Experts Matter. Find Yours.

Connect for media, speaking, professional opportunities & more.

#Expert Research: Incentives Speed Up Operating Room Turnover Procedures

The operating room (OR) is the economic hub of most healthcare systems in the United States today, generating up to 70% of hospital revenue. Ensuring these financial powerhouses run efficiently is a major priority for healthcare providers. But there’s a challenge. Turnovers—cleaning, preparing, and setting up the OR between surgeries—are necessary and unavoidable processes. OR turnovers can incur significant costs in staff time and resources, but at the same time, do not generate revenue. For surgeons, the lag between wheels out and wheels in is idle time. For incoming patients, who may have spent hours fasting in preparation for a procedure, it is also a potential source of frustration and anxiety. Reducing OR turnover time is a priority for many US healthcare providers, but it’s far from simple. For one thing, cutting corners in pursuit of efficiency risks patient safety. Then there’s the makeup of OR teams themselves. As a rule, well-established or stable teams work fastest and best, their efficiency fueled by familiarity and well-oiled interpersonal dynamics. But in hospital settings, staff work in shifts and according to different schedules, which creates a certain fluidity in the way turnover teams amalgamate. These team members may not know each other or have any prior experience working together. For hospital administrators this represents a quandary. How do you cut OR turnover time without compromising patient care or hiring in more staff to build more stable teams? To put that another way: how do you motivate OR workers to maintain standards and drive efficiency—irrespective of the team they work with at any given time? One novel approach instituted by Georgia’s Phoebe Putney Health System is the focus of new research by Asa Griggs Candler Professor of Accounting, Karen Sedatole PhD. Under the stewardship of perioperative medical director and anesthesiologist, Jason Williams MD 02MR 20MBA, and with support from Sedatole and co-authors, Ewelina Forker 23PhD of the University of Wisconsin and Harvard Business School’s Susanna Gallini PhD, staff at Phoebe ran a field experiment incentivizing individual OR workers to ramp up their own performance in turnover processes. What they have found is a simple and cost-effective intervention that reduces the lag between procedures by an average of 6.4 percent. Homing in on the Individual Williams and his team at Phoebe kicked off efforts to reduce OR turnover times by first establishing a benchmark to calculate how long it should take to prepare for different types of procedure or surgery. This can vary significantly, says Williams: while a gallbladder removal should take less than 30 minutes, open-heart surgery might take an hour or longer to prepare. “There’s a lot of variation in predicting how long it should take to get things set up for different procedures. We got there by analyzing three years of data to create a baseline, and from there, having really homed in on that data, we were able to create a set of predictions and then compare those with what we were seeing in our operating rooms—and track discrepancies, over-, and underachievement.” Williams, a Goizueta MBA graduate who also completed his anesthesiology residency at Emory University’s School of Medicine, then enlisted the support of Sedatole and her colleagues to put together a data analysis system that would capture the impact of two distinct mechanisms, both designed to incentivize individual staff members to work faster during turnovers. The first was a set of electronic dashboards programmed to record and display the average OR turnover performance for teams on a weekly basis, and segment these into averages unique to individuals working in each of the core roles within any given OR turnover team. The dashboard displayed weekly scores and ranked them from best to worst on large TV monitors with interactive capabilities—users could filter the data for types of surgery and other dimensions. Broadcasting metrics this way afforded Williams and his team a means of identifying and then publicly recognizing top-performing staff, but that’s not all. The dashboards also provided a mechanism with which to filter out team dynamics, and home in on individual efforts. “If you are put in a room with one team, and they are slower than others, then you are going to be penalized. Your efforts will not shine. Now, say you are put in with a bigger or faster team, your day’s numbers are going to be much higher. So, we had to find a way to accommodate and allow for the team effect, to observe individual effort. The dashboards meant we could do this. Over the period of a week or a month, the effect of other people in the team is washed out. You begin to see the key individuals pop up again and again over time, and you can see those who are far above their peers versus those who, for whatever reason, are not so efficient.” Sharing “relative performance” information has been shown to be highly motivating in many settings. The hope was that it would here, too. Three core roles: Who’s who in the Operating Room turnover team? OR turnover teams consist of three roles: circulating nurse, scrub tech, and anesthetist. While other surgery staff might be present during a turnover, depending on the needs of consecutive procedures, these are the three core roles in the team, and they are not interchangeable in any way: each individual assumes the same responsibilities in every team they join. Typically, turnover tasks will include removing instruments and equipment from the previous surgery and setting up for the next: restocking supplies and restoring the sterile environment. Turnover tasks and activities will vary according to the type of procedure coming next, but these tasks are always performed by the same three roles: nurse, scrub tech, and anesthetist, working within their own area of expertise and specialty. OR turnover teams are assembled based on staff schedules and availability, making them highly fluid. Different nurses will work with different scrub techs and different anesthetists depending on who is free and available at any given time. With dashboards on display across the hospital’s surgery department, Williams decided to trial a second motivational mechanism; this time something more tangible. “We decided to offer a simple $40 Dollar Store gift card to each week’s top performing anesthetist, nurse, or scrub technician to see if it would incentivize people even more. And to keep things interesting, and sustain motivation, we made sure that anyone who’d won the contest two weeks in a row would be ineligible to win the gift card the following week,” says Williams. “It was a bit of a shot in the dark, and we didn’t know if it would work.” Altogether, the dashboards remained in situ over a period of about 33 months while the gift card promotion ran for 73 weeks. It was important to stress the foundational importance of safety and then allow individuals to come up with their own ways to tighten procedures. This was a bottom-up, grassroots experience where the people doing the work came up with their own ways to make their times better, without cutting corners, without cutting quality, and without cutting any safety measures. Jason Williams MD 02MR 20MBA Incentives: Make it Something Special and Unique Crunching all of this data, Sedatole and her colleagues could isolate the effect of each mechanism on performance and turnover times at Phoebe. While the dashboards had “negligible” effect on productivity, the addition of the store gift cards had immediate, significant, and sustained impact on individuals’ efforts. Differences in the effectiveness of the two incentives—the relative performance dashboard and the gift cards—are attributable to team fluidity, says Sedatole. “It’s all down to familiarity. Dashboards are effective if you care about your reputation and your standing with peers. And in fluid team settings, where people don’t really know each other, reputation seems to matter less because these individuals may never work together again. They simply care less about rankings because they are effectively strangers.” Tangible rewards, on the other hand, have what Sedatole calls a “hedonic” value: they can feel more special and unique to the recipient, even if they carry relatively little monetary value. Something like a $40 gift card to Target can be more motivating to individuals even than the same amount in cash. There’s something hedonic about a prize that differentiates it from cash—after all, you will just end up spending that $40 on the electricity bill. Asa Griggs Candler Professor of Accounting, Karen Sedatole “A tangible reward is something special because of its hedonic nature and the way that human beings do mental accounting,” says Sedatole. “It occupies a different place in the brain, so we treat it differently.” In fact, analyzing the results, Sedatole and her colleagues find that the introduction of gift cards at Phoebe equates to an average incremental improvement of 6.4% in OR turnover performance; a finding that does not vary over the 73-week timeframe, she adds. To get the same result by employing more staff to build more stable teams, Sedatole calculates that the hospital would have to increase peer familiarity to the 98th percentile: a very significant financial outlay and a lot of excess capacity if those additional team members are not working 100% of the time. These are key findings for healthcare systems and for administrators and decision-makers in any setting or sector where fluid teams are the norm, says Sedatole: from consultancy to software development to airline ground crews. Wherever diverse professionals come together briefly or sporadically to perform tasks and then disperse, individual motivation can be optimized by simple mechanisms—cost-effective tangible rewards—that give team members a fresh opportunity to earn the incentive in different settings on different occasions—a recurring chance to succeed that keeps the incentive systems engaging and effective over time. For healthcare in particular, this is a win-win-win, says Williams. “In the United States we are faced with lower reimbursements and higher costs, so we have to look for areas where we can gain efficiencies and minimize costs. In the healthcare value model, time and costs are denominators, and quality and service are numerators. Any way we can save on costs and improve efficiencies allows us to take care of more patients, and to be able to do that effectively. “We made some incredible improvements here. We went from just average to best in class, right to the frontier of operative efficiency. And there is so much more opportunity out there to pull more levers and reach new levels, which is truly encouraging.” Looking to know more or connect with Asa Griggs Candler Professor of Accounting, Karen Sedatole? Simply click on her icon now to arrange an interview or time to talk today.

No More Edits for “Face the Nation”

Mark Lukasiewicz, dean of Hofstra’s Lawrence Herbert School of Communication, is featured in an article in Variety: “CBS News Agrees Not to Edit ‘Face The Nation’ Interviews Following Homeland Security Backlash.” The report covers a CBS News decision to discontinue editing taped interviews with newsmakers who appear on “Face the Nation.” The agreement came after the Trump administration complained about an interview with Secretary of Homeland Security Kristi Noem. During the course of the segment, Noem made unsubstantiated statements about Kilmar Abergo Garcia, a Salvadoran man who was deported from the U.S., despite having protected legal status. CBS decided to air an edited version of the interview and to make the full exchange available online. “A national news organization is apparently surrendering a major part of its editorial decision-making power to appease the administration and to bend to its implied and explicit threats. Choosing to edit an interview, or not, is a matter for newsrooms and news organizations to decide. The government has no business in that decision,” said Dean Lukasiewicz.

Professor Sangeeta Khorana made a Fellow of the Academy of Social Sciences

Professor Sangeeta Khorana, professor of international trade policy at Aston University, has been made a Fellow of the Academy of Social Sciences Fellows are elected for their contributions to social science, including in economic development, human rights and welfare reform The 2025 cohort of 63 Fellows will join a 1,700-strong Fellowship with members from academia, the public, private and third sectors. Professor Sangeeta Khorana, professor of international trade policy at Aston University, has been made a Fellow of the Academy of Social Sciences as part of the Autumn 2025 cohort. The 63 new Fellows have been elected from 39 UK organisations, comprising 29 higher education institutions, as well as think tanks, non-profits, business, and from countries beyond the UK including Australia and China. The Academy of Social Science’s Fellowship comprises 1,700 leading social scientists from academia, the public, private and third sectors. Selection is through an independent peer review which recognises their excellence and impact. Professor Khorana has more than 25 years of academic, government and management consulting experience in international trade. She has worked for the Indian government as a civil servant and on secondment to the UK Department for Business and Trade. Her expertise includes free trade agreement (FTA) negotiations and World Trade Organization (WTO) issues. As well as sitting on various expert committees, Professor Khorana is an advisor on gender and trade to the Commonwealth Businesswomen’s Network in London and serves on Foreign Investment Committee of the PHD Chambers of Commerce and Industry, India. The Autumn 2025 cohort of Fellows have expertise in a range of areas including educational inequalities, place-based economic development, human rights protection, the regulation of new technologies, and welfare reform, highlighting the importance, breadth and relevance of the social sciences to tackling the varied challenges facing society today. As well as excellence in research and professional applications of social science, the new Fellows have also made significant contributions beyond the academy, including to industry, policy and higher education. Professor Khorana said: “I am deeply honoured to be elected a Fellow of the Academy of Social Sciences. This recognition underscores not only the importance of international trade policy as a driver of inclusive and sustainable growth, but also the role of social sciences in shaping fairer and more resilient societies. At Aston University, my research seeks to bridge academia, government and industry to inform evidence-based trade policy for global cooperation. I am proud to contribute to the Academy’s mission of demonstrating how social science knowledge and practice can address some of the most pressing challenges of our time.” President of the Academy, Will Hutton FAcSS, said: “It’s a pleasure to welcome these 63 leading social scientists to the Academy’s Fellowship. Their research and practical applications have made substantial contributions to social science and wider society in a range of areas from international trade policy and inclusive planning systems through to innovative entrepreneurship and governing digital technologies. We look forward to working with them to promote further the vital role the social sciences play in all areas of our lives.”

Spitting image: What the blunder by Philadelphia Eagles' Carter can teach us about teams

Social media caught fire when Philadelphia Eagles' defensive tackle Jalen Carter got tossed for spitting on Dallas Cowboys' quarterback Dak Prescott before the first snap of this year's NFL season opener. While the impact on the game was obvious, what unfolded on the field of play has lessons for the workplace and the boardroom. The University of Delaware's Kyle Emich can talk about the parallels between the two worlds when individuals let their teams down. Emich, a professor of management in UD's Lerner College of Business and Economics, said emotional events occur all the time in the workplace, especially in board rooms, where the atmosphere is often competitive. "Emotion regulation is a key part of harnessing motivation appropriately in a competitive context," Emich said. • Early on, the Cowboys were able to regulate their emotions to tap into the incident when they roared out to several seamless offensive drives. • Emich says the Eagles' young, inexperienced and not-yet-gelled defensive unit was unable to regulate their emotions and preserve their confidence (collective efficacy) after the incident. They were unable to stop Dallas in the first half. • Carter's act could also have served as an emotion regulation cue for both teams. The Eagles defense was unable to regulate and maintain stability, leading to a number of costly penalties. But the Cowboys seemed to have had the same issue when they retaliated with personal fouls of their own. • In the end, the Eagles were able to come together under the leadership of their coach, Nick Sirianni, and quarterback, Jalen Hurts, to secure a 24-20 victory. To connect with Emich for an interview, visit his profile page and click on the "contact" button.

Georgia Southern reaches new economic impact record of $1.167 billion

Recent reports from the University System of Georgia (USG) show Georgia Southern University continues its legacy of significant economic impact on its surrounding region. According to the USG’s latest Economic Impact report, the system recorded a $23.1 billion total economic impact from July 1, 2023 until June 30, 2024. In the same period, Georgia Southern continues to reach new heights with a record annual economic impact of $1.167 billion for FY 2024, a 1.9% increase over the previous year. “Georgia Southern’s record economic impact across the region reflects the extraordinary dedication of our faculty and staff on all three campuses to ensuring we continue to meet the needs of our students and our region today and into the future,” said Georgia Southern President Kyle Marrero. “We remain steadfast in our goals of graduating career-ready students, advancing the economic development of the region and elevating our public impact research enterprise.” The report shows there are 3,096 jobs on Georgia Southern’s campuses in Statesboro, Savannah and Hinesville. Because of institution-related spending, an additional 6,627 jobs exist off-campus, totaling 9,723 jobs due to institution-related spending in fiscal year 2024. The report also noted that Georgia Southern students spent $442,818,489 in the region in fiscal year 2024. In addition, the USG’s newest Lifetime Earnings study found that bachelor’s degree graduates from the class of 2024 will earn, on average, more than $1.4 million above what they would without a college degree through their lifetime. The findings confirm how much each level of higher education can add to a USG graduate’s total earnings throughout their lives. Across the entire USG, the analysis showed that the 73,006 degrees conferred by USG institutions can expect combined total lifetime earnings of $230 billion. “A degree from one of USG’s 26 public colleges and universities is a million-dollar deal for graduates and a billion-dollar boost for Georgia,” USG Chancellor Sonny Perdue said. “Students see real returns through higher earnings and better opportunities. Meanwhile, our institutions power Georgia’s economy and help local communities thrive.” Georgia high school graduates who obtain a bachelor’s degree will boost their state work-life earnings by 82%, surpassing the 80% increase estimated for the nation. Georgia Southern University conferred 5,172 degrees in FY 2024. This group of degree recipients can expect their combined work in Georgia to total lifetime earnings of $16.54 billion. The report also broke down total Georgia lifetime earning predictions by degree: The 102 GS graduates with doctoral degrees will earn a total of $429 million. The 1,116 GS graduates with master’s degrees will earn a total of $3.8 billion. The 3,870 GS graduates with bachelor’s degrees will earn a total of $12.5 billion. The 45 GS graduates with associate degrees will earn a total of $97.9 million. The 39 GS graduates with certificates will earn a total of $78.2 million. The Lifetime Earnings report also shows the U.S. work-life earnings for graduates. For example, all Georgia Southern students who graduated in the class of 2024 who graduated with a bachelor’s degree will earn a collective $12.6 billion in their lifetimes. Without the degree, their projected lifetime earnings would only be a collective $7 billion. The Economic Impact as well as the Lifetime Earnings studies were both conducted on behalf of USG by Jeffrey M. Humphreys, Ph.D., director of the Selig Center for Economic Growth in the University of Georgia’s Terry College of Business. If you're interested in knowing more about Georgia Southern University - simply contact Georgia Southern's Director of Communications Jennifer Wise at jwise@georgiasouthern.edu to arrange an interview today.

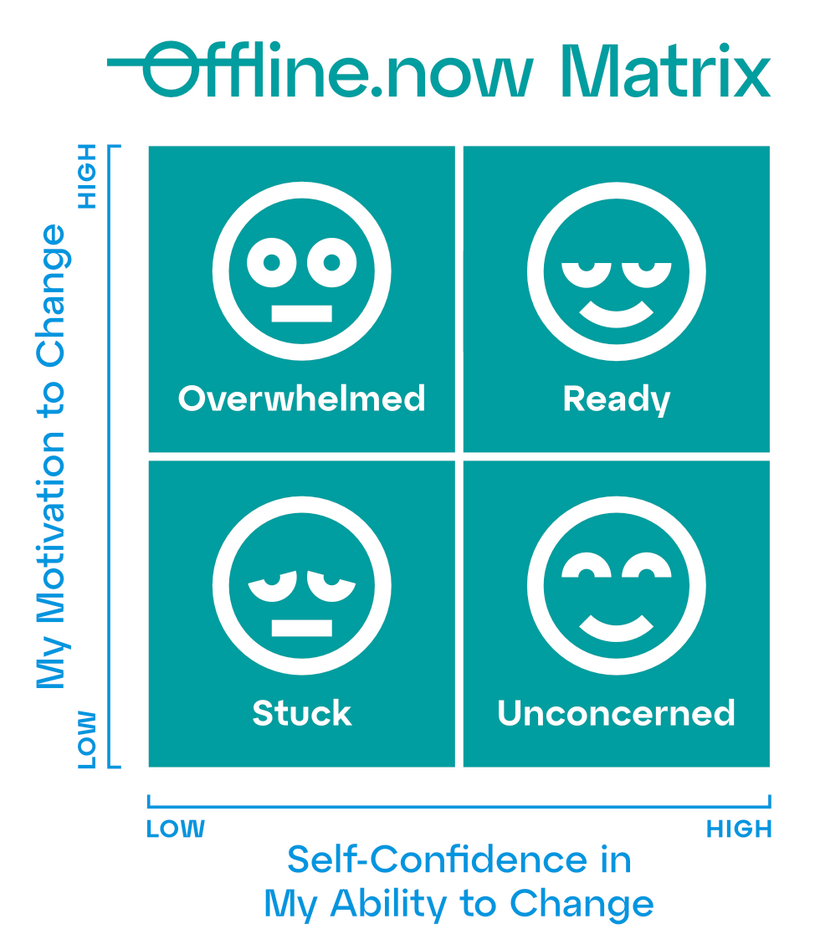

Start changing your phone habits with Offline.now

WHY THIS MATTERS Changing your relationship with a phone is hard. We see it at home and at work, across generations. Shame and all-or-nothing fixes don’t last. Offline.now focuses on practical tools and plain-language guidance people can act on today. WHAT OFFLINE.NOW OFFERS Homepage: take the 2-question quiz - clarifies where you are in your journey to change phone habits. Expert Directory - human support from therapists, coaches, counsellors, social workers, and specialists trained in everything from doomscrolling and nomophobia to online dating burnout and notification overload. Digital Balance Hub - quick guides and explainers you can act on today. HOW THE OFFLINE.NOW MATRIX HELPS Our intuitive Offline.now Matrix assessment tool presents four quadrants - Overwhelmed, Ready, Stuck, and Unconcerned - each offering practical real-world strategies to help people move towards their goals. STORY ANGLES FOR JOURNALISTS The two-question start: a practical way to change phone habits Doomscrolling isn’t a willpower problem - match the fix to the person From screen-time shame to personal progress: small-wins that stick Night routines that hold: what changes when people start in the right quadrant Parents, teens, and teams: a common language for digital balance INTERVIEW AVAILABILITY Eli Singer, Founder & CEO of Offline.now - pioneered early social strategy for Coca-Cola, Ford, and MoMA; published in Harvard Business Review; lead researcher on The Power of the 2×2 Matrix. See Eli’s profile for full bio and contact. FOR PRACTITIONERS Experts are invited to join the Offline.now directory.

Before you scroll past thinking, “Oh, another scam alert,” please pause. This isn’t your average “don’t answer spam calls” notice. What follows is an examination of the growing sophistication of grandparent scams—complete with call centers, scripts, and even AI voice cloning. More importantly, it’s about how to protect yourself and, especially, the older members of your family. Read on—not just for awareness, but for fundamental tools to keep your loved ones safe. Even Elvis Isn't Safe From Scammers You know the world has gone topsy-turvy when even the King of Rock 'n' Roll isn't immune to fraud. I've written before about the recent attempt to scam Elvis Presley's Graceland estate, but a recent story about senior fraud really got my blood boiling. U.S. authorities in Boston just charged 13 people connected to what I can only describe as a "grandparent scam industrial complex" – a sophisticated operation that bilked over 400 elderly Americans out of more than $5 million. These weren't your run-of-the-mill phone scammers calling from their basement. Oh no. These criminals were running call centers with scripts, managers, and daily money-making leaderboards like they were selling insurance, not breaking hearts. The math alone should make you furious: $5 million divided by 400 victims equals about $12,500 per person. That's not pocket change – that's someone's emergency fund, their vacation savings, or money they've been carefully setting aside for healthcare costs. The Grandparent Scam: Emotional Manipulation 101 If you're not familiar with grandparent scams, buckle up. These predators have turned family love into their business model, and they're disgustingly good at it. Here's their playbook: Step 1: The Panic Call – "Grandma, it's me! I'm in jail and need bail money RIGHT NOW!" Step 2: The Identity Theft – Using social media details (yes, those cute Facebook posts about little Johnny's soccer game), they sound convincingly like your grandchild. Some are even using AI voice-cloning technology. Step 3: The Time Crunch – Everything's an emergency. No time to think, no time to verify. Just panic and send money. Real emergencies, by the way, allow time for a phone call to confirm details. Step 4: The Collection – Cash via courier, rideshare driver pickup, wire transfers, even Bitcoin. Anything except the legitimate ways actual legal systems collect bail money (spoiler alert: the good guys don't send Uber drivers to your house). The Boston Grandparent Fraud Case: Scamming at Scale The level of organization in this Boston case reads like a twisted business manual. These criminals weren't just winging it – they had: • Dedicated "Opener" staff who made initial contact with victims • Specialized "Closers" who pretended to be lawyers demanding payment • Management training programs for their scam employees • Daily performance systems (because nothing says "organized crime" quite like gamifying elderly financial abuse) A number of things bothered me about this case The fraudsters got over $5 million from 400 victims. The simple math shows that, on average, each victim would have lost $12,500 – that’s not “walking around” money. I suspect many would have had to tap into a variety of savings accounts or possibly borrow from others to source funds on short notice. This creates an extra degree of hardship for victims who are struggling to manage on a fixed income. The average age of the victims was 84. This breaks my heart. The oldest in this cohort are especially vulnerable. At this age, many seniors live alone or are more isolated, making them easier prey for these deceitful tactics. Many of them are still uninformed about how these scams operate. The scammers showed a very high level of sophistication. According to court documents from the U.S. Department of Justice, District of Massachusetts (2025), the scammers operated a sophisticated “call center” with technology at multiple sites, enabling them to place a massive number of calls to unsuspecting victims. • These scams would begin with an “Opener” employee, who would call victims and read a script (see below) pretending to be a grandson or granddaughter who was in an accident. • Then, a “Closer” would allegedly follow up with another call, pretending to be their grandchild’s attorney, asking for a sum of money to pay for their grandchild’s fees due to the accident. Each of these call center locations had managers overseeing staff who trained, supervised, and paid employees. The most sickening part? They kept detailed records of how much money they stole each day, treating vulnerable seniors like ATM machines with feelings. Here is an actual photo of their “Leaderboard” taken as evidence in the Boston case. When it came to handling cash, they also had a plan for that. Most often, they used unsuspecting rideshare drivers whom they ordered to do a package pickup at the victim’s house. And these heartless criminals often went back for seconds and thirds. Using lines designed to trigger seniors into emptying their bank accounts. They would say things like "Oh, there's been a mix-up," or "A pregnant woman's baby was lost in the crash" – any lie to squeeze more money from people who'd already been devastated once. Now, I’ve been in enough boardrooms to know that leaderboards usually track sales of widgets, mortgages, or, at worst, how many stale muffins are left in the breakroom. But imagine walking into work and your boss says, “Congratulations, you scammed the most grandmas today—you win Employee of the Month!” That’s not just evil, it’s the kind of thing that should earn you a permanent bunk bed in a tiny jail cell. And using Uber drivers to pick up cash? Please. The only thing Uber should be picking up is takeout and slightly tipsy people at 11 p.m.—not Grandma’s retirement savings. Some of These Scams Are Coming From Inside Canada Here's where this story hits close to home. While we might imagine these scams operating from some far-off location, some of the biggest operations have been running right here in Canada. In March 2025, Montreal police arrested 23 people connected to a massive network that allegedly defrauded seniors across 40 U.S. states of $30 million over three years. The suspected ringleader, Montreal developer Gareth West, allegedly ran call centers from Quebec properties and laundered the proceeds into luxury real estate. West remains at large, proving that sometimes the worst criminals are hiding in plain sight in Canadian suburbs. The Canadian Reality Check According to the Canadian Anti-Fraud Centre, emergency or 'grandparent scams' have become one of the fastest-growing crimes targeting seniors in Canada, with reported losses rising from $2.4 million in 2021 to over $11.3 million in 2023. Here's where it gets even more interesting. Those figures are just the losses for gradparent fraud that are reported – experts estimate the true losses are at least ten times higher since only 5-10% of fraud victims come forward. Let that sink in: we could be looking at over $100 million in actual losses annually in Canada alone. Here’s the part that really stings: no one is exempt. Not me, not you, not even that friend who insists they “don’t answer unknown numbers.” (Sure, Jan. We all know you still pick up when it says “potential spam.”) This isn’t just about losing money—it’s about losing confidence. The shame, the self-doubt, and the “How could I fall for that?” spiral are often worse than the financial loss. I’ve seen strong, capable people withdraw after being scammed, too embarrassed to tell their own families. And honestly—I get the same chill when I read these stories: Would I have caught it in time? It’s a reminder that vigilance is like flossing—we all know we should do it daily, and yet… sometimes we forget until it hurts. Supporting an Elder Who’s Been Scammed Here’s where we need to step up as families and communities Practical Support: • Help them file a report with the police and the Canadian Anti-Fraud Centre. • Contact their bank to determine if the funds can be recovered. • Lock down social media and adjust privacy settings so future scammers have less ammunition. Emotional Support: • Listen without judgment. Don’t say, “I would never have fallen for that.” (Trust me—you might.) or “you know better, Granddad”. • Normalize the experience: this can happen to anyone. If AI can clone voices and manipulate emotions, it’s not about intelligence—it’s about being human. • Follow up regularly. Shame makes people pull back, so check in to ensure they’re not withdrawing or losing confidence. Your Family’s Fraud Fighting Toolkit Look, I've spent over 30 years in the financial industry, and I can tell you that preventing fraud is always easier than recovering from it. Here's your family's defence strategy: The P-A-U-S-E Method Pause – Don't act immediately, no matter how urgent the request sounds. Ask questions only family members would immediately know ("What's Mom's maiden name?") Use known phone numbers to call your grandchild directly and verify information Set up systems to protect family members (like a secret family password) Explain to others – share this information widely with all family members Know the Red Flags • Demands for immediate action (real emergencies allow verification time) • Requests for secrecy ("Don't tell Mom and Dad!") • Payment via courier, rideshare, wire transfer, or cryptocurrency • Emotional manipulation ("I'm so scared, Grandma!") • Any request for cash payment to resolve legal issues Family Password System Set up a secret word or phrase that only your family knows. Make it something memorable but not guessable from social media. "Fluffy" (your childhood dog) is better than a pet name you posted on a recent social media post. What to Do If You're Targeted Stop. Don't. Send. Money. Instead: • Hang up immediately • Call your local police to file a report • Report to the Canadian Anti-Fraud Centre: 1-888-495-8501 or visit antifraudcentre-centreantifraude.ca • If you've already sent money, contact your bank immediately • Tell other family members what happened – you're not the only target These criminals exploit the most powerful human emotions: love, fear, and the desire to protect our families. They've turned grandparents' natural instinct to help their grandchildren into a multi-million-dollar crime operation. But here's what they're banking on (pun intended): that we'll be too embarrassed to talk about it, too confused to verify it, and too panicked to think clearly. Don't give them that satisfaction. Remember, the average age of victims in the Boston case was 84. These aren't people who have time to recover from financial mistakes. Every dollar stolen from a senior is a dollar that won't be there for healthcare, housing, or basic dignity in their final years. We Can Fight Back Knowledge is power, and conversation offers protection. The more we discuss these scams openly – around dinner tables, in community centres, at family gatherings – the more we hinder these criminals from succeeding. Share this post with the seniors in your life. Not because they're naive, but because they're caring. And because caring people deserve to know how heartless criminals are trying to exploit their love. What is your family doing to protect against fraud? What are your strategies and ideas for keeping our loved ones safe? I’m also particularly interested in what financial institutions and various government agencies are doing these days to combat fraud and protect this vulnerable group. As I research this topic more, I’d love to hear from you. Remember: Real grandchildren in genuine emergencies can wait five minutes for you to confirm who you're talking to. Scammers can't. Helpful Resources: • Canadian Anti-Fraud Centre: 1-888-495-8501 • Report online: antifraudcentre-centreantifraude.ca • For more retirement security tips, visit retirewithequity.ca Stay safe. Don't Retire - Rewire! Sue

As Trump rolls back regulations, this expert examines the costs of compliance

President Donald Trump has signaled a push to scale back federal regulation across a wide range of industries, reigniting a national debate over the costs and benefits of government rules. For Joseph Kalmenovitz, an assistant professor of finance at the University of Rochester’s Simon Business School who studies the economics of regulation, the moment underscores the importance of understanding not just what regulations do — but how much they cost. Kalmenovitz, who combines legal training with cutting-edge empirical methods, has developed innovative ways to measure regulatory intensity. His research shows how compliance requirements translate into millions of additional hours of paperwork for firms — costs that often fall outside public view. A recent Bloomberg Law article cited his work in explaining how Wall Street alone devotes an estimated 51 million extra hours each year to compliance since the Great Financial Crisis. Beyond tallying hours, Kalmenovitz’s studies also explore how overlapping rules across agencies — what he calls “regulatory fragmentation” — can stifle productivity, profitability, and growth, especially for smaller firms. His long-term aim is to provide evidence-based insights that can guide smarter rulemaking in Washington. “The dream is that people will take insights from my work and use them to improve the way regulation is conceived,” he told Simon Business Magazine. Kalmenovitz is a leading voice in translating data into meaningful insights about the hidden costs and design of regulation whose work has been published in the Journal of Finance, the Review of Financial Studies, Management Science, and the Journal of Law and Economics. He is available for interviews and can be contacted through his profile.

Play, Learn, Lead: How Aston’s Gamification-Driven MBA Is Redefining Business Learning

Professor Helen Higson OBE of Aston Business School, discusses why gamification is embedded in all of the School's postgraduate portfolio of degrees Give the students something to do, not something to learn; and the doing is of such a nature as to demand thinking; learning naturally results. (attributed to John Dewey, US educational psychologist (1859-1952) Imagine you’re the CEO of a cutting-edge robotics firm in 2031, making high-stakes decisions on R&D, marketing and finance; one misstep and your virtual company could collapse. You win, lose, adapt, and grow. This isn’t a case study, it’s your classroom experience at Aston Business School in Birmingham. Imagine you’re participating in Europe’s biggest MBA tournament, the University Business Challenge, where your strategic flair and financial acumen will be tested against the continent’s sharpest minds. Then you’re solving real-world sustainability crises in the Accounting for Sustainability Case Competition, crafting solutions that could be showcased in Canada. What if you could do all this from your classroom seat, armed with only your MBA learnings, teamwork and the thrill of gamified learning. At Aston, we believe the best way to master business is by doing business. That’s why we’ve embedded active learning through games, simulations, and competitions across all our postgraduate programs. The results? Higher engagement, deeper learning, and students who graduate with confidence and real-world skills. Research says gamified learning boosts motivation, lowers stress, and helps students adopt new habits for lifelong success. As educational researchers Kirillov et al. (2016) found, “Gamification creates the right conditions for student motivation, reduces stress, and promotes the adoption of learning material—shaping new habits and behaviours.” This has led to what Wiggins (2016), calls the “repackaging of traditional instructional strategies”. In Aston Business Sschool we have long embraced this approach as a way of increasing student outcomes and stimulating more student engagement in their learning. Our Centre for Gamification in Education (A-GamE), launched in 2018, is dedicated to advancing innovative teaching methods. We run regular seminars with internal and external speakers showcasing gamification adoption, design and research and we use these techniques across the ABS in a wide range of disciplines. (We have included two examples of this work in our list of references.) Furthermore, in 2021 we published a book which outlines the diverse ways in which we use these methods (Elliott et al. 2021). Subsequently, during 2024 we redesigned all our postgraduate portfolio of degrees, and as part of this initiative games and simulations were embedded across all programmes. Why Gamification Works Through simulations like BISSIM, students step into executive roles, steering futuristic companies through the twists and turns of a dynamic marketplace. A flagship programme running since 1981, BISSIM was developed in collaboration between academics from ABS and Warwick Business School, and every decision on R&D, marketing, or HR has real consequences as teams battle each other for the top spot. After each year of trading the results are input into the computer model. The results are then generated for each company in the form of financial reports, KPIs and other non-financial results and messages. Each team’s results are affected by their own decisions and the competitive actions of the other teams, as well as the market that they all influence. This year one of our academics, Matt Davies, has been awarded an Innovation Fellowship further to commercialise the game. Competitions with Global Impact We also encourage students to take part in national and international competitions which have the same effect of developing their engagement with real-life business problems on a global scale. Beyond the classroom, Aston students represent the university in major competitions like the University Business Challenge (in which ABS had the highest number of UK teams this year) and the Accounting for Sustainability (A4S) Case Competition, for which we are an “anchor business school”. Here, theory gets stress-tested against real-world scenarios and top talent from around the globe. The result? Award-winning teams, global experience, and friendships built under pressure. At the heart of this approach is Aston’s Centre for Gamification (A-GamE), dedicated to making learning interactive, motivating, and fun. Regular seminars, fresh research, and close ties to industry keep the curriculum evolving and relevant, so students graduate ready to lead, adapt, and thrive in any business environment. Why does it matter? In a volatile, fast-paced economy, employers appreciate agility, teamwork and decisiveness. At Aston, every simulation and competition is geared towards sharpening these skills. Graduates emerge not only knowledgeable, but prepared for the job market. Engagement Our students have been embracing these opportunities. Six MBA/Msc teams developed their A4S videos, hoping to reach the final in Canada early in 2025, and three teams out of nine reached the national UBC finals. Additionally, the BISSEM simulation has just finished inspiring another group of MBA students (particularly as the prize for the winning team was tickets to a game at our local Aston Villa premiership football (soccer) club, currently riding high in the league!). Typical feedback from non-Finance specialists is that they suddenly surprised themselves during their participation in the simulation and were reconsidering the options of taking a career in Finance. It seems that our original purposes have been met – increased confidence, passion, deep learning and engagement have been achieved. To interivew Professor Higson, contact Nicola Jones, Press and Communications Manager, on (+44) 7825 342091 or email: n.jones6@aston.ac.uk Elliott, C., Guest, J. and Vettraino, E. (editors) (2021), Games, Simulations and Playful Learning in Business Education, Edward Elgar. Kirillov, A. V., Vinichenko, M. V., Melnichuk, A. V., Melnichuk, Y. A., and Vinogradova, M. V. (2016), ‘Improvement in the Learning Environment through Gamification of the Educational Process’, International Electronic Journal of Mathematics Education, 11(7), pp. 2071-2085. Olczak, M, Guest, J. and Riegler, R. (2022), ‘The Use of Robotic Players in Online Games’, in Conference Proceedings, Chartered Association of Business Schools, LTSE Conference, Belfast, 24 May 2022, p. 79-81. Wiggins, B. E. (2016), ‘An Overview and Study on the Use of Games, Simulations, and Gamification in Higher Education’, International Journal of Game-Based Learning (IJGBL), 6(1), 18-29. https://doi.org/10.4018/IJGBL.2016010102

President Puts the Heat on U.S. CEOs

The Wall Street Journal interviewed Dr. Meena Bose about President Donald Trump upping public pressure on CEOs and telling them how to conduct their business. Recently he called for Intel’s chief executive to resign and told Detroit carmakers not to raise prices. Dr. Bose explained that this level of interference is highly unusual. “This is certainly not an approach the United States has seen in modern American politics,” she said. “It’s government bending economic interests.” Dr. Bose is a Hofstra University professor of political science, executive dean of the Public Policy and Public Service program, and director of the Kalikow Center for the Study of the American Presidency.