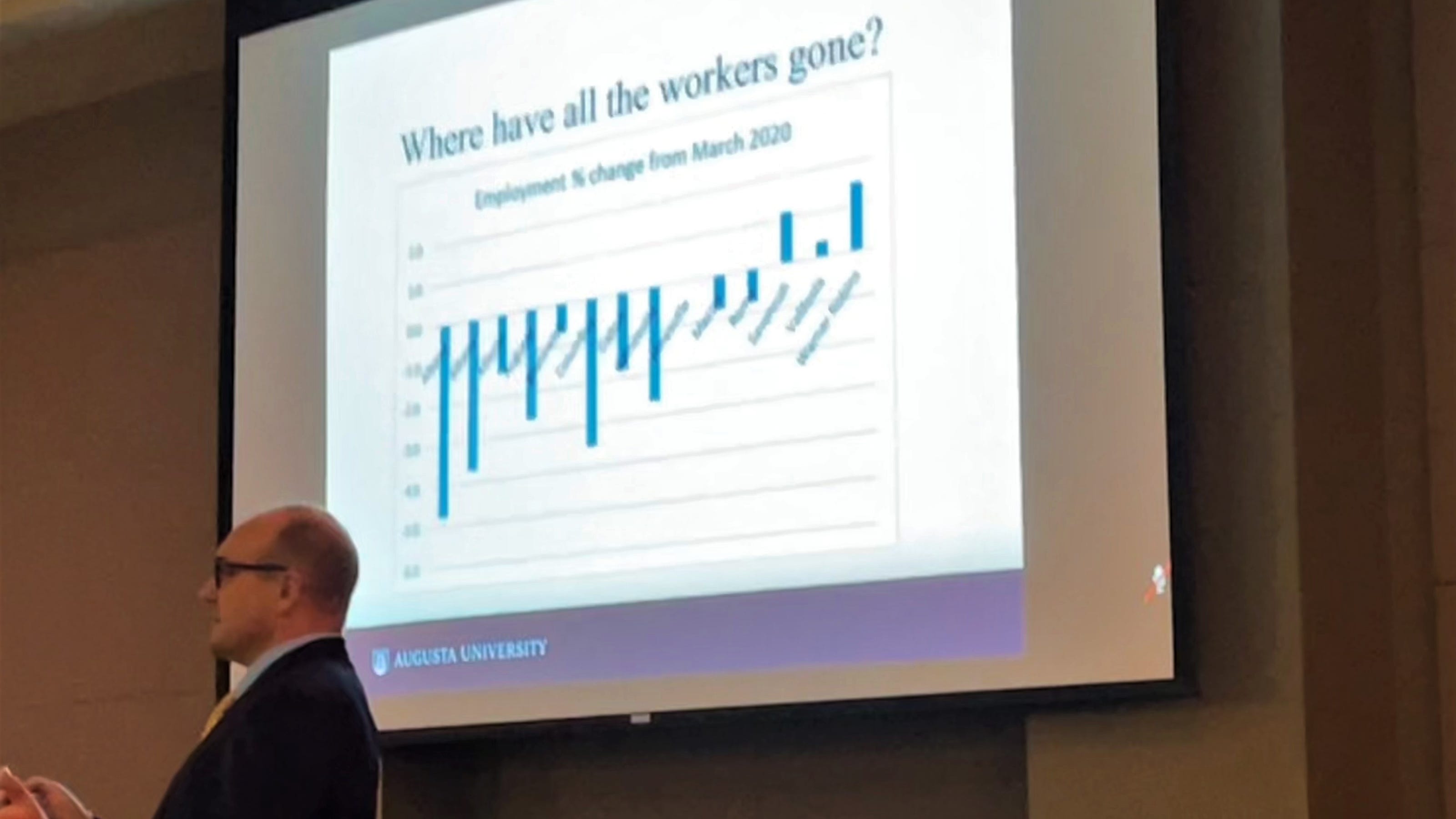

As the legendary political guru James Carville used to say, "It’s the economy, stupid." And these days with housing prices, inflation and the cost of living all pointing up in a very steep trajectory – the state of the economy is front and center for a lot of politicians, Americans and families as the year comes to a close. There’s a lot to be considered, and that’s where experts like Augusta’s Dr. Simon Medcalfe are being sought out to explain economic trends what is behind them. “U.S. retail sales are high,” explains Medcalfe “We had a lot of stimulus checks coming through the door and that’s really spurred extra spending and it’s across a whole range of retail sectors.” According to Medcalfe, household items are also seeing double-digit price increases. “What we’ve seen over the last 18 months during the pandemic, is a shift in our consumer preferences and consumer behavior.” • Furniture sales are up 29% • Used cars and cars in general are up 25-26% • Gardening and building supplies are up 14% • Electronics have seen an almost 30% increase • Clothing sales are up a whopping 50% But it’s not all good news - as the price of everything as we know is going up. “Inflation is running about 6.8% nationally,” Medcalfe explains. “It’s running about 7.2% in the south and it’s certainly a concern of policymakers and economists.” But theirs is sunshine behind those clouds as Medcalfe believes 2022 will see a return to normal. “I think next year inflation will come down. I know it won’t be at these high levels, but I still think it’ll be above the Feds target level of inflation, so look for those interest rate increases next year.” The economy and what to expect locally and nationally are hot topics – and if you are a reporter covering this topic – that’s where we can help. Dr. Simon Medcalfe is a highly regarded economics expert and the Cree Walker Chair in the Hull College of Business at Augusta University. Medcalfe is available to speak with media regarding the economy and its outlook – simply click on his icon now to arrange an interview today.