Experts Matter. Find Yours.

Search experts on 50,000+ topics. Or browse by topic category.

- Recent Searches

Featured

Global experts with a broad range of areas of expertise.

Connecting credible expert sources & academic research

ExpertFile is a trusted resource for journalists, industry, funding agencies and government policymakers looking for fresh perspectives and innovative academic research.

Spotlights

Read expert insights on a wide variety of topics and current events.

The AI In Action Symposium, hosted by the LSU E. J. Ourso College of Business, brings together expert voices at the heart of the AI revolution to explore how they have successfully navigated this evolving landscape. The 2026 symposium focuses on the practical implications of AI in business, including hiring AI-ready talent, ensuring responsible and ethical use, and exploring the challenges of implementing AI across both large enterprises and small startups. Speakers Attendees will hear from Louisiana leaders and national AI experts, including… Secretary Bruce Greenstein of the Louisiana Department of Health April Wiley, Senior Vice President at Community Coffee Robert Veit and Julian Tandler from Scale Team Six, a San Francisco-based business accelerator Dr. Tonya Jagneaux, who leads medical analytics at the Franciscan Missionaries of Our Lady Health System (FMOLHS) Hunter Thevis, president and co-founder of Lafayette-based S1 Technology …and many more! Details March 20, 2026, 8:00 a.m. – 1:00 p.m. Registration deadline is March 15. Held on the LSU A&M Campus, in the LSU Student Union Register at lsu.edu/business/ai-symposium Discount available for LSU System employees

U.S. Has a “Checkered History” of Toppling Authoritarian Regimes

In a Newsday article about Long Island Iranian-Americans’ reactions to recent developments involving Iran’s leadership, Dr. Paul Fritz, associate professor and chair of Hofstra’s Department of Political Science, discussed the history of the United States toppling authoritarian regimes, which, he said, rarely leads to new democracies or stable leadership without extensive American support. “The Trump administration is banking on the people rising up and demanding some change to the regime,” Dr. Fritz said. “Foreign imposed regime change doesn’t work very often.”

Got Expertise to Share?

Join leading professionals already using ExpertFile’s easy to use Platform for showcasing your organization’s experts and their insights on your website...and to the world.

Is writing with AI at work undermining your credibility?

With over 75% of professionals using AI in their daily work, writing and editing messages with tools like ChatGPT, Gemini, Copilot or Claude has become a commonplace practice. While generative AI tools are seen to make writing easier, are they effective for communicating between managers and employees? A new study of 1,100 professionals reveals a critical paradox in workplace communications: AI tools can make managers’ emails more professional, but regular use can undermine trust between them and their employees. “We see a tension between perceptions of message quality and perceptions of the sender,” said Anthony Coman, Ph.D., a researcher at the University of Florida's Warrington College of Business and study co-author. “Despite positive impressions of professionalism in AI-assisted writing, managers who use AI for routine communication tasks put their trustworthiness at risk when using medium- to high-levels of AI assistance." In the study published in the International Journal of Business Communication, Coman and his co-author, Peter Cardon, Ph.D., of the University of Southern California, surveyed professionals about how they viewed emails that they were told were written with low, medium and high AI assistance. Survey participants were asked to evaluate different AI-written versions of a congratulatory message on both their perception of the message content and their perception of the sender. While AI-assisted writing was generally seen as efficient, effective, and professional, Coman and Cardon found a “perception gap” in messages that were written by managers versus those written by employees. “When people evaluate their own use of AI, they tend to rate their use similarly across low, medium and high levels of assistance,” Coman explained. “However, when rating other’s use, magnitude becomes important. Overall, professionals view their own AI use leniently, yet they are more skeptical of the same levels of assistance when used by supervisors.” While low levels of AI help, like grammar or editing, were generally acceptable, higher levels of assistance triggered negative perceptions. The perception gap is especially significant when employees perceive higher levels of AI writing, bringing into question the authorship, integrity, caring and competency of their manager. The impact on trust was substantial: Only 40% to 52% of employees viewed supervisors as sincere when they used high levels of AI, compared to 83% for low-assistance messages. Similarly, while 95% found low-AI supervisor messages professional, this dropped to 69-73% when supervisors relied heavily on AI tools. The findings reveal employees can often detect AI-generated content and interpret its use as laziness or lack of caring. When supervisors rely heavily on AI for messages like team congratulations or motivational communications, employees perceive them as less sincere and question their leadership abilities. “In some cases, AI-assisted writing can undermine perceptions of traits linked to a supervisor’s trustworthiness,” Coman noted, specifically citing impacts on perceived ability and integrity, both key components of cognitive-based trust. The study suggests managers should carefully consider message type, level of AI assistance and relational context before using AI in their writing. While AI may be appropriate and professionally received for informational or routine communications, like meeting reminders or factual announcements, relationship-oriented messages requiring empathy, praise, congratulations, motivation or personal feedback are better handled with minimal technological intervention.

My MBA at 69: Q1 Results Are In. And Nobody Is More Surprised Than Me

When I wrote my first post about starting an MBA at 69, I was running on caffeine, stubbornness, and a mild identity crisis. I was drowning in software platforms, APA formatting, and the humbling reality that open-book quizzes could still make me sweat. Fast forward to today. I am now 25% complete. Even typing that makes me sit up straighter. More surprising? I am maintaining an A average. Yes. An A. Let that land for a moment. Before anyone faints, let me be clear. I am not retiring my original mantra. "Even C's Get Degrees" still lives on a sticky note in my brain. I repeat it whenever the ego starts strutting around like it owns the place. The goal was never perfection. The goal was sustainable progress and full nights of sleep. The A average is delightful. The mantra is protective. My dog Dottie approves of both. She now perches on the back of the couch while I work, casting supervisory glances in my direction like a very small, very opinionated board member. We are in a much better place emotionally. The household has stabilized. What I did not anticipate was how much this experience would reveal about me. Lesson #1: Experience Is the Assignment Nobody Grades The content is strong. The business frameworks and systems I am learning are elegant. But the real gift has been realizing that my decades of experience give depth to everything I read. When the textbook discusses competitive positioning or industry cycles, I do not see abstract diagrams. I see real businesses. I hear boardroom conversations. I remember decisions that worked beautifully — and others that required creative explanations and, occasionally, some very careful walking back. The theories have texture because I have lived them. This MBA is not separate from my work. It is sharpening it. Every case study filters through the same question: How does this apply to retirees? I cannot turn that lens off. Frankly, I would not want to. At the same time, not every concept survives intact outside the classroom. We are taught that firms must choose clearly between cost leadership and differentiation. Tidy in theory. Messier in practice, where most organizations stumble through imperfect hybrids while real-world pressures refuse to behave according to the textbook. I learn the models thoroughly. I cite them properly. I demonstrate mastery. And yes, after nearly losing my mind over whether a journal article published in 2019 requires a DOI or a retrieved-from URL, I can now format an APA 7th edition reference in my sleep. Whether I want to is another conversation entirely. But maturity lets me see where the models bend. Lesson #2: Selective Excellence Is Not Laziness. It's Wisdom. One of the biggest lessons this term has been prioritization. At 29, I wanted to prove myself. At 69, I want to improve myself. Earlier in life I would have tried to ace everything equally. Today, I allocate energy strategically. Marketing excites me. Strategy energizes me. Organizational behaviour feels like coming home. Those subjects get my full intellectual investment. Accounting gets solid, disciplined, B-minus effort. I say that proudly. Retirement is also selective excellence. You do not need to be good at everything anymore. You get to double down on what lights you up. Coursework. Careers. Life. All of it. But growth is not without discomfort. Lesson #3: The Classroom Has No Hallways Anymore My program is entirely virtual. No hallway conversations. No accidental coffee chats that turn into the best part of your week. Everything happens on screens, and group projects test my patience more than any midterm ever could. I even considered removing my photo from my profile to avoid immediate age assumptions. Then I took a breath and remembered who I am. If someone sees my age and quietly categorizes me as someone's grandmother, so be it. They have never met Aunt Equity when she puts her purse down. For the record: I do not own a purse. In one recent group assignment, a teammate gently pointed out that I had used an em dash in a formal case report. A rookie mistake, apparently. Instead of bristling, I thanked them for the compliment. If I am still making rookie mistakes, I am still capable of growth. That exchange meant more to me than the grade. Lesson #4: The Advantage of Having Nothing Left to Prove Age has given me something powerful: detachment. I am not chasing internships. I am not competing for promotions. I am here because I want to be here, and that freedom changes everything. I can question thoughtfully. I can log off at a reasonable hour. I can engage with students young enough to be my grandchildren without an ounce of ego about it. Mostly. And still, whenever I feel the ego creeping back in about that A average, I whisper: "Even C's Get Degrees." It works every time. Lesson #5: Curiosity Does Not Come With an Expiry Date The deeper curriculum of this MBA has little to do with GPA. It has taught me that humility sharpens thinking. That curiosity does not expire. That stretching intellectually at 69 feels remarkably similar to climbing toward Everest Base Camp at 60. You question your sanity. You adapt. You keep moving. When I look at my latest grades, I do not feel relief. I feel possibility. If I can adapt to new technology, academic writing standards, and Zoom calls at 7 AM, then reinvention is not reserved for youth. It is available to anyone willing to risk being a beginner again. Are You Putting Your Experience To Work? If you are over 60 and thinking about taking a course, writing a book, starting a business, or learning something that scares you a little — here is the truth: Your experience is not a liability. It is leverage. Your decades are not dead weight. They are the whole point. And if you are willing to risk being a beginner again, reinvention will meet you exactly where you are. I am 25% done. Seventy is approaching. The mantra still stands. Remember, even C's Get Degrees. But when you bring seven decades of lived experience into the classroom, the curve has a way of bending in your favour. Now, if you will excuse me, Dottie has just planted herself directly on my laptop and is staring at me with the quiet authority of someone who has already read the syllabus on Google Scholar. Eighteen courses to go. Multiple pots of extra-strong coffee. A carefully curated cocktail of patience, tolerance, and self-care. The honeymoon is officially over. What lies ahead is a full marathon: War and Peace-length reading lists, spreadsheets that test the limits of human endurance, and enough group projects to make a grown woman question everything she knows about herself. Dottie remains unbothered. She has seen me do hard things. She knows I finish what I start. She also knows the whining, complaining, and pleading will eventually stop. (insert slow, world-weary head shake from a very wise ten-pound dog who has heard it all before). Don’t Retire… ReWire! Sue Want to become an expert on serving the senior demographic? Just message me to be notified about the next opportunity to become a "Certified Equity Advocate" — mastering solution-based advising that transforms how you work with Canada's fastest-growing client segment. Here's the link to sign up.

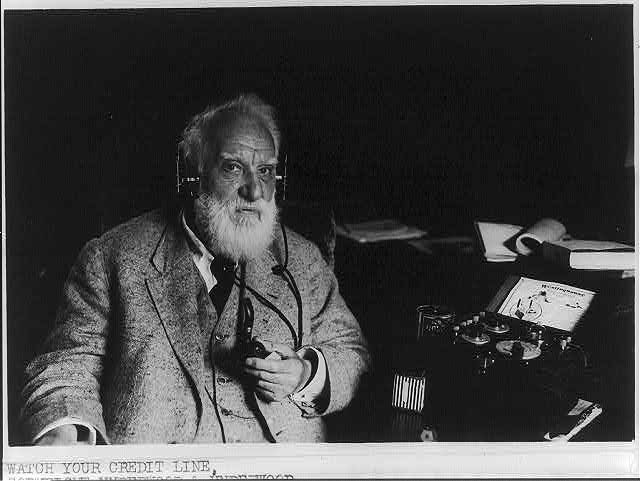

On March 10, 1876, Alexander Graham Bell spoke the first words ever transmitted over telephone: “Mr. Watson, come here; I want you.” This simple request to Bell’s assistant, Thomas Watson, marked a significant milestone in direct person-to-person communication. Now, 150 years later, this message has paved the way for advanced cellular technology in the form of satellites, wireless networks and the personal devices we carry everywhere. For Mojtaba Vaezi, PhD, associate professor of electrical and computer engineering at Villanova University and director of the Wireless Networking Laboratory, Bell’s few words spoken over telephone marked the beginning of an ongoing technological revolution. “One hundred fifty years ago when telephone communication first started, there was essentially a wired line and a transmitting voice,” said Dr. Vaezi. “That simple, basic transmission has transformed the field of communication technology in unimaginable ways.” According to Dr. Vaezi, five shifts have defined the past century and a half of communication technology: wired devices to wireless, analog to digital, voice to data, fixed landlines to mobile phones and human-to-human communication giving way to an increasing focus on machines and artificial intelligence. Early wireless networks were built around one device per person. Today's networks must support multiple devices per person, plus the technology behind innovations such as smart homes, driverless cars and even remote surgery. “Applications are much more diverse now, so communication has to follow,” said Dr. Vaezi. “A big portion of communication now, in terms of number of connections to the network, is from machine to machine—not human to human or even human to machine." The growing number of connections can cause a host of issues for users. When multiple users share the same wireless spectrum simultaneously, their signals interfere with one another—a problem that is becoming more acute as the number of connected devices increases exponentially. Dr. Vaezi’s research at Villanova focuses on developing techniques that allow multiple users to transmit messages on the same frequency at the same time and still be understood. Another vibrant research area of Dr. Vaezi’s involves Integrated Sensing and Communication (ISAC). This field of study focuses on integrating wireless communications and radar so they can function within the same spectrum. “Historically, radar and wireless communication work in different bandwidths or spectrums and use separate devices. Although they are related, they happen in different fields,” said Dr. Vaezi. “Almost every communication scheme that has been developed has focused on this: How can we better utilize the spectrum?” ISAC is increasingly important as new innovations like driverless cars become fixtures in everyday life. These vehicles rely on radar to continuously scan for hazards, and when a hazard is detected, a signal must be sent to trigger safety mechanisms. Currently, the radar and communications systems operate on separate bandwidths using separate hardware. Dr. Vaezi's research explores how both functions could be housed in a single device running on one shared spectrum. Areas of study like Dr. Vaezi’s that focus on machine to machine communication are becoming increasingly relevant as communication technology evolves and moves away from simple person to person messaging. As for the next big milestone in communications, Dr. Vaezi is looking ahead to the implementation of 6G by 2030, though he tempers expectations. For most users, the change will feel modest, amounting to slightly faster device speeds. The most massive shift with 6G will be the amount of added coverage in areas that previously did not have network accessibility. “Say you order a package and it’s coming from somewhere abroad,” explained Dr. Vaezi. “6G will add network coverage over oceans, so you’ll be able to track your package in real time using that satellite technology.” The sixth generation of cellular technology will continue to connect our world and optimize current communications to accommodate more users and devices that need network access each day. It is far different from Alexander Graham Bell’s historic phone call 150 years ago. That brief exchange over a single wired line laid the groundwork for a communications ecosystem that now supports billions of devices, complex data networks and emerging technologies yet to be seen. It also serves as a reminder that despite how far communication technology has come, and how complex it has gotten, it all shares a common, simple goal: to transmit information from one point to another.

Hospitals Pursue Excellence as ChristianaCare Earns Seven Beacon Awards

Seven ChristianaCare nursing units have earned the AACN Beacon Award for Excellence — one of the nation’s highest honors for delivering top-quality care. This recognition comes at a time when hospitals nationwide are working to stabilize their nursing workforce, strengthen leadership and deliver consistent, high‑quality care amid ongoing burnout and staffing pressures. Interviews are available with Danielle Weber, DNP, MSM, RN BC, NEA BC, chief nurse executive at ChristianaCare, who can discuss how ChristianaCare is driving quality and setting national standards during challenging times.

Strategic Closure of Strait of Hormuz Puts Pressure on US, Threatens Global Oil Trade Stability

Less than a week after the onset of the war in Iran, and amid escalating conflict in the region, Iran effectively closed the Strait of Hormuz to shipping tankers moving oil from the Middle East by threatening attacks against any vessel who entered the waterway. Thus, the small body of water, which moves a large percentage of the world’s crude oil, has become one of the most discussed places in the world in recent days. Frank Galgano, PhD, is a professor of Geography and the Environment at Villanova University. He is an expert in military and Middle East geography and has also studied global maritime shipping and access to natural resources. Dr. Galgano says there geographic, geopolitical, military and economic factors at play, along with widespread potential consequences, as Iran holds steady on their closure of the strait and the U.S. considers how, or if, it will attempt to help escort oil ships through. Geography and Significance of Strait of Hormuz Situated between Iran to the north and Oman and the United Arab Emirates to the south, the Strait of Hormuz is a narrow shipping lane that connects the Persian Gulf to the Gulf of Oman and, further out, the Arabian Sea. It is one of the most vital chokepoints in the Middle East, along with the Suez Canal, Straits of Tiran, Bab al-Mandab and the Turkish Straits. “Right now, because of oil, it is the most important,” Dr. Galgano said. “Every day, roughly 20 percent of global petrochemical use goes through Hormuz.” The strait itself is barely over 20 nautical miles at its narrowest, but only a small portion of that is shipping lanes. Depth constraints limit shipping to two lanes, each two miles wide, with a two-mile buffer between. “You’re essentially looking at all of that shipping constrained to six nautical miles, and the ships are relatively slow,” Dr. Galgano said. “There are usually about 14-25 tankers every 24 hours transiting the Gulf, so there is always a ship in line." By Iran threatening military action against any oil-carrying ships in Hormuz—and by shipping companies refusing to attempt to traverse it— one-fifth of the global oil trade is essentially cut off indefinitely. That is concerning, given that it takes very little to send global oil prices skyrocketing. Dr. Galgano referenced the 2010-11 Somali pirate issue that caused supertankers—which cost upward of $50,000 a day to operate—to be rerouted. “That alone caused gas prices to raise 10 cents per gallon,” he said. In this case, the biggest impact will be felt throughout Asia, which relies more heavily on oil imports. But the U.S., despite being the second-biggest producer of crude oil last year, will still feel significant effects, since oil is traded globally. “It takes these supertankers eight or 12 days to reach the East Coast from Hormuz,” Dr. Galgano said. “So, a few days later you might see diminished supplies, but there is a critical point where we would face a real shortage.” Attempting to Move Ships Through Hormuz Poses Huge Danger Unlike the Iranian-backed Houthi rebels attacks on Israeli ships and those belonging to its allies in the Red Sea last year, Iran itself has far more sophisticated weapons, along with a strong motive to do whatever it can to put pressure on the U.S. and involved allies. In addition to drones designed for attacking ships—like the ones used by Houthis—Iran also possesses Chinese and Russian anti-ship missiles, according to the professor. “Ships are very vulnerable,” he said, then referencing the 2000 bombing of the USS Cole by Al Qaeda operatives. “That was just two guys in a rubber boat with an explosive device, and it almost sunk the whole ship. If one is carrying oil, it becomes almost like a large fuel bomb.” The United States has weighed the idea of sending a convoy to help escort and protect these ships. They did as much in the late 1980s in Operation Earnest Will, in which President Reagan ordered Kuwaiti supertankers—which were being fired at—to reflag under the U.S. flag so the Navy could legally escort them. But weapons technology has changed, and while U.S. naval ships could certainly defend themselves, “supertankers are slow and it is still an incredibly dangerous operation,” Dr. Galgano said. “The convoy would have to be lucky 100 percent of the time. Iran would only have to be lucky once to hit a ship and cause an immediate fiasco, both physically and in the media.” Global Dependance on Shipped Goods According to Dr. Galgano, between 75 and 90 percent of all items you handle on a day-to-day basis come from inside the hull of a ship: shocks on your car, clothes on your back, or components of your computer. When shipment is disrupted, it can cause supply chain and cost issues. “During the pandemic, Ford was waiting on chips for F-150s, and HP was waiting in chemicals to make ink,” Dr. Galgano said. “Even the ship that got stuck in the Suez Canal a few years ago caused $10 billion in losses per day due to the backup.” For commodities like oil, the indefinite inability to utilize perhaps the most important shipping lanes in the world due to large scale conflict quickly raises the economic stakes to even greater levels. “Iran absolutely knows that, and they see this as a bargaining chip,” Dr. Galgano said. “Cause economic pain to force cessation of the attacks.”

Expert Insights: Environmental Risk in Times of Regulatory Change & Litigation Pressure

Environmental risks are becoming a central concern for organizations as regulations tighten, public expectations rise, and litigation related to environmental claims grows more common. Companies today must navigate a complex landscape where regulators, investors, and advocacy groups are paying closer attention to how environmental impacts are managed and reported. Recently, J.S. Held published the article, Environmental Claims and Disputes: Navigating Regulatory Change and Litigation Pressure, led by environmental risk and compliance expert Kimberly Logue Ortega. In this article, experts from J.S. Held share practical insights for insurance professionals and legal advisors on identifying environmental risks across industries and preparing for environmental disputes before they escalate. It examines how this increased scrutiny is creating new legal and financial pressures, particularly when organizations fail to comply with evolving regulations or when environmental claims made in public disclosures are challenged. A key issue is the growing focus on corporate environmental statements and sustainability reporting. Businesses face potential consequences whether they overstate environmental achievements, commonly referred to as “greenwashing" or avoid discussing them altogether. Without strong governance systems, clear internal oversight, and transparent reporting processes, organizations may expose themselves to regulatory penalties, legal disputes, and reputational damage. The article emphasizes that effective environmental governance is no longer simply a compliance exercise but an essential part of responsible corporate management. Kimberly Logue Ortega specializes in environmental risk and compliance. With over fifteen years of experience in the areas of environmental and natural resources law, Ms. Logue provides consulting and expert services for industrial facilities and law firms throughout the country. She has extensive experience with assessing and managing potential and ongoing compliance obligations. She routinely supports clients and media on rulemaking and legislative efforts focused on environmental and natural resources issues. View her profile As environmental regulations and stakeholder expectations continue to evolve, organizations that proactively strengthen their compliance frameworks and reporting practices will be better positioned to manage risk and build trust. The full report offers deeper insights into how companies can navigate regulatory change, reduce exposure to environmental claims, and develop stronger governance strategies in an increasingly complex landscape. To explore the topic further, simply connect with Kimberly through her icon below.

MedPage Today: Ozzy Osbourne shined a light on Parkinson’s stigma

Ozzy Osbourne was best known for two things: his shape-shifting resilience as a pioneer of heavy metal music and, most recently, his remarkable authenticity during his public journey with Parkinson's disease. Osbourne, who passed away on July 22, possessed a unique ability to connect directly with people who were suffering. He was an honest and transparent voice for what it was like to live with a neurodegenerative disease. He was willing to go where others would not, and he took on the stigma of a Parkinson's diagnosis. Stigma remains one of the most underrecognized yet pervasive challenges in Parkinson's disease. Far too often, individuals are made to feel ashamed of their visible symptoms like tremors, facial masking, or soft speech. This reality can lead to social withdrawal, depression, and even delayed medical care. Research has shown that perceived stigma is not only linked to reduced quality of life, but it also correlates with worse outcomes. That's why, when someone like Osbourne rises up and speaks out, it matters. It sends a powerful message that Parkinson's does not define a person, and that no one should suffer in silence. Many people with Parkinson's disease choose to conceal their diagnosis from those closest to them. A recent study published in Scientific Reports found that nearly 23% of participants kept their condition hidden, even from family members. Broader surveys have suggested that more than half of individuals with Parkinson's disease may conceal symptoms, mask tremors, or avoid public situations due to stigma and fear of judgment. People who hide their diagnosis frequently report lower social support, reduced engagement in physical activity, and significantly worse emotional well-being. These findings underscore how pervasive and harmful disclosure avoidance can be.